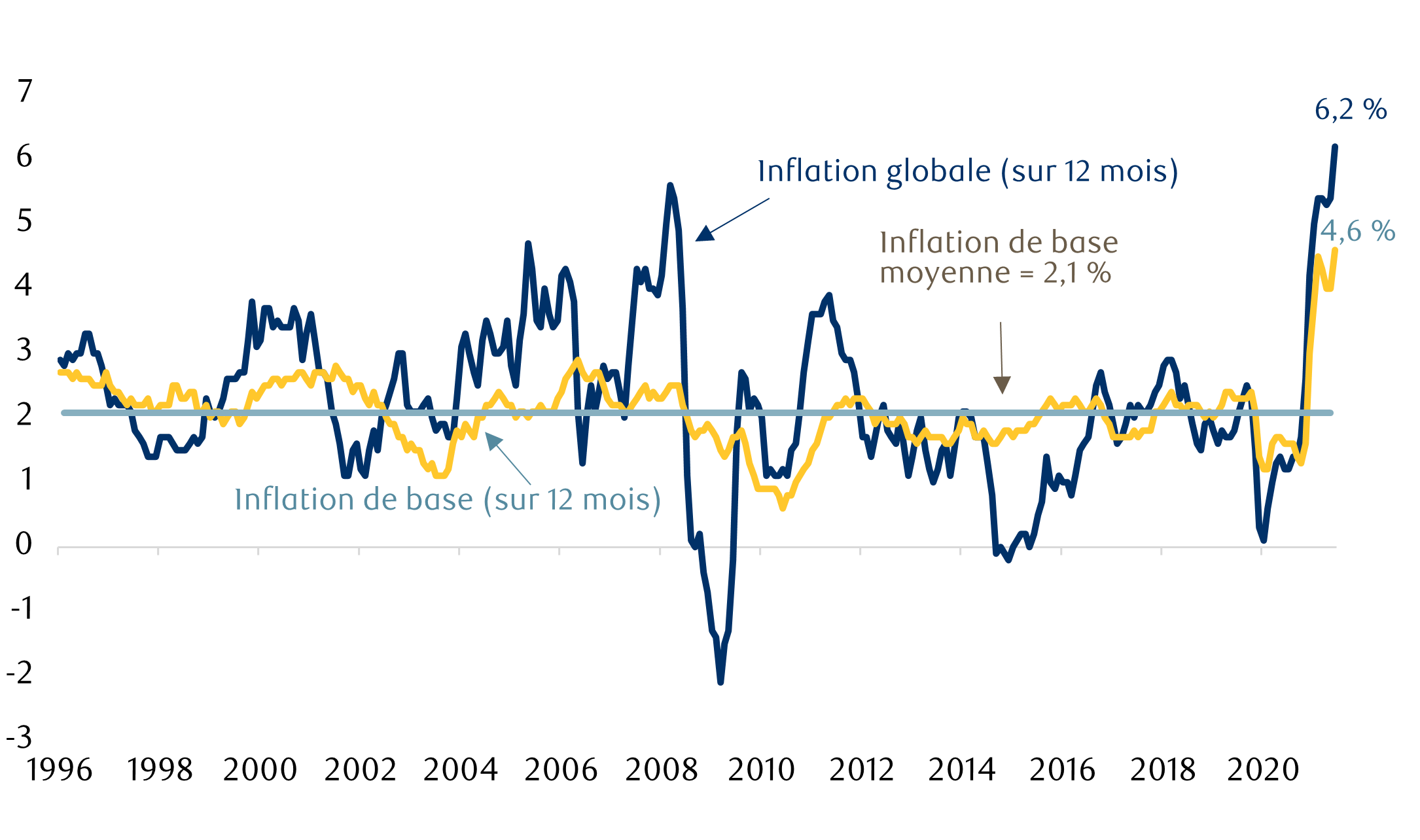

Les problèmes de la chaîne logistique conjugués à l’accélération de la demande qui a suivi la pandémie exercent des pressions haussières sur les prix. En octobre, l’inflation globale a atteint 6,2 % sur 12 mois. Elle grimpe aussi dans d’autres pays, bien qu’avec un certain décalage. En Europe, elle s’est établie à 4,1 % sur 12 mois en octobre. Bien que l’inflation s’explique par des facteurs généralement temporaires, elle restera probablement élevée au cours des deux prochaines années. Cependant, en matière de placements, les facteurs à long terme sont plus importants et, sur un horizon plus long, nous constatons plus de forces baissières que haussières.

Inflation globale et de base

Sources : Bloomberg, RBC GMA. Données au 12 novembre 2021.

Pourquoi l’inflation est-elle importante pour les marchés ?

L’inflation influe sur les taux obligataires de deux façons. Premièrement, les investisseurs en obligations exigent un rendement nominal plus élevé pour compenser les pertes subies en raison de l’inflation, ce qui pousse les taux à la hausse. Deuxièmement, les attentes inflationnistes stimulent les taux à court terme, étant donné que les investisseurs tiennent compte du rythme des modifications susceptibles d’être apportées aux taux d’intérêt et du moment où elles devraient avoir lieu. Les banques centrales, comme la Réserve fédérale américaine (Fed), établissent des cibles précises en ce qui concerne le niveau d’inflation souhaité pour que l’économie du pays fonctionne bien. Lorsque l’inflation dépasse la cible, les banques centrales interviennent en relevant les taux d’intérêt en vue de ralentir l’activité et d’éviter une surchauffe de l’économie.

Par contre, cette fois, la Fed a fait savoir qu’elle attendrait que l’inflation augmente de façon durable au-dessus de la cible de 2 % avant de majorer les taux. Après des années de croissance atone et de faibles taux d’inflation, elle s’attache tout particulièrement à soutenir les élans économiques pour favoriser l’accélération de la croissance à l’avenir.

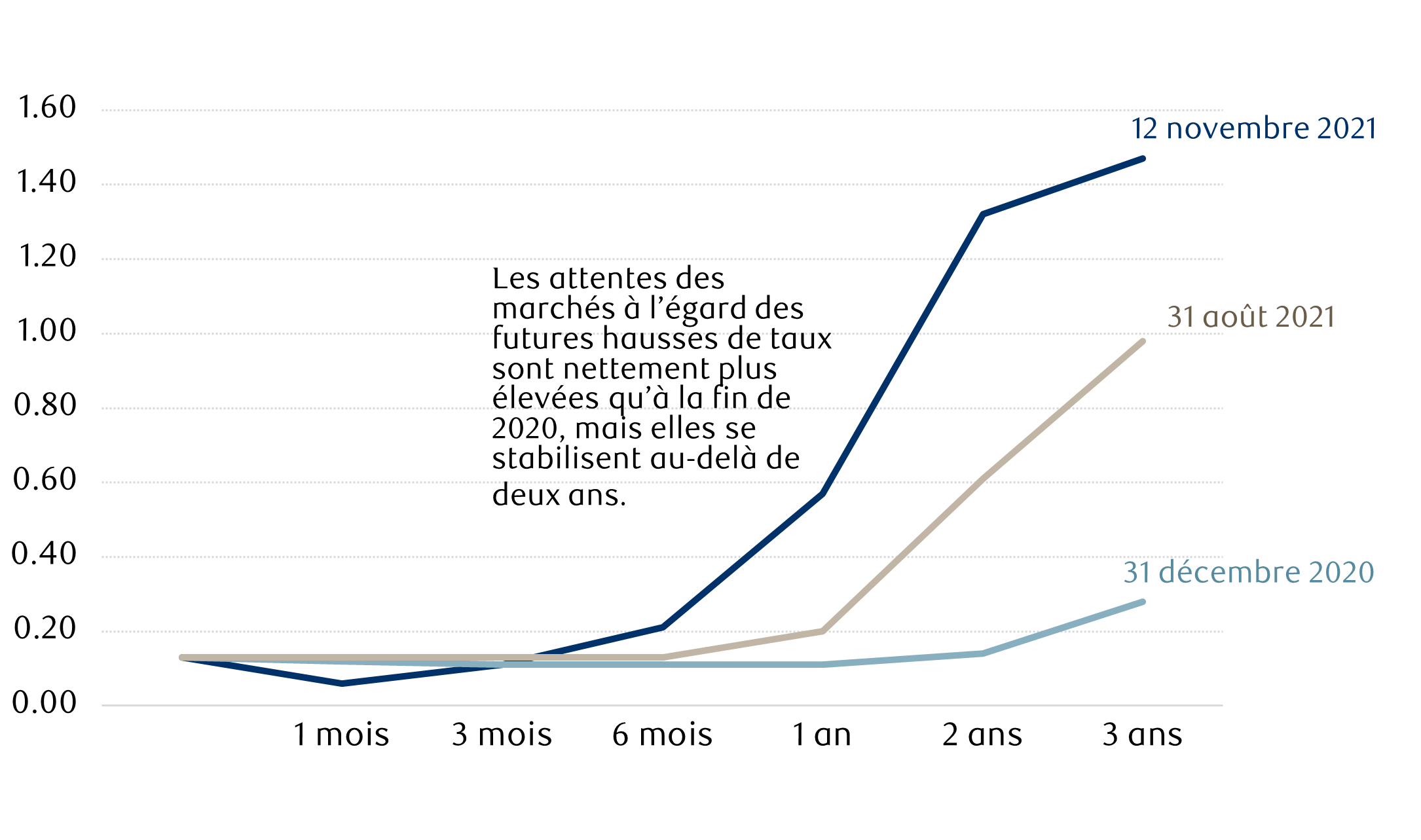

De leur côté, les investisseurs surveillent de près les chiffres élevés de l’inflation et restent à l’affût de tout ce qui pourrait leur permettre d’anticiper la trajectoire future des taux. Ils tentent non seulement d’estimer quand la première hausse de taux se produira, mais aussi la rapidité à laquelle les autres suivront. Ces prévisions sont prises en compte dans les taux directeurs implicites du marché, dont la courbe reflète les attentes à divers moments dans l’avenir. Et nous avons pu voir ce phénomène à l’œuvre tout au long de 2021. Comme les données de l’inflation n’ont cessé de surprendre à la hausse durant l’année, les attentes à court terme en matière de hausses de taux ont été relevées. À ce stade, les investisseurs prévoient que la Fed augmentera les taux plus rapidement afin de juguler l’inflation. Toutefois, au-delà de deux ans, les prévisions se stabilisent ; les investisseurs restent donc d’avis que l’inflation ne perdurera pas.

Attentes des marchés à l’égard des hausses de taux

Sources : RBC GMA et Bloomberg. Données en date du 12 novembre 2021. Selon les taux directeurs implicites du marché à différentes dates.

Les actions ont tendance à offrir une meilleure protection contre l’inflation que les titres à revenu fixe. En effet, en théorie, les sociétés devraient être en mesure d’accroître leurs bénéfices et leurs revenus à un rythme égal ou supérieur à l’inflation. Toutefois, les taux d’intérêt sont une variable à ne pas négliger pour évaluer la valeur des flux de trésorerie futurs d’une société. Souvent, l’inflation et les attentes relatives aux hausses des taux agissent plus fortement sur les titres de sociétés assortis d’une prime de croissance. On le voit bien lorsqu’on compare le rendement de l’indice S&P 500 à celui du Nasdaq 100. Ce dernier est principalement composé d’entreprises à forte croissance du secteur de la technologie, dont le potentiel de croissance future détermine en grande partie l’évaluation. Alors que l’indice S&P 500 a chuté d’environ 5,2 % par rapport à son sommet entre le début de septembre et le début d’octobre, le Nasdaq a enregistré une baisse nettement plus importante de 7,3 %. Pourquoi ? Lorsque les taux montent, la valeur finale des flux de trésorerie futurs diminue, ce qui fait baisser le prix courant, toutes choses étant égales par ailleurs. Pour cette raison, les sociétés évaluées en fonction de leur potentiel de croissance sont plus sensibles aux prévisions de taux. Une hausse de taux peut également avoir une incidence disproportionnée sur la valorisation des sociétés qui versent une grande partie de leurs bénéfices aux actionnaires, étant donné que la nature de leurs actions s’apparente un peu plus à celle des titres à revenu fixe.

Qu’est-ce qui fait grimper l’inflation ?

À bien des égards, il n’est pas étonnant que l’inflation augmente d’une année sur l’autre. Au printemps dernier, de strictes mesures de confinement ont été imposées partout dans le monde, et un certain nombre de sociétés ont été forcées de fermer leurs portes et de mettre à pied des millions de travailleurs. Aussi, au mois d’avril l’an passé, les prix du pétrole ont brièvement plongé en territoire négatif. L’inflation était très faible. La flambée actuelle de l’inflation s’explique en partie par un rattrapage des prix, qui remontent au niveau auquel ils devraient se trouver.

De manière plus fondamentale, les perturbations des chaînes logistiques causées par la pandémie représentent un moteur clé. Après avoir privilégié les services, la demande vise maintenant les biens, qui doivent être expédiés, et les ménages dépensent plus que jamais auparavant. Le manque de conteneurs entraîne des retards dans l’acheminement des marchandises d’un point du globe à l’autre ; les produits finis arrivent donc plus tard sur le marché et les prix montent d’un bout à l’autre de la chaîne logistique. La pénurie de certains produits est particulièrement grave, comme celle des composants électroniques, qui se répercute sur quantités de produits, y compris les voitures.

En outre, les prix de l’énergie ont grimpé en flèche, les fournisseurs n’ayant pas su combler la demande en plein essor. Le pétrole se négocie autour de 80 $ et plus, son prix le plus élevé en sept ans. Le prix du gaz naturel a également bondi. Comme vous le savez, les prix s’ajustent en fonction de l’offre et de la demande. À l’heure actuelle, l’offre est insuffisante, tandis que la demande revient à la normale, ce qui stimule l’inflation.

Certains redoutent la venue d’une période de stagflation, étant donné que la croissance économique devrait ralentir et l’inflation, rester élevée. Cependant, cette hypothèse nous paraît peu probable. Dans les années 1970, l’inflation était beaucoup plus forte qu’aujourd’hui aux États-Unis et la croissance était nettement plus lente, l’économie enregistrant même des contractions ponctuelles. Même si le rythme de l’expansion se modérera sans doute l’an prochain, il devrait demeurer plus soutenu que par le passé. On peut difficilement qualifier de stagnation une croissance réelle de près de 4 %.

Perspectives à moyen et à long terme

D’autres pressions inflationnistes pourraient se manifester au cours des prochaines années. Toutefois, comme l’a mentionné Eric Lascelles, économiste en chef à RBC Gestion mondiale d’actifs, elles ne s’éterniseront probablement pas. Ainsi, la reprise des économies après la pandémie alimente l’inflation : la demande s’envole, alors que les perturbations minent l’offre. Néanmoins, les écarts de production demeurent et, même si les capacités excédentaires ont diminué, l’économie n’est pas sur le point de connaître une surchauffe. À preuve, les mesures générales du chômage demeurent élevées. Dans ce contexte, pour ce qui est du cycle, il existe actuellement peu d’arguments en faveur d’une inflation vraiment élevée.

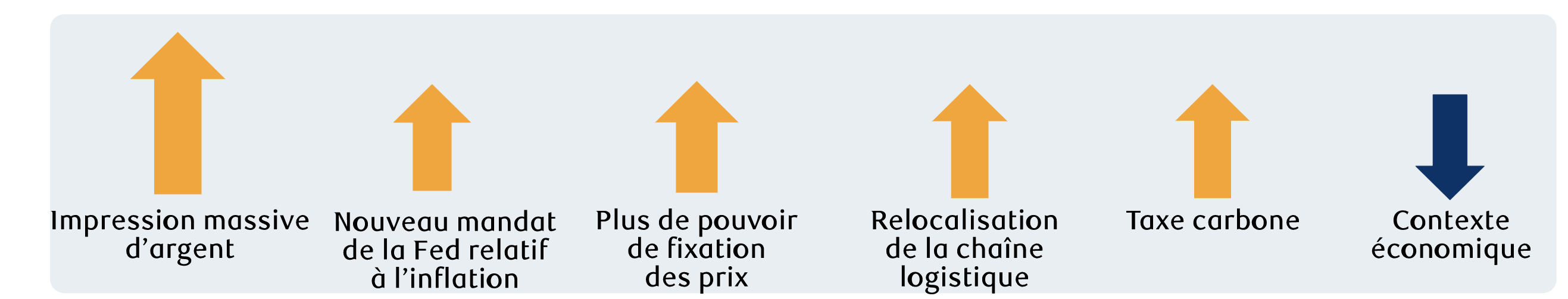

Forces inflationnistes à moyen terme

Le montant de l’argent imprimé par les banques centrales représente assurément un risque d’inflation majeur. Cependant, encore une fois, le risque est moins grand qu’il ne paraît. Une grande partie des liquidités que la Réserve fédérale américaine a générées n’a pas été injectée dans l’économie et a plutôt servi à gonfler les réserves de la banque centrale. Les banques centrales ont pour objectif d’atteindre un taux d’inflation normal. Elles ont tous les outils en main pour rectifier le tir au besoin, bien qu’au prix de taux d’intérêt plus élevés.

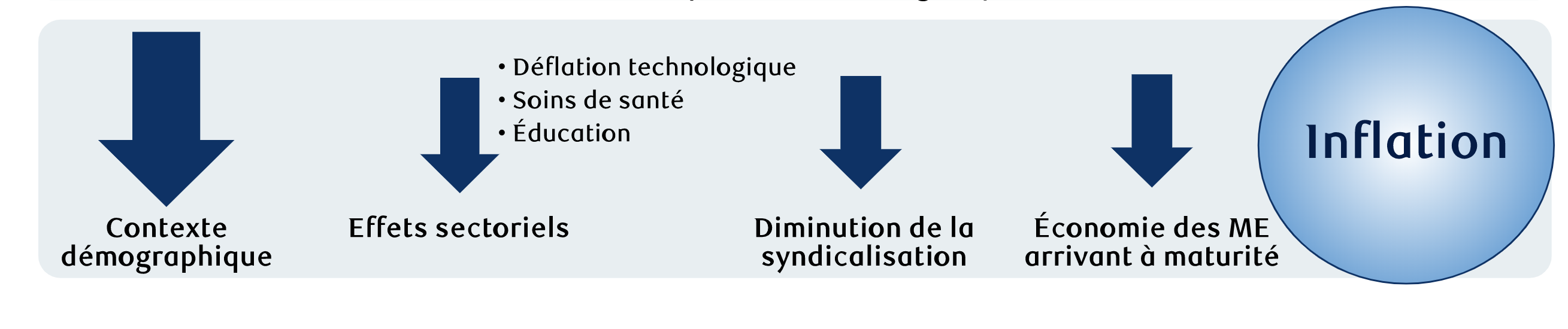

À plus long terme, plusieurs forces structurelles baissières devraient contenir l’inflation, notamment :

- Situation démographique. Le ralentissement de la croissance démographique et le vieillissement de la population devraient exercer des pressions à la baisse sur les prix, comme on le voit au Japon.

- Technologie. LLe rythme des progrès technologiques devrait continuer d’accroître la productivité et s’avérer déflationniste.

Forces inflationnistes à long terme

Certes, les consommateurs font face à une flambée de l’inflation en ce moment ; mais bon nombre des pressions haussières seront de courte durée. L’inflation pourrait rester élevée au cours des prochains mois, mais elle ne devrait dépasser que modérément 2 % au cours des prochaines années. Ce niveau, bien que légèrement supérieur à ce à quoi nous nous sommes habitués ces dernières années, n’a rien de problématique. À long terme, de fortes pressions baissières se manifestent. Il n’est donc pas étonnant que les banques centrales, les principaux experts mondiaux en la matière, ne s’inquiètent guère du risque d’une inflation structurellement forte, même si elles reconnaissent que l’inflation élevée dure plus longtemps qu’elles l’avaient d’abord prévu.

Comment les investisseurs peuvent-ils atténuer les risques associés à une hausse de l’inflation ?

Les investisseurs ont assurément beaucoup de facteurs à considérer dans le contexte actuel. C’est l’une des raisons pour lesquelles il est plus important que jamais de surveiller de près la composition de l’actif des portefeuilles et de l’adapter au besoin à mesure que les conditions du marché changent.

- Les investisseurs en titres à revenu fixe sont souvent attirés par le revenu stable que procurent ces placements. Toutefois, cette qualité fait en sorte que le pouvoir d’achat associé au revenu futur d’une obligation (qui est fixe dans la plupart des cas) diminue à mesure que l’inflation augmente. Ces risques peuvent être atténués en détenant des obligations présentant des caractéristiques diverses, comme des échéances plus courtes ou des risques plus élevés, ainsi qu’en diversifiant les placements à l’échelle mondiale.

- Les actions, quant à elles, tendent à offrir une meilleure protection contre l’inflation. Cela dit, certains segments du marché sont plus touchés que d’autres. La clé pour les investisseurs est la diversification. La protection contre une hausse de l’inflation peut provenir de l’exposition à des sociétés ayant des liens avec les marchandises ou l’immobilier, ou à des entreprises capables de répercuter les hausses de prix sur leurs clients sans nuire à la demande.

Dans le contexte d’un portefeuille équilibré, la protection contre l’inflation tend à inciter les investisseurs à augmenter la pondération des actions au détriment de celle des titres à revenu fixe. En théorie, les actions offrent un potentiel de hausse plus élevé et ont toujours démontré leur capacité à générer des rendements supérieurs à l’inflation.

Néanmoins, comme les actions peuvent aussi être plus volatiles, les investisseurs sont susceptibles d’avoir de la difficulté à respecter leur plan. C’est pourquoi les titres à revenu fixe peuvent jouer un rôle important au sein d’un portefeuille équilibré diversifié. Bien utilisés, ils peuvent contribuer à créer une expérience de placement plus agréable. La clé réside dans le fait de choisir ces placements avec soin et d’appliquer des stratégies délibérées tenant compte de l’inflation.

Soyez au fait des dernières perspectives de RBC Gestion mondiale d’actifs.