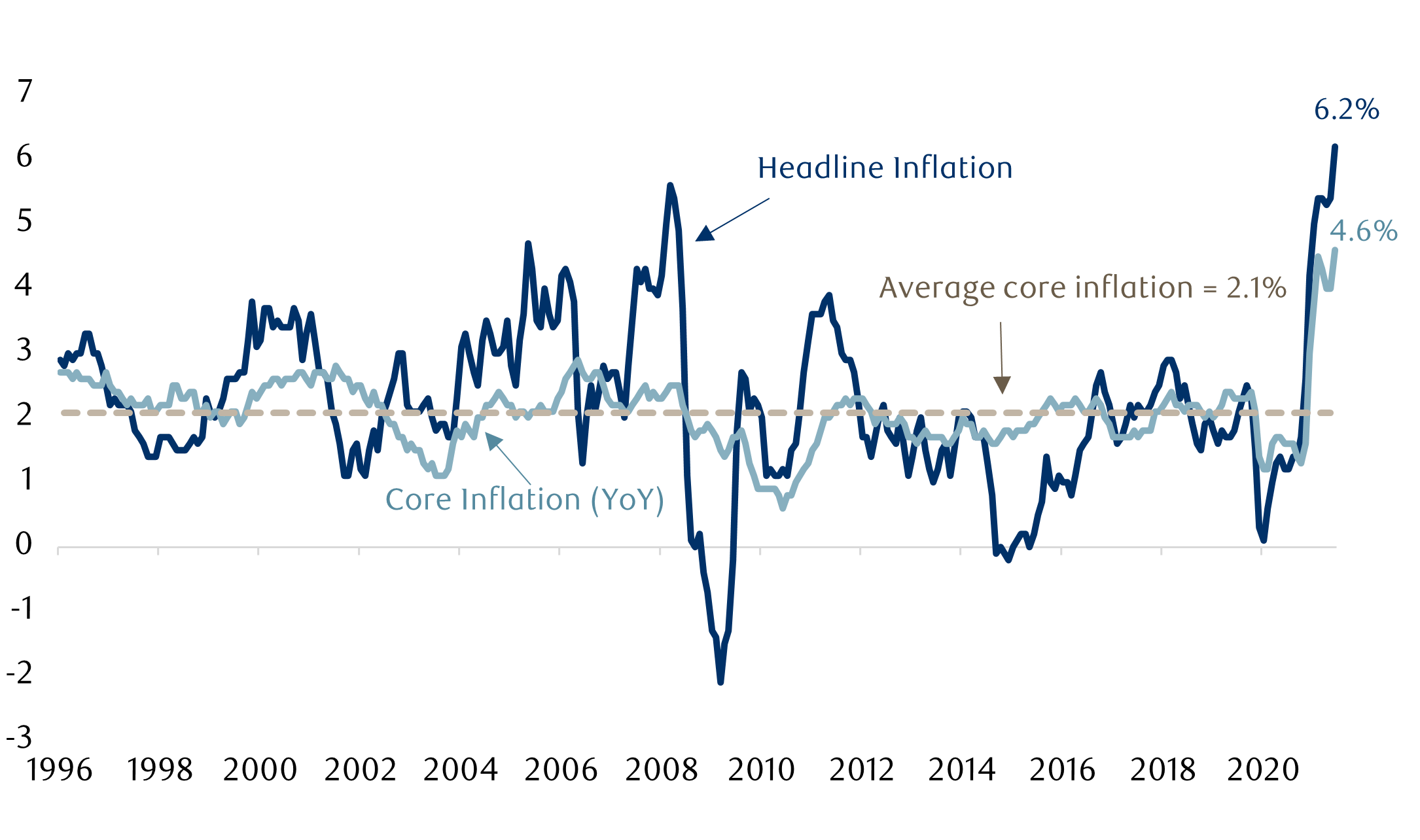

Supply chain issues, in addition to a strong demand impulse which has gained traction out of the pandemic, have continued to put upward pressure on prices. October’s year-over-year headline inflation number rose to 6.2% from a year ago. Inflation is also heating up in other countries, too, albeit with a lag. Europe’s headline inflation number was 4.1% year-over-year in October. Despite inflation’s ties to factors that are largely temporary in nature, it is likely to continue to run hot over the next one to two years. However, when it comes to investing, the longer-term forces carry greater importance and at this time we see more downward forces than upward pressure on long-term inflation.

Headline and Core Inflation

Source: Bloomberg, RBC GAM. Data as of November 12, 2021. YoY = year over year CPI data.

Why does inflation matter for markets?

Bond yields are driven by inflation in two ways. First, bond investors demand a higher nominal return to offset the losses they suffer as a result of inflation, pushing up yields. Second, inflation expectations drive short-term rates as investors consider the pace and timing of changes in interest rates. Central banks like the U.S. Federal Reserve (Fed) have set explicit targets around the level of inflation that is expected for a properly functioning economy. When inflation begins to outpace the level targeted by central banks, they increase interest rates in order to slow down activity and prevent the economy from overheating.

However, the Fed has been very clear about wanting to see inflation sustainably rise above 2% before raising rates. After years of lackluster growth and low prevailing rates of inflation, they are being very conscientious about nourishing economic impulses, with the goal of spurring stronger growth in the future.

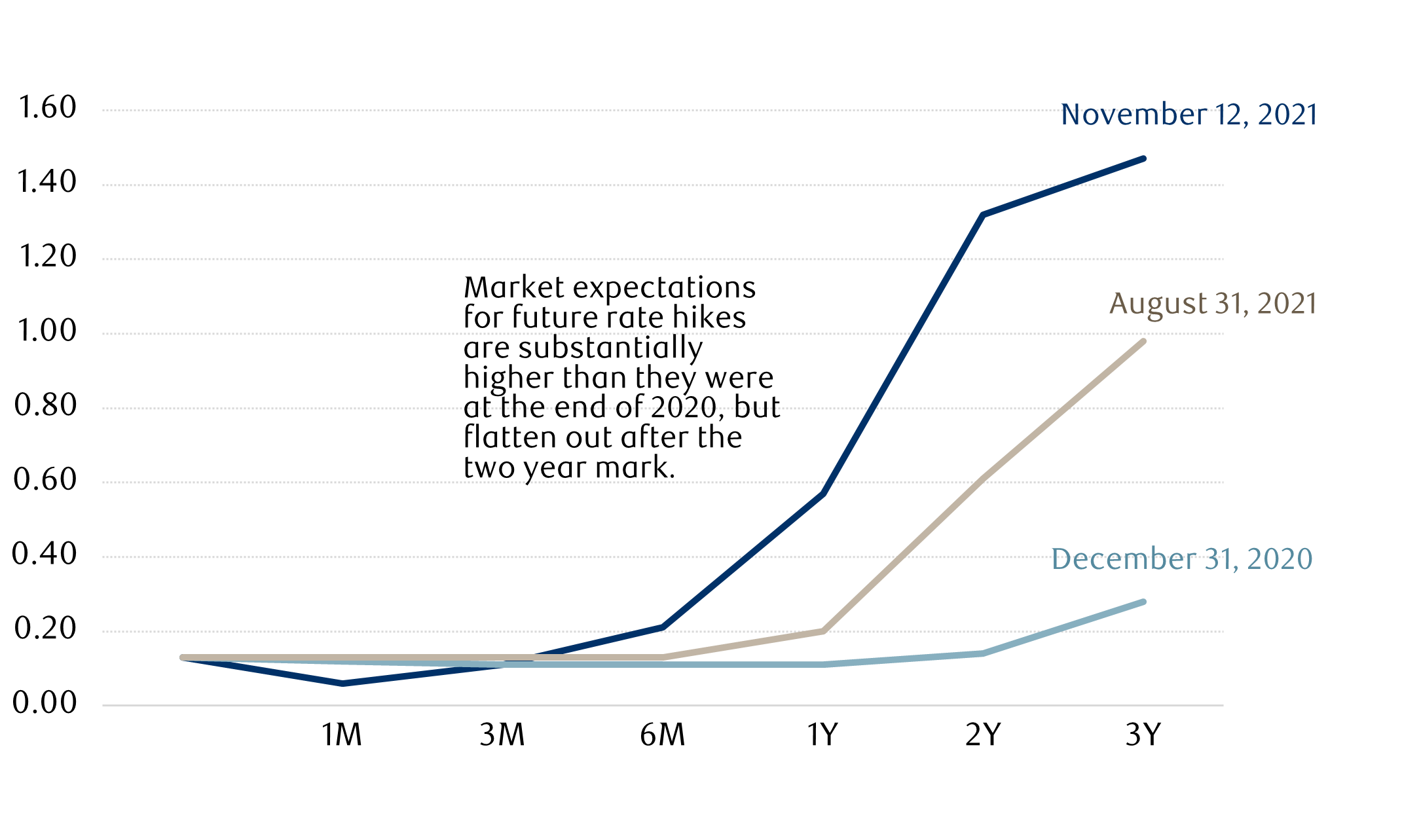

At the same time, investors see these higher prints and look for signals about the future trajectory of rates. They try to gauge not just when the first rate hike might occur, but also how quickly subsequent hikes will happen. These forecasts are reflected in market implied policy rates, a curve that shows the imbedded expectations at various points in the future. Indeed, we can see this in action throughout 2021. As inflation numbers have continued to surprise higher throughout the year, the near-term expectations for rate hikes have shifted higher. At this point it seems investors anticipate the Fed will hike rates more quickly to stem additional inflation, though those expectations start to level out once we hit the two-year mark, suggesting investors still believe inflation will not be persistent.

Market expectations for rate hikes

Source: RBC GAM, Bloomberg. Data as of November 12, 2021. Based on market implied policy rates as of various dates.

Compared to fixed income, equities tend to offer better protection against inflation. This is because, in theory, companies should be able to grow their earnings and revenues at a rate that matches or exceeds inflation. However, interest rates are an important input into assessing the value of a company’s future cash flows. Companies that tend to have a growth premium associated with them are often more impacted by inflation and rate hike expectations. This is evident when we compare performance of the S&P 500 to that of the Nasdaq 100, which predominantly consists of high-growth technology businesses heavily valued on their future growth potential. While the S&P 500 dropped about 5.2% off its highs in early September through to early October, the Nasdaq was down considerably more at 7.3%. Why? Higher rates mean a lower terminal value on future cash flows, which demands a lower current price, all else equal. This makes companies that are valued on growth potential more sensitive to future rate expectations. It also disproportionately impacts the valuation of companies that pay out a large proportion of their earnings to shareholders given their more fixed income-like nature.

What is driving higher inflation?

In many ways, higher year-over-year inflation numbers were predictable. Last spring, in the midst of tight global lockdowns, a number of businesses were forced to shutter their doors and lay off millions of workers. April was also the month oil prices briefly went into negative territory. Inflation was very low. Today, some of the heat from inflation represents prices catching up to where they would have been.

More fundamentally, the ramifications of supply-chain issues that were brought on by the pandemic are a key driver. Demand has shifted from services toward goods that must be shipped, and households are spending more than ever before. Container shortages are leading to delays in getting goods from one part of the globe to another, leading to delays in getting end products out to the market and pushing up prices all along the supply chain. Certain products are in particularly short supply, such as computer chips – with cascading products for many electronic products including motor vehicles.

In addition, energy costs have risen sharply as suppliers failed to respond to reviving demand. Oil now trades around $80+, its highest price in seven years. Natural gas prices have also shot higher. Prices adjust based on the forces of supply and demand. In this case, there is a shortage of supply and normalizing demand – enter inflation.

There has been some concern that the world is potentially entering a stagflationary environment, as economic growth is expected to slow and inflation continues to remain high. However, we find it hard to agree with this thesis. The U.S. economy experienced much higher inflation in the 1970s than we have now, while also experiencing much slower, and at times even negative, economic growth. While growth is likely to slow over the next year, it is expected to remain quite buoyant relative to history. It’s hard to argue that nearly 4% real growth is a stagnating economy.

The medium-term and long-term outlook

When stretching our horizon out over the next couple of years, other inflationary pressures come into play. However, as Eric Lascelles, Chief Economist of RBC Global Asset Management has discussed, these are not likely to be permanent. For instance, the effects of economies reviving from the pandemic are inflationary – the demand impulse is strong while supply remains disrupted. That said, output gaps still exist and while the level of economic slack has narrowed, the economy is not in a position where it is set to overheat at this time. To this end, broad measures of unemployment remain elevated. As such, it’s hard to argue for outright high inflation from a cyclical perspective at this time.

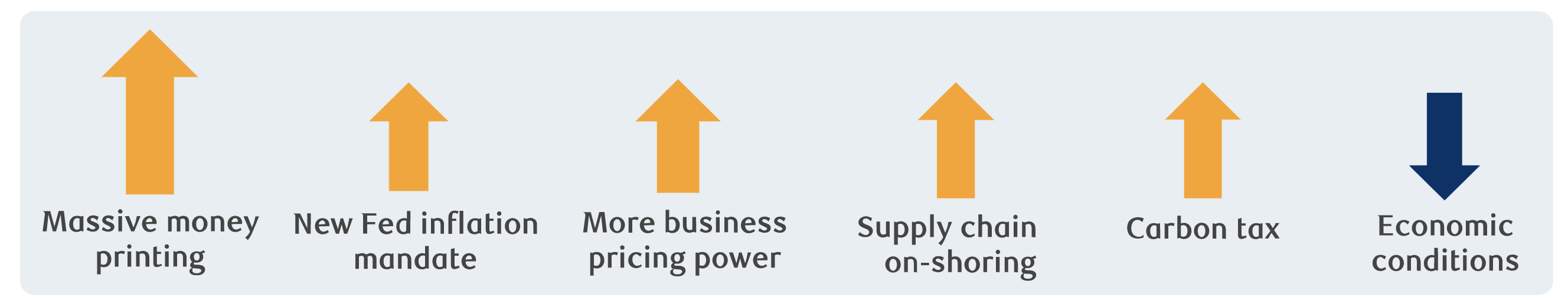

Medium-term inflationary forces

The amount of money being printed by central banks is certainly a key inflationary risk. However, this risk is actually smaller than it appears. A majority of the money printed by the U.S. Federal Reserve has not made its way into the economy, and has instead been returned to the central bank in the form of additional reserves. In addition, we cannot forget that it is the goal of central banks to achieve a normal amount of inflation. They have every ability to course-correct, albeit at the cost of higher interest rates.

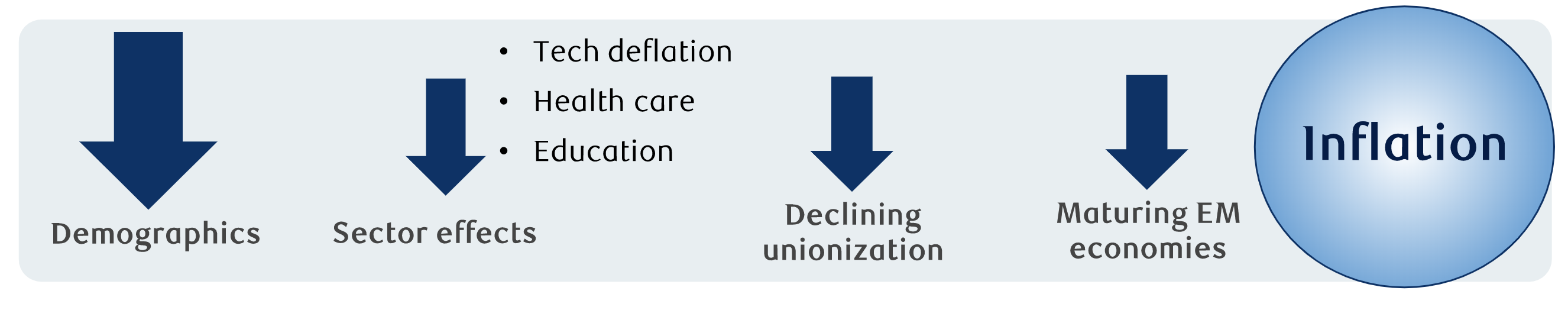

Looking toward the long-term picture, several downward structural forces materialize that are likely to keep inflation in check. These include:

- Demographics: Slower population growth and an aging population should exert downward pressure on prices, much as in Japan.

- Technology: The rate of technological progress should continue to increase productivity and will likely prove deflationary.

Long-term inflationary forces

All of this to say, consumers are undeniably facing rising inflation right now. But, many of these pressures are temporary. While inflation may remain elevated over the next few months, it’s likely to run only moderately above 2% over the next few years. This is a bit higher than we’ve experienced in recent years, but it’s not truly problematic. Over the long run, there are significant downward pressures. As such, it’s little wonder why central bankers, the world’s leading experts on the subject, are largely unfazed by the risk of structurally high inflation even as they acknowledge that high inflation has been more persistent than they had initially envisioned.

How can investors mitigate the risks associated with higher inflation?

The current environment certainly leaves investors with plenty to consider. It’s one of the reasons why evolving portfolios and closely monitoring their asset mix as market conditions change is now more important than ever.

- Fixed income investors are often enticed by the stable stream of income these holdings provide. However, this quality means the purchasing power associated with a bond’s future income (which is fixed in most cases) declines as inflation rises. These risks can be mitigated by holding bonds with a variety of characteristics including: shorter-maturity, higher risk, as well as looking globally for investments.

- Equities, meanwhile, tend to offer better protection against inflation. That said, certain pockets of the market are impacted more than others. The key for investors is diversification. Protection against higher levels of inflation can come from exposure to companies with ties to commodities, real estate, or those with the ability to pass on price increases to their customers without impacting demand.

Within the context of a balanced portfolio, protection against inflation tends to lead investors to add more equities at the expense of fixed income. In theory, equities offer more upside potential and have historically demonstrated an ability to generate returns that exceed inflation.

Yet equities can also lead to greater volatility – which can in turn make it harder for an investor to stick with their plan. For this reason, fixed income plays an important role within a diversified balanced portfolio. Used well, it can help create a smoother investment experience. The key is to choose these investments carefully, with deliberate strategies to address inflation.

Get the latest insights from RBC Global Asset Management.