Institutional investors have long known the benefits of adding exposure to Collateralized Loan Obligations (CLOs) in their portfolios. In fact, more than U.S.$1.4 trillion is now invested in CLOs globally1, with growth expected to continue.

In this article, we describe what CLOs are and how individual investors can access this asset class through RBC AAA CLO (CAD Hedged) ETF (RCLO). We’ll also explore how CLOs can help diversify your fixed income portfolio and potentially enhance returns.

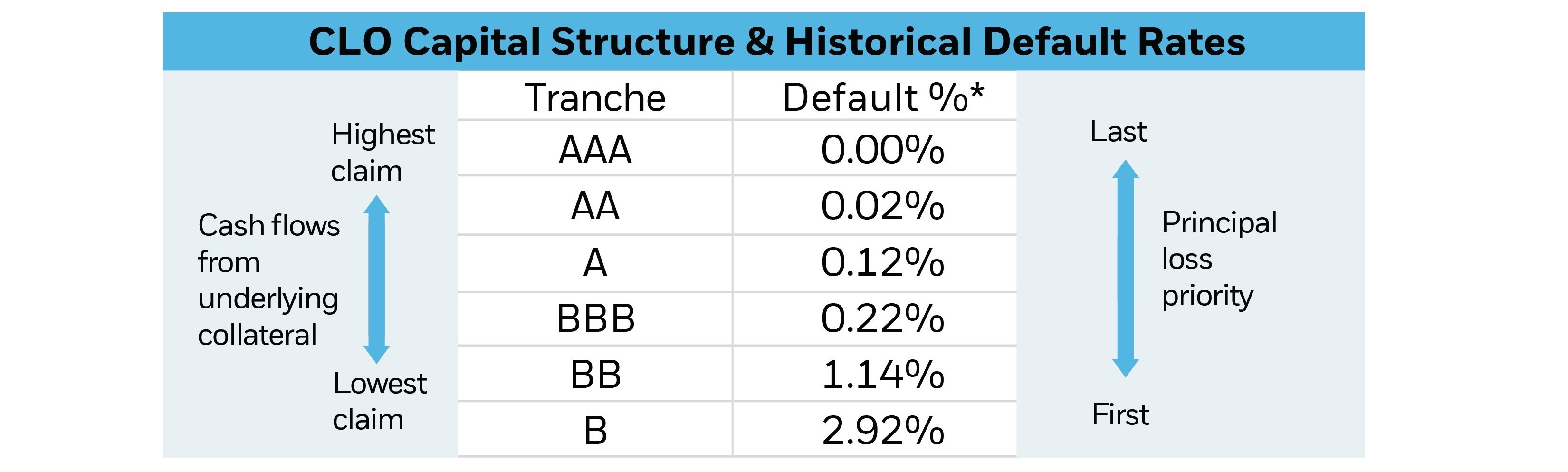

- CLOs are special purpose vehicles that hold a portfolio of senior secured corporate loans (loans to companies). To finance the purchase of these loans CLOs issue a series of debt tranches, that are ranked in seniority starting with AAA to single-B, and an equity tranche.

- AAA-rated CLO debt tranches are the most senior tranche with the highest credit rating. They are the first to receive income while being the last to absorb any loss. In fact, AAA CLO debt tranches have never experienced a default2. Investing in the senior tranches of CLOs can add a level of safety to fixed income portfolios along with stable returns.

- Given their unique structure, CLOs offer higher yields than similarly rated fixed income investments such as investment grade corporate or government bonds.

- As CLOs are highly specialized, complex investments that are often reserved for large institutional investors, prospective investors should look to experienced investment managers, such as the BlueBay Fixed Income Global CLO & Securitized Credit Team that manages RBC AAA CLO (CAD Hedged) ETF (RCLO).

- RCLO provides an efficient and transparent way for individual investors to access the most senior tranches of the CLO market.

Think of a CLO as a financial entity with assets and liabilities. The assets are senior secured corporate loans selected by a CLO manager.

To finance these assets, floating rate debt of various sections or tranches, seniorities and ratings are issued to investors. Cash flows generated from the underlying senior secured loans are used to make interest and principal payments to the CLO debt holders. After servicing the debt tranches, any remaining cash flows will flow to the equity tranche, which may offer the highest return potential but also bears the greatest risk.

The debt tranches of a CLO are arranged like a ladder. The top-rated tranches are prioritized for interest and principal payments. The lowest rated tranches accept the highest risk and first loss absorption.

Source: RBC GAM; S&P Global, “CLO Spotlight: Thirty Years Strong: U.S. CLO Tranche Defaults From 1994 Through First-Quarter 2024.” *Includes CLO 1.0 & CLO 2.0 generations. Past default rates are not indicative of future default rates.

Earn income

CLOs typically offer a higher yield relative to other comparably rated fixed income investments.Diversification benefits

A single CLO can hold 150–450 senior secured loans, diversified across multiple sectors and industries.Low default rates

The CLO manager must regularly test that the CLOs underlying loan portfolios can cover its interest and principal payments. With this rigorous process, AAA-rated CLO debt tranches have never experienced a default.Near zero duration

CLO debt tranches are structured to be floating rate instruments. This means the interest they pay adjusts with market rates*. As such, their interest rate duration is near-zero as their sensitivity to fluctuations in interest rates is very low.Low correlation to traditional fixed income

CLOs historically have had low correlation with traditional fixed income assets due to their floating rate structure and loan diversification.While these benefits can be attractive, it’s important to note that CLOs also come with risks. There is default risk, which can occur if many borrowers fail to repay their loans. However, the securitization process and capital structure of CLOs are designed to mitigate these risks.

Investing in CLOs can be complex and requires a highly experienced management team. This is where RCLO can help provide investors with efficient access to this unique asset class.

RCLO is an actively managed ETF that invests in the highest rated debt tranches of CLOs from issuers located in the United States. It may also invest in CLOs from issuers located in Europe.

RCLO will invest at least 75% of its portfolio in AAA-rated CLO debt tranches and may invest no more than 25% of its portfolio in AA and/or A-rated CLO debt tranches. RCLO will not invest in CLO debt tranches rated below A-.

In addition, RCLO is currency hedged to minimize exposure to changes in foreign currencies relative to the Canadian dollar.

Safety

The majority of the portfolio invests in AAA-rated CLO debt tranches. These tranches are seen as having the lowest risk of default.Easy access

RCLO is an efficient way to gain access to this asset class, with a low minimum investment requirement.Liquid

As an ETF, RCLO trades like a stock and can be bought and sold throughout the trading day at market prices.Experienced management team

RCLO leverages the expertise of the BlueBay Fixed Income Global CLO & Securitized Credit team. This team currently manages ~U.S.$9.1B in securitized credit that contains ~U.S.$4.2B in CLOs. The team adds value through CLO manager analysis, collateral analysis, security selection, and sound risk management.CLOs offer a unique opportunity for investors seeking higher yields and portfolio diversification. Through RCLO, individual investors can access the benefits of CLOs in a more liquid and transparent way, while ensuring a high degree of credit quality is maintained. As with any investment, it is crucial to understand the risks and to consider how this asset class can fit within your overall investment strategy.

Additional resources

How can we help?

The RBC iShares alliance offers an unparalleled breadth of ETF solutions, a commitment to exceptional service and top investment expertise located around the world.

Advisors: Contact your dedicated sales team and access portfolio resources – Login here.

Investors: Explore the different ways you can invest with ETFs.