What do we mean by social infrastructure? The RBC Emerging Markets Equity team defines social infrastructure as essential public assets and services that support people’s daily lives and have a significant influence on their standard of living. Within this definition we include education, healthcare, housing, public transport, water & waste management, and renewable energy.

Rapid urbanization is creating unprecedented demand for infrastructure assets in emerging markets (EM). At the same time, historic underinvestment has led to significant shortfalls in the quality and quantity of infrastructure in EM. This growing supply/demand mismatch has put pressure on fundamental social assets such as education, healthcare and housing, which has negatively impacted the quality of life for people in urban areas. Poor social infrastructure has contributed to problems such as rising congestion levels, increased crime, housing shortages and pollution. The current COVID-19 pandemic has further exacerbated the situation and has highlighted the lack of healthcare equipment and provision globally.

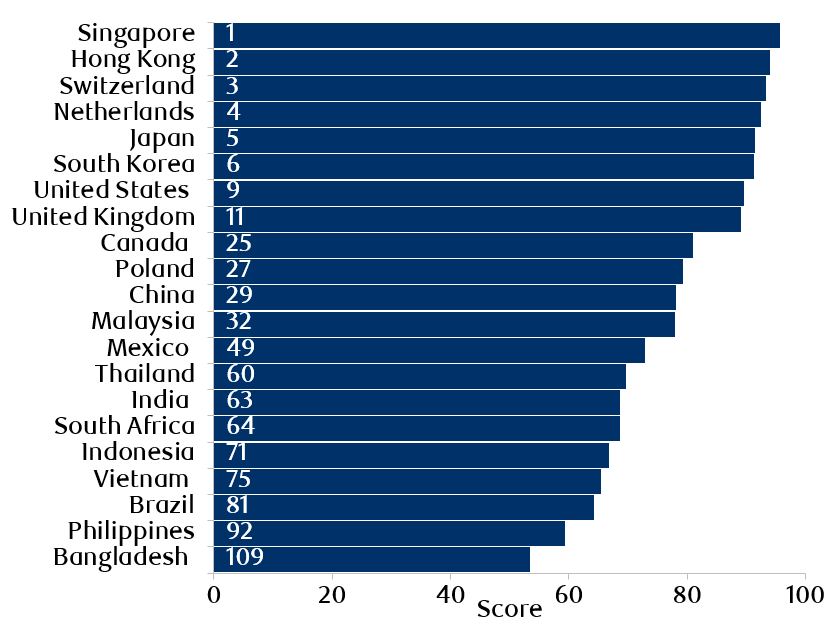

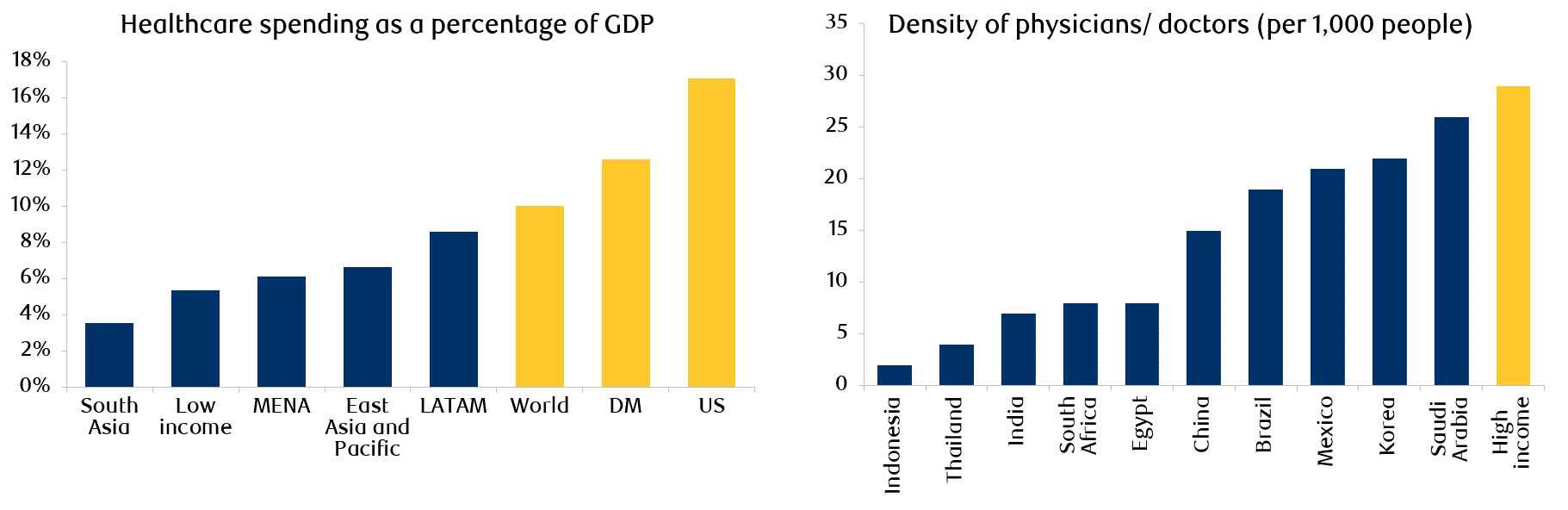

The pandemic has impacted both developed and emerging markets, but the lack of basic social infrastructure in some parts of EM has made the situation particularly dire. As shown in Exhibits 1 and 2, EM countries lag developed markets (DM) in the quality of overall infrastructure particularly in areas such as healthcare.

Exhibit 1: Quality of overall structure

Source: The Global Competitiveness Report, World Economic Forum. Data as at October, 2018. The Infrastructure pillar of the Global Competitiveness Index 4.0 assesses the quality and extension of transport infrastructure (road, rail, water and air) and utility infrastructure (electricity and water).

Exhibit 2: Underinvestment in social infrastructure has led to shortages in EM (Healthcare example)

Source: LHG: World Health Organization, World Economic Outlook, UBS, April 2018. Underlying data as of 2016. Source: World Bank. Data as at July, 2019. Data collected from 2010-2015.

Investing in social infrastructure, both in the form of new investment as well as to maintain existing assets, is therefore critical in order to resolve the many challenges created by rapid urbanization and to ensure the sustainable growth of cities going forward.

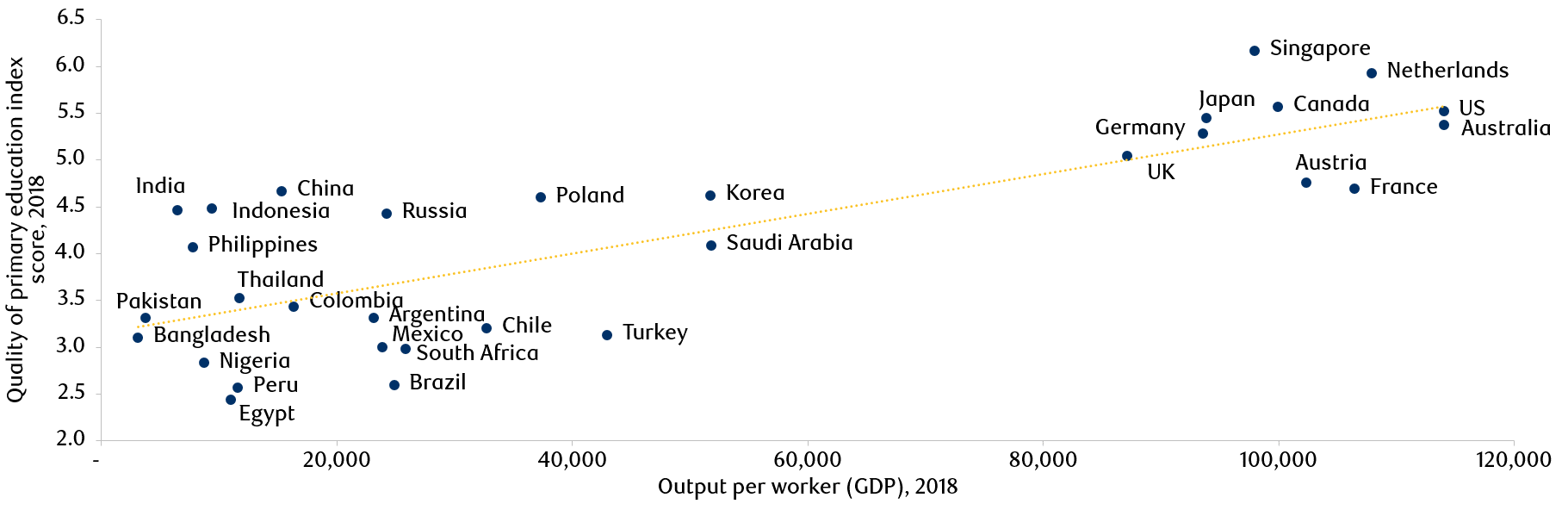

Social infrastructure also brings long-term economic benefits and is positively correlated to the development of a country. For example, Exhibit 3 shows a strong link between the quality of education in a country and its productivity. A similar relationship can be found between other social infrastructure assets and economic measures, such as public healthcare expenditure and economic growth.1

Exhibit 3: Relationship between labour productivity and quality of primary education

Source: Global Competitiveness Index and International Labour Organization (ILO), ILOSTAT. Data as at December, 2019. Note: Quality of Primary Education Index of the Global Competiveness Index.

Can the social infrastructure opportunity be realized in EM?

It is important to ask ourselves whether EM governments have the political desire and ability to address the shortfalls in social infrastructure, particularly considering the ongoing and extensive government stimulus programs launched in response to the current COVID-19 pandemic.

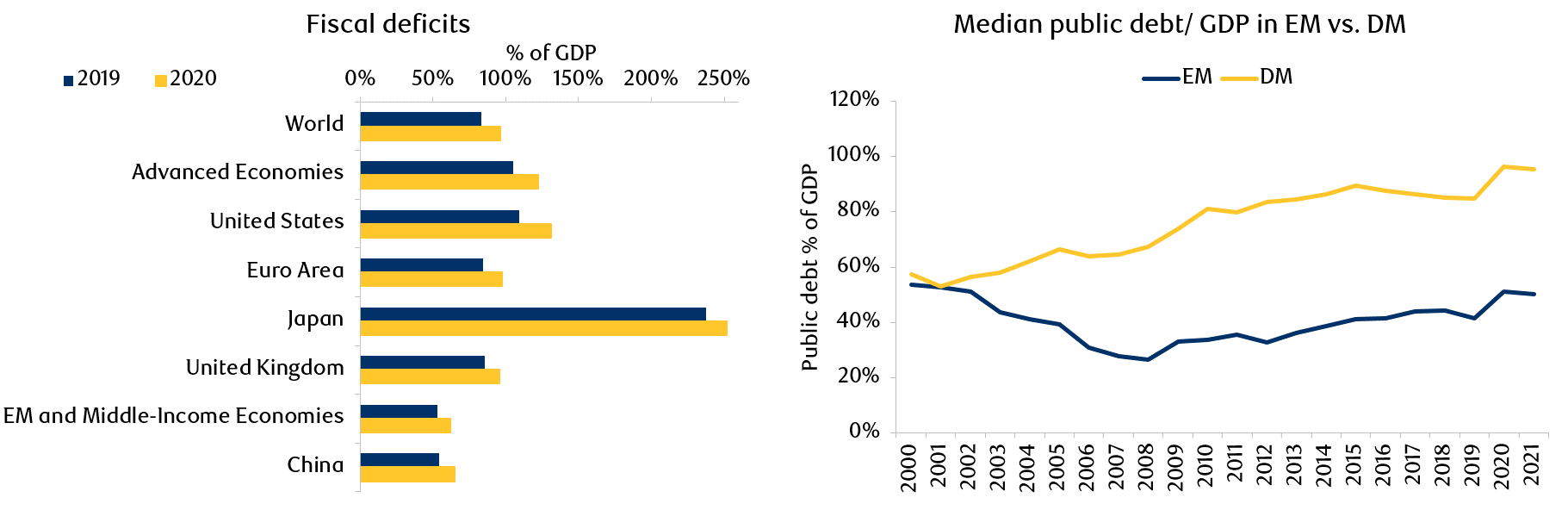

Globally, governments have committed over US$8tn to fight COVID-19 and to revive their economies. The key concern with the fiscal stimulus in EM has been the government debt backdrop. Although we are likely to see a deterioration in fiscal deficits in some countries, overall, EM have more favourable fiscal positions than DM. Furthermore, although government debt will inevitably increase in EM, the debt still appears manageable at these levels which we believe bodes well for future social infrastructure investment in the region (Exhibit 4).

Exhibit 4: Fiscal deficits & Government Debt / GDP in EM vs. DM

Source: LHG: IMF, Fiscal Monitor, BAML Research. Data as at April, 2020. RHG: IMF, Fiscal Monitor, Citi Research. Data as at April, 2020.

History has shown that times of crisis cause changes in human behaviour which are often long lasting. The current COVID-19 pandemic has highlighted that the human race is not invincible. We believe that one positive outcome of the pandemic is that it may prove to be a wake-up call for governments and businesses, highlighting the need to prioritize investment in social assets in order to mitigate future risks.

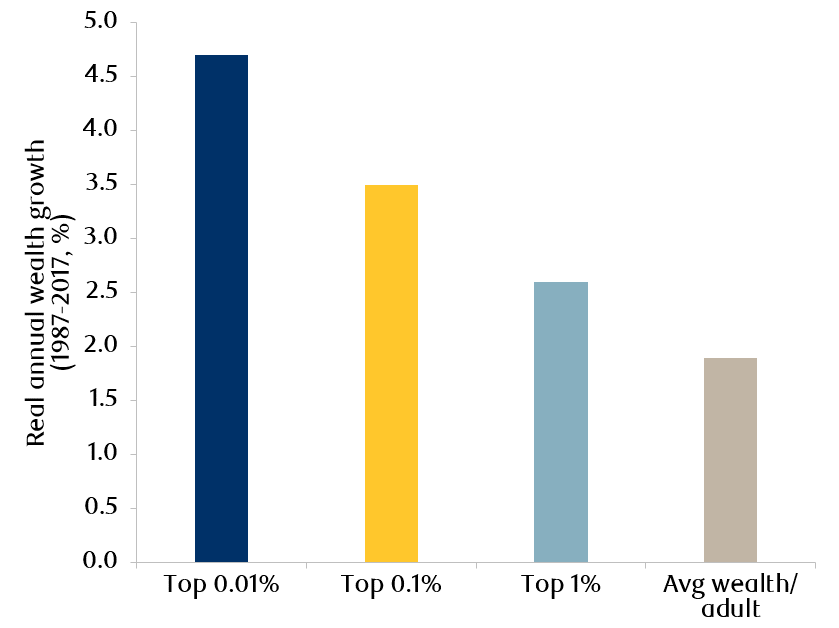

The pandemic has also accentuated social divisions and financial inequality that have been increasing globally in recent decades (Exhibit 5). The resulting social tensions have manifested themselves in protests, for example, in Hong Kong and Chile in 2019 and, more recently, in the U.S. and Europe.

Exhibit 5: Global wealth growth and inequality

Source: Jefferies, WID. World. Data as at December, 2019. Note: Growth rates are expressed in real terms, after the deduction of inflation.

We believe the growing risks from social divisions have become too large for governments to ignore and that, as a result, investment in social infrastructure will not only be imperative for the future sustainable development of cities, but also for the survival of economic and political structures.

EM Social Infrastructure by sector

The table below summarizes some of our key findings across the key social infrastructure sectors in EM:

|

Housing |

|

|

Education |

|

|

Healthcare |

|

|

Public transport |

|

|

Water & waste management |

|

|

Renewable energy |

|

EM Social Infrastructure by country

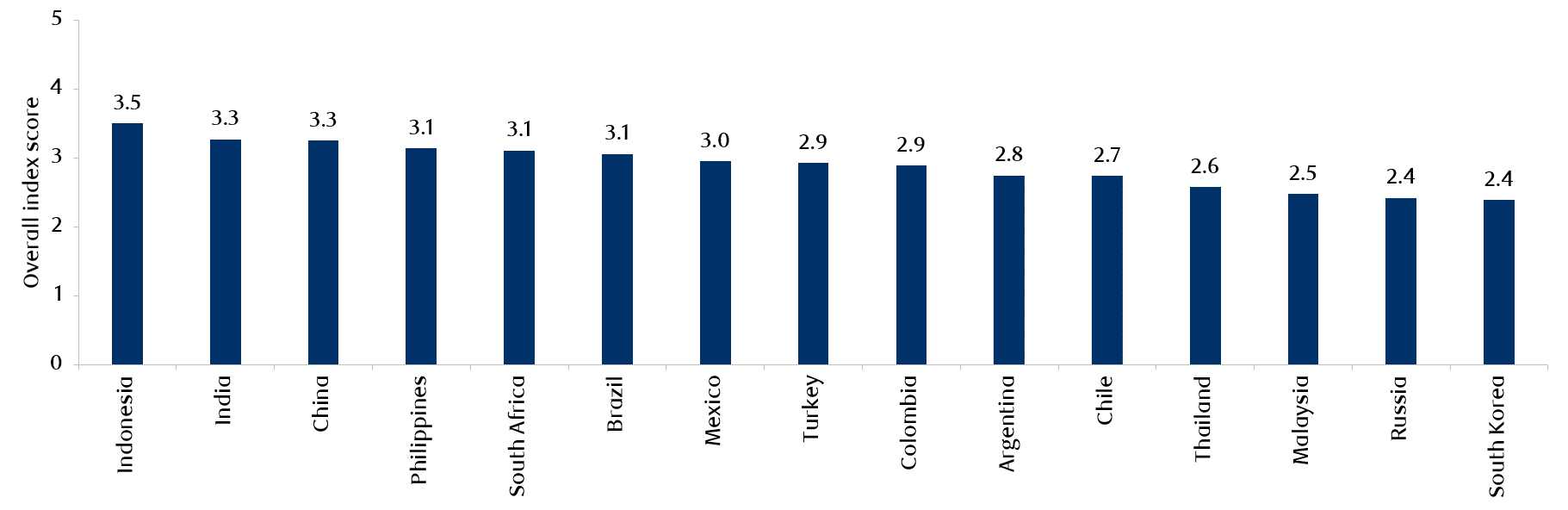

In order to assess the opportunities and risks of the social infrastructure theme within EM, we developed a country scorecard. Exhibit 6 summarizes our results.5

Country highlights:

- Indonesia, India, China and the Philippines scored the highest in our country scorecard. These scores reflect a large investment opportunity owing to 1) underpenetrated social infrastructure, stemming from historical underinvestment, 2) strong economic and demographic factors driving demand for social assets, and 3) positive supply-side factors such as government support.

- India stands out as having an attractive housing opportunity, due to 1) a significant shortfall in affordable housing, 2) over-crowded homes and slum settlements, and 3) a large young demographic driving demand. Government support has so far been positive including initiatives such as “Housing for All by 2022”, however further investment will be required given the scale of the deficit versus the rapidly growing demand.

- Thailand, Malaysia, Russia and South Korea scored relatively poorly in our scorecard, largely reflecting already developed social infrastructure and thus a limited opportunity set.

- South Africa’s ranking is largely influenced by its scores in healthcare, education and housing, where we see significant under-penetration which will require investment. However, the government’s ability to invest in social infrastructure is relatively low due to weak economic factors such as GDP growth and government debt. That said, this could suggest a significant opportunity for private investors in South Africa.

- The Latin American countries fare moderately in our scorecard overall, although at the sector level we identified select attractive opportunities. Brazil and Mexico scored well in education, Chile and Colombia scored well in healthcare, while Brazil, Colombia and Mexico scored well in public transport.

Exhibit 6: Social Infrastructure – EM country scorecard

Source: RBC Global Asset Management and the RBC Emerging Markets Equity team. Data as at December, 2019. Note: the weights assigned to each parameter and the methodology behind the country scorecard are subjective. For some metrics data was not available from a uniform source for all countries, or the data points were not reported by all countries for a given year.

The RBC Emerging Markets Equity team’s thematic research helps inform our top-down investment positioning. In the case of social infrastructure, it has highlighted both risks and opportunities across the EM universe. In particular, it has reinforced the structural opportunity within housing in India, to which we maintain good exposure in our portfolios, as well as to education and health-related services more broadly. It has also highlighted risks relating to climate change and the environment at both country and industry level in EM.

Get the latest insights from RBC Global Asset Management.