Executive summary

India was the first country to legally mandate corporate social responsibility (CSR) in 2013; large companies are required to spend 2% of their average net profit for the past three years on CSR by law.1

- Often we see environmental, social and corporate governance (ESG) analysis on Indian corporates as being overly optimistic or simplistic when assessing these CSR efforts, and an absence of recognition that it is actually mandated by law.

- We surveyed the top 30 publicly listed companies in India. Our studies show there is limited visibility on how the money is distributed and disclosure from companies remains insufficient.

- We suggest some ideas to improve upon the existing CSR mandate.

Background of the Indian mandated CSR legislation

In 2013, India was one of the first countries to adopt CSR legislation. The CSR framework adopted in Section 135 of the Companies Act, 2013 is premised on the principle that profitmaking enterprises should contribute a prescribed amount to social and environmental causes such as eradicating hunger and poverty, promoting education and gender equality and promoting health care.2

Section 135 applies to both Indian companies and foreign companies doing business in India that, during the immediately preceding financial year, had (1) annual turnover of at least INR$10 billion (approximately US$133 million), (2) net worth of at least INR$5 billion (approximately US$67 million) or (3) net profit of INR$50 million (approximately US$667,000).

CSR expenditures

Under Section 135, companies that trigger any of the financial thresholds described above are required to spend at least 2% of their average net profits made during the three immediately preceding fiscal years on CSR activities. However, the current regime follows a “comply or explain” model. As such, companies subject to Section 135 that fail to make mandated CSR contributions are only required to explain in their annual board report the reasons for non-compliance. There currently are no financial penalties for non-compliance.

The dangers of ESG cheerleading

With the rising importance that international institutional investors ascribe to ESG factors, we have noticed that Indian companies have been keen to highlight their CSR commitments, be it in annual reports or when we meet with companies. Rarely do they mention that this is mandated by law.

As investors and sceptics we tend to be cynical, but clearly there are companies that put their contributions to good use. Nevertheless we have also noticed that international third party ESG providers often take at face value efforts by companies that may not actually meet acceptable thresholds.

We think it is worth doing further analysis and asking our investee companies the right questions rather than “box ticking” when it comes to CSR contributions, analyzing where the contributions are going.

RBC Global Asset Management survey results – 30 largest companies in MSCI India Index

We reviewed the latest CSR reports of the largest 30 companies in the MSCI India Index to reach the findings below. These 30 companies combined make up 77% of the MSCI India Index by weight, as of November 2020. We highlight three key findings below. (Exhibit 1)

Exhibit 1: 64% of the companies surveyed complied with the 2% spending guideline on a one year basis

Do the companies meet the 2% spending requirement over the past year?

Source: 2020 Company Reports, RBC Global Asset Management. Data as at November, 2020.

Observations from the RBC Global Asset Management survey

Our study highlights that while all companies we studied have a publicly disclosed CSR policy, 33% of these companies have insufficient disclosure (refer to Exhibit 2). We deem insufficient disclosure as CSR policies with no clear or measurable goals, lack of transparency or lack of accountability. Quite a few media outlets have highlighted the risk of inefficiency, instability, corruption and interference under a mandated CSR regime.3,4 We do see partial merits in these claims having reviewed the CSR reports of the top 30 companies.

Exhibit 2: Based on RBC’s internal review of the CSR reports, we found 67% of companies had good and well thought out disclosures

Percentage of companies with good and well-thought-out disclosure

Source: 2020 Company Reports, RBC Global Asset Management. Data as at November, 2020.

Exhibit 3 highlights that most companies implement their CSR projects through a combination of channels. These options include the company’s own foundation, donation to well-known charities and the use of less reputable charities. We believe there is a lot more accountability when funds are given to well-known charities. This is of course under the general assumption that they have a clearer vision and focus, an established implementation process to assure efficiency, and adequate oversight and reporting to keep donors and the general public up-to-date on their progress.

It is worth noting that Indian companies and charities operate in an often challenging environment in terms of corruption, even in the context of other emerging markets. India ranks below average on the corruption front, ranked 80 out of 180 countries by Transparency International.5 A Transparency International survey from 2019 suggests that 63% of public service users paid a bribe in the previous 12 months. In the instances where funds are distributable via the company’s foundation or through unnamed or less reputable charities or third parties, we see greater potential for weaker governance and higher risk of corruption.

Exhibit 3: CSR funds are distributed via 3 main channels. Companies utilize multiple channels to distribute funds

How the funds are distributed

Source: 2020 Company Reports, RBC Global Asset Management. Data as at November, 2020.

The RBC Asian Equity Team believes that ESG factors are an essential and integrated part of our active investment management process and we highlight our approach to ESG here. Corporate governance is an important consideration for us. We believe the survey results do impact our view on the individual company’s corporate governance. We like to see companies that have a clear purpose in their donations which are in line with their business strategy and positively contribute towards the community. Non-compliance with ESG requirement and or a lack of transparency does reflect poorly on a company’s governance, which is taken into consideration in our investment process.

Ideas to improve upon the existing CSR framework

We highlight several ideas that we believe would improve upon the existing CSR framework in India.

First, we believe that companies should continue to allocate more of the CSR funds to well-known external charities after sufficient due diligence, to improve governance and impact while lowering the risk of corruption.

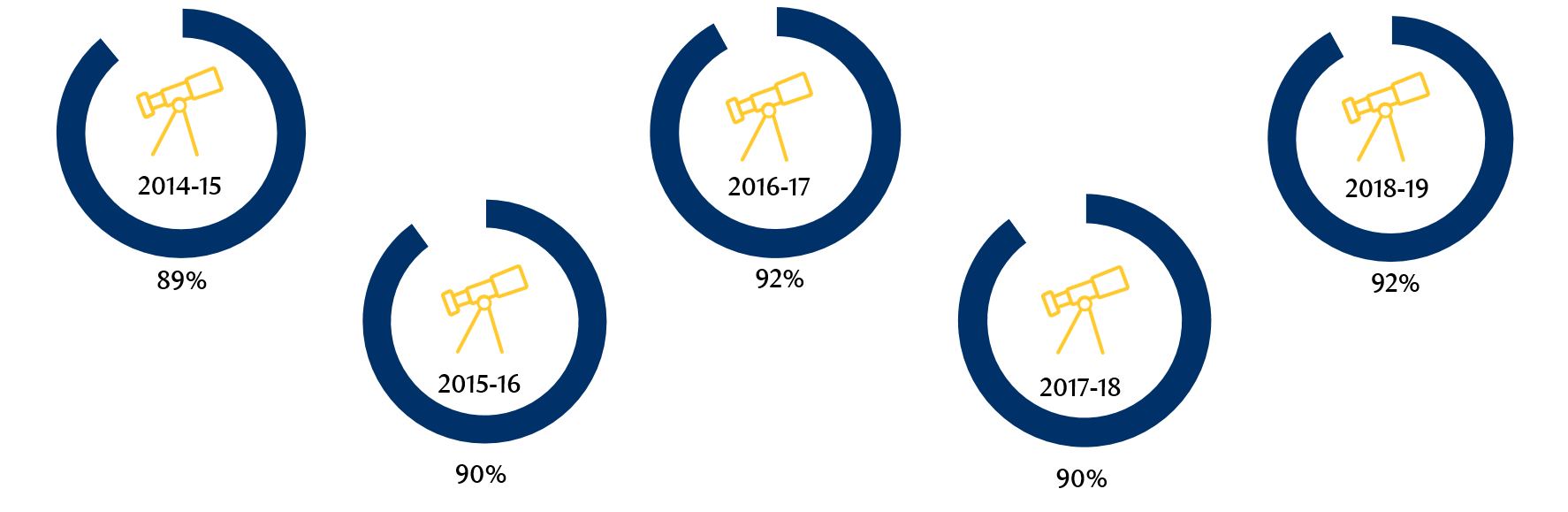

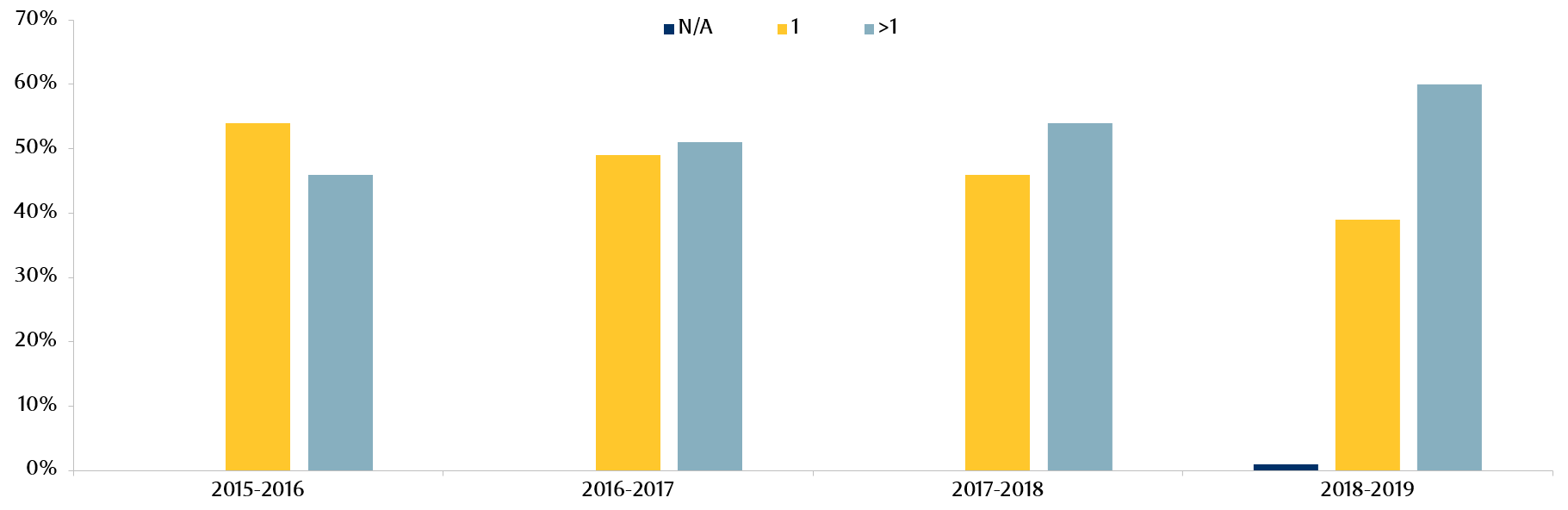

Second, we would like to see more independent director oversight in the CSR committees. It is encouraging to note that KPMG has shown this to be trending in the right direction, both in regards to the number of independent directors and the formation of stand- alone CSR Committees.6 (Exhibit 4 & 5)

Exhibit 4: Percentage of stand-alone CSR Committees

Source: KPMG in India’s analysis based on India’s CSR reporting survey. Data as at December 2019.

Exhibit 5: Number of independent directors in the CSR Committee

Source: KPMG in India’s analysis based on India’s CSR reporting survey. Data as at December 2019.

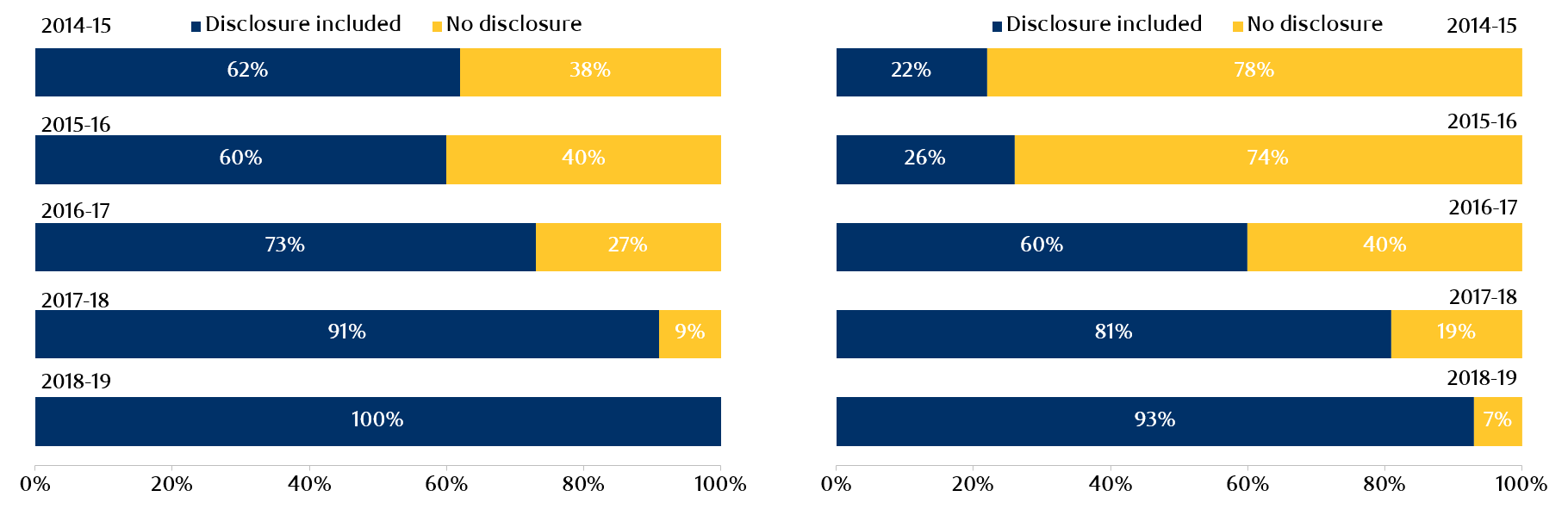

Third, we believe there is further room to improve upon transparency and disclosure in either the CSR reports or annual reports. We have seen marked improvement in reporting, but there remains further room to improve in identifying and monitoring the outcomes of key performance indicators (KPIs). (Exhibit 6)

Exhibit 6: Disclosure on focus areas of CSR & disclosure on outreach/people impacted

Source: KPMG in India’s analysis based on India’s CSR reporting survey. Data as at December 2019.

Conclusion

Since the corporate social responsibility legislation was adopted in India in 2013, we have seen an improvement in the creation of a dedicated CSR committees and increased annual disclosure via annual reports or CSR reports. However there remains room for improvement, especially as concerns of inefficiency and corruption exist. We believe the increased allocation of funds to external, well regarded and audited charities, along with increased oversight by independent non-executive directors are ways to mitigate this risk. We have seen marked improvement in reporting, but there remains further room to improve in identifying and monitoring the outcomes of KPIs.

Get the latest insights from RBC Global Asset Management.