It has been just over 12 months since markets started their trajectory upwards following the COVID-19 selloff. To mark this occasion we caught up with Sarah Riopelle to get her take on the past year and how she is positioning portfolios for the road ahead.

Markets look very different today than they did a year ago. What are your thoughts on the past year and how are you positioning the portfolios for the year ahead?

It has certainly been an interesting year and one that has tested the resilience of many investors. Looking back, I can honestly say that was a stressful time and I was certainly not immune to those feelings of uncertainty as I sat in my home office watching the markets and managing the funds.

However, if the events of the past year have taught us anything, it’s that staying the course and maintaining a long-term focus is critical in the face of market volatility. I strongly believe that making changes to investment plans in the middle of a crisis is not a good idea. Concern and anxiety are not a good recipe for making decisions that will impact you over the long term, so we need to remind investors to stick to the plan that they diligently prepared alongside their advisors.

Looking forward, I would say that the pandemic is entering a new phase with the rollout of vaccines and businesses gradually getting back to normal. Our view is that the economy is set to experience a healthy recovery from the COVID-19 shock with extremely stimulative monetary and fiscal policies in place and consumers well positioned to boost their spending. As always, there are a number of risks that bear watching including the possibly negative impact of new COVID-19 variants, elevated unemployment levels and the potential for higher inflation.

Balancing all of these risks and opportunities, we believe a bias towards risk taking is appropriate. Although the advantage of stocks over bonds has diminished somewhat through the past quarter, equities continue to offer an attractive risk premium versus fixed income and we remain overweight equities as a result.

Longer-term bond yields have surged as investors’ expectations of faster inflation and better economic growth are offsetting the impact of central-bank efforts to hold rates down. What is your view and how are you positioning your portfolios?

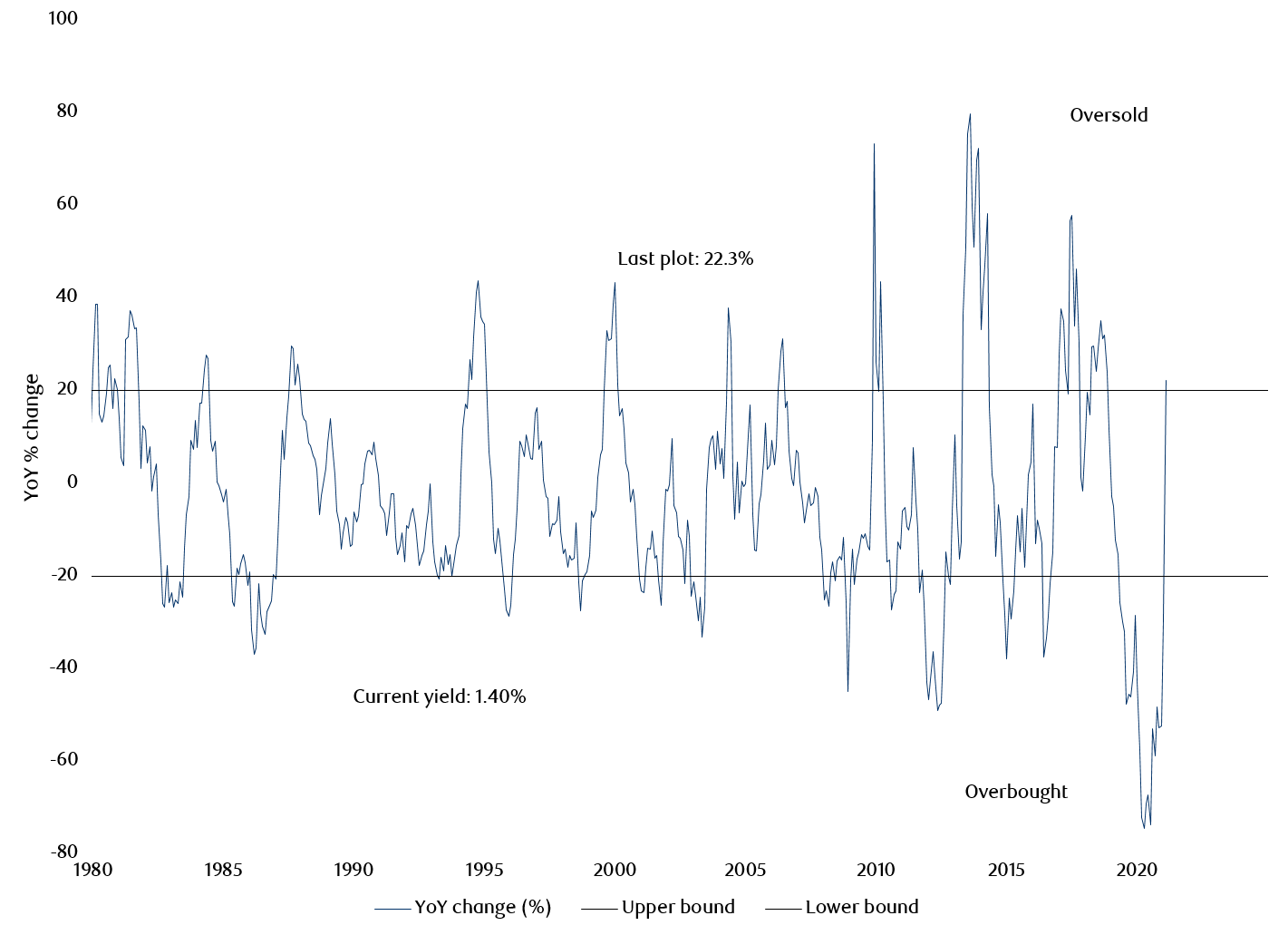

We’ve seen a substantial jump in fixed-income yields over the last few weeks with the U.S. 10-year Treasury yield rising over 80 basis points since the start of the year to above 1.70% for the first time since the pandemic. For the first time since early 2020, we expect slightly positive returns for sovereign bonds over the year ahead. This is a major shift in the outlook for fixed-income markets as investors may actually be able to earn their coupons without suffering capital losses.

A lot of the valuation risk in the fixed-income market that existed in 2020 has been alleviated by the rapid change in yields so far this year. While we think that bonds yields will gradually climb over the longer term, the speed and magnitude of the recent sell-off suggests that bonds could rally from these levels in the near term.

U.S. 10-year T-bond yields

Rate of change

Note: as of February 28, 2021. Source: RBC GAM

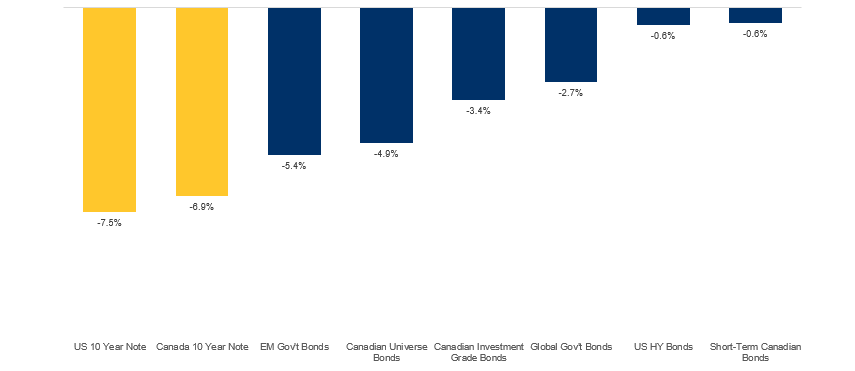

Despite the modest outlook for returns, bonds will continue to play an integral role in portfolios. That said, the concept of diversification should be applied within fixed income markets as well. That is because rising yields have a varying impact for different segments of the bond market. Over the past 20 years, we have broadened our fixed-income allocations by including investment-grade, high-yield and emerging-market debt, sourced from our sovereign-bond allocations. While sovereign bonds certainly have their place in a portfolio, investors may want to consider diversifying their fixed-income exposure to include holdings that are less sensitive to the risks facing sovereign bonds. Such shifts can help mitigate interest-rate risk, preserve capital and lower portfolio volatility.

YTD Fixed Income Returns

Source: Morningstar Direct and FTSE. Returns in Canadian dollars. As of March 26, 2021. US 10 Year Note = JPM US Constant Mat 10 Yr TR, Canada 10 Year Note = JPM Canada Constant Mat 10 Yr TR, EM Gov't Bonds = JPM EMBI Global Diversified TR , Canadian Universe Bonds = FTSE Canada Universe Bond Index, Global Gov't Bonds = FTSE WGBI Hdg CAD, Canadian Investment Grade Bonds = FTSE Canada Corporate Bond Index, Short-Term Canadian Bonds = FTSE Canada Short Term Bond Index, US HY Bonds = ICE BofA US High Yield TR

An economic recovery brings with it the risk of an inflationary burst given the combination of massive stimulus and pent-up demand. Should we be worried about inflation and its impact on portfolios?

The combination of significant easing in monetary policy, central banks’ willingness to accept faster inflation and historically high sovereign-debt loads has investors concerned that inflation could run too hot. Prices are indeed rising, albeit off a low base, and we believe that inflation expectations remain in line with levels of the past decade.

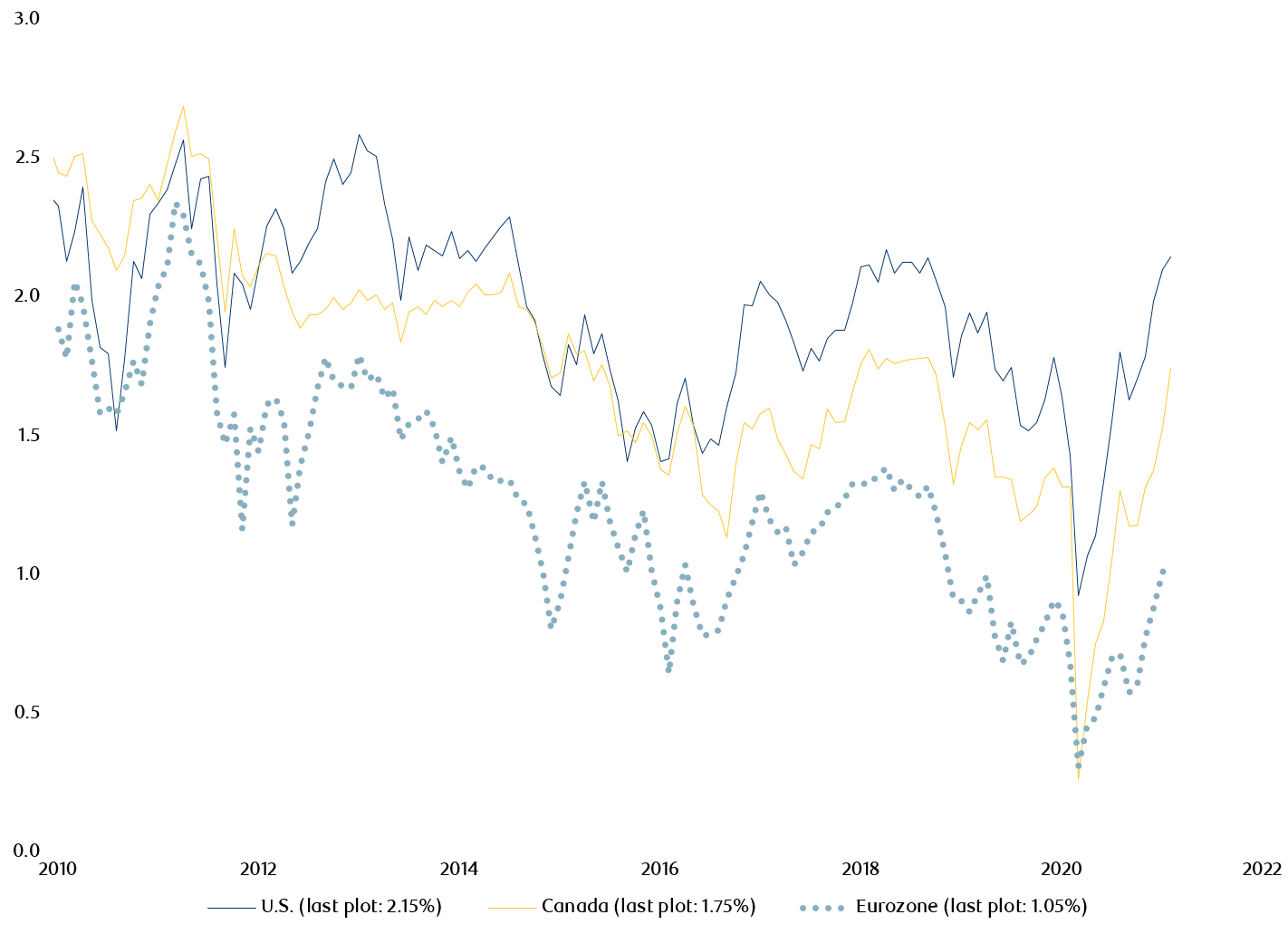

What has caught the attention of many investors is the fact that market-based measures of inflation expectations have been rising in most countries. While it is true that readings have trended higher over the past couple of quarters, actual levels of expected inflation are still quite reasonable. Our view is that the underlying inflation trend will move higher, but that it will remain at low levels relative to history.

Implied long-term inflation premium

Breakeven inflation rate: nominal vs. 10-year real return bond

Note: As of February 26, 2021. Eurozone represents GDP-weighted breakeven inflation of Germany, France and Italy. Source: Bloomberg, RBC CM, RBC GAM

To read more insights, head over to the Portfolio Solutions team page, which includes all of Sarah’s publications.