As the world’s second-largest economy, China’s onshore (A-share) market is similarly immense, comprising ~70% of the USD 10 trillion market1. And since joining the World Trade Organization in 2001, foreign interest is growing as China continues to open up its economy and markets.

Historical barriers-to-entry prohibited foreign investors from accessing Chinese onshore equities, as capital markets’ access was tightly regulated through the QFII (Qualified Foreign Institutional Investors) quota system. Daily trading volumes were dominated by retail investors, while institutional investors – both domestic and foreign – were less prevalent. This resulted in different trading behaviour and risk characteristics to those of other global equity markets.

However, the launch of Stock Connect (a programme which linked international investors with China onshore markets in Shanghai (2014) and Shenzhen (2016) via Hong Kong), as well as the inclusion of China A-shares in certain MSCI indices in 2017, have been key drivers in transforming the characteristics of the asset class.

That said, many global – and even emerging market (EM) – equity investment managers do not appear to fully appreciate the importance of the MSCI inclusion, with many allocators continuing to hold China underweights against their regional indices. A Greenwich Associates survey, released in 20202, showed that over 70% of global managers and 30% of EM managers had zero exposure.

Below are the key reasons why we believe that allocating capital to A-shares deserves careful consideration by global investors.

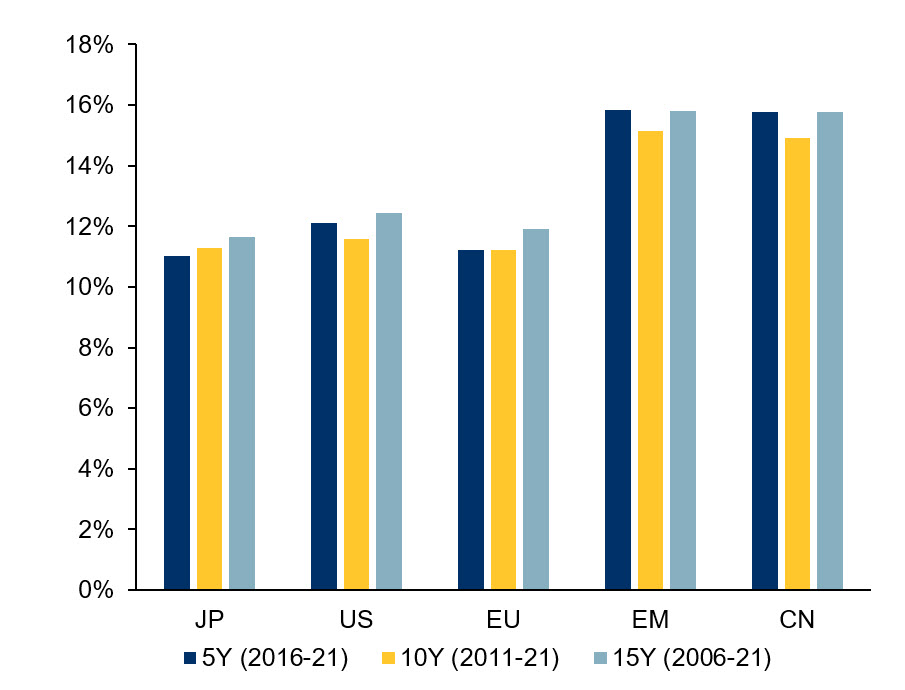

Firstly, as an inefficient market with a wealth of idiosyncratic alpha opportunities, high return dispersion means that outcomes can vary more widely compared to those in other global equity markets. This lends China equity investing to being an ideal market for active stock pickers who can successfully differentiate themselves by selecting winners. Furthermore, the universe for onshore equities is large and under-researched, opening up access to companies in many ‘new economy’ sectors, such as tech, industrials, consumer and healthcare. Research coverage for the onshore market is improving but a long tail of under-researched stocks continues to exist, giving stock pickers an extensive opportunity set.

Exhibit 1: Average stock return dispersion by market

Source: Citi Research, MSCI Indices, RBC Global Asset Management, as at May 2021.

Secondly, financial market deregulation is a priority for Chinese regulators, and assuming that this continues, index providers will increase China equity index weights. The current MSCI China Index inclusion rate is temporarily capped at 20%, however this will move up with market liberalisation, which will lead to increased fund flows (even with no change in fundamentals).

Foreign interest in Chinese onshore equities is increasing and while momentum is gathering pace, this shift is still in its early days. Other Asian markets that have the highest retail participation include Taiwan and South Korea and these markets show approximately 50-60% contribution from retail and ~30% from foreign investors. We believe that onshore equities should continue in this direction, and provided that the market continues to open up, investors will see meaningful tailwind in addition to idiosyncratic alpha.

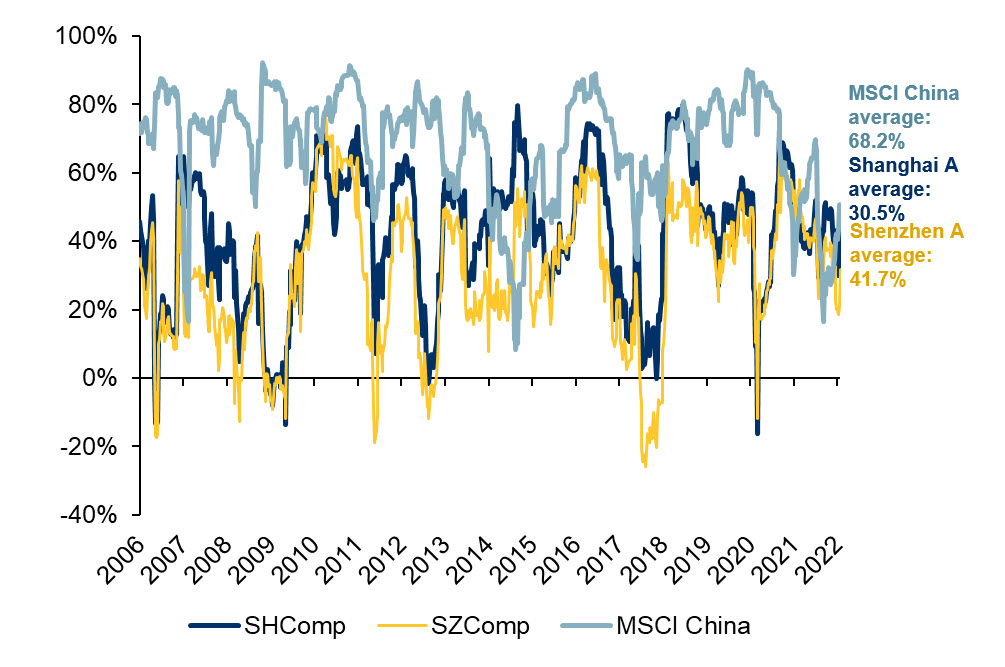

Finally, Chinese equities, particularly onshore equities, appear to be less driven by global macroeconomic factors and are therefore less correlated to other global equity indices. In a recent study3, we found that there are some signs of convergence, but concluded that there are fundamental reasons to believe that low correlation – and diversification benefits – will continue, despite the changing faces of market access and participants’ structure.

Many tend to think of China as ‘the factory of the world’, however with distinctive economic structures and policies, it is somewhat less dependent on the global economy than many would believe. This makes China’s economic drivers fundamentally different to those of global markets. As a source of diversification, we believe that this is not likely to diminish over time.

Exhibit 2: Chinese equity indexes, correlation versus MSCI World Index (26-week)

Source: UBS Quantitative Research, DataStream, Wind, RBC Global Asset Management, as at 28 January 2022.

In conclusion, we believe that investors seeking diversification and idiosyncratic alpha should benefit from increased China exposure, as long as financial market deregulation continues and index inclusion moves up. Being selective and carrying out in-depth due diligence are key to navigating this dynamic market, and as such, active managers who understand the market well and use a disciplined risk management process are integral to A-share equity allocation.

Get the latest insights from RBC Global Asset Management.