Cryptocurrencies – in particular, Bitcoin – continue to capture the attention of investors. At the beginning of 2023 Bitcoin was at multi-year lows, but it has started to rally – even reaching new all-time highs in 2024. Yet, many struggle to understand the complexity and nuance of the space. To add some clarity, we explore several key questions:

- What is cryptocurrency/Bitcoin?

- What’s blockchain technology and how does it support Bitcoin and other cryptocurrencies?

- How has Bitcoin performed?

- What do investors need to consider before they enter the space?

What is cryptocurrency?

There are few similarities between cryptocurrencies and traditional currencies (such as dollars or euros). You can use both to purchase goods and services. However, that’s pretty much where the resemblance ends. For example:

- Unlike dollars, you can’t hold cryptocurrencies in your hand. They are completely electronic.

- They’re global.

- Transactions are largely anonymous, although everything is tracked and records kept in vast databases.

How does all this work? To understand cryptocurrencies, let’s take a deeper dive into Bitcoin. It was the first and is now the largest cryptocurrency in the world.

What is Bitcoin?

A 2008 white paper laid out the plans for Bitcoin. The currency was designed to support a platform where individuals could securely hold, send, and receive items of value digitally – without the need for a trusted intermediary like a bank. The solution lay in the creation of a distributed, decentralized database to help manage and authenticate transactions. This is called a blockchain.

What’s blockchain technology? How does it support Bitcoin and other cryptocurrencies?

If you’re a visual learner, imagine a physical chain where every link is a group of transactions (or block). As transactions occur, they’re timestamped and then added to the chain in a new link.

On the surface, the concept of the blockchain is simple. However, the true ingenuity of the system rests in its use of a decentralized network. Bitcoin uses a network of thousands of computers to host its blockchain. Unlike most databases, these computers are not all under one roof. Also, each computer or group of computers is operated by different parties. Called “Bitcoin miners,” they verify every transaction in the blockchain. Bitcoin maintains the integrity of its network by providing economic incentives for its miners to behave honestly.

While more details are beyond the scope of this article, the important takeaway is that the blockchain has worked successfully. Since Bitcoin’s blockchain was launched over 10 years ago, it has been operating securely, with nearly 100% uptime. What’s more, to date the Bitcoin blockchain has never been hacked and regularly processes billions of dollars in daily transactions. All without a central, organizing figure.

How has Bitcoin performed?

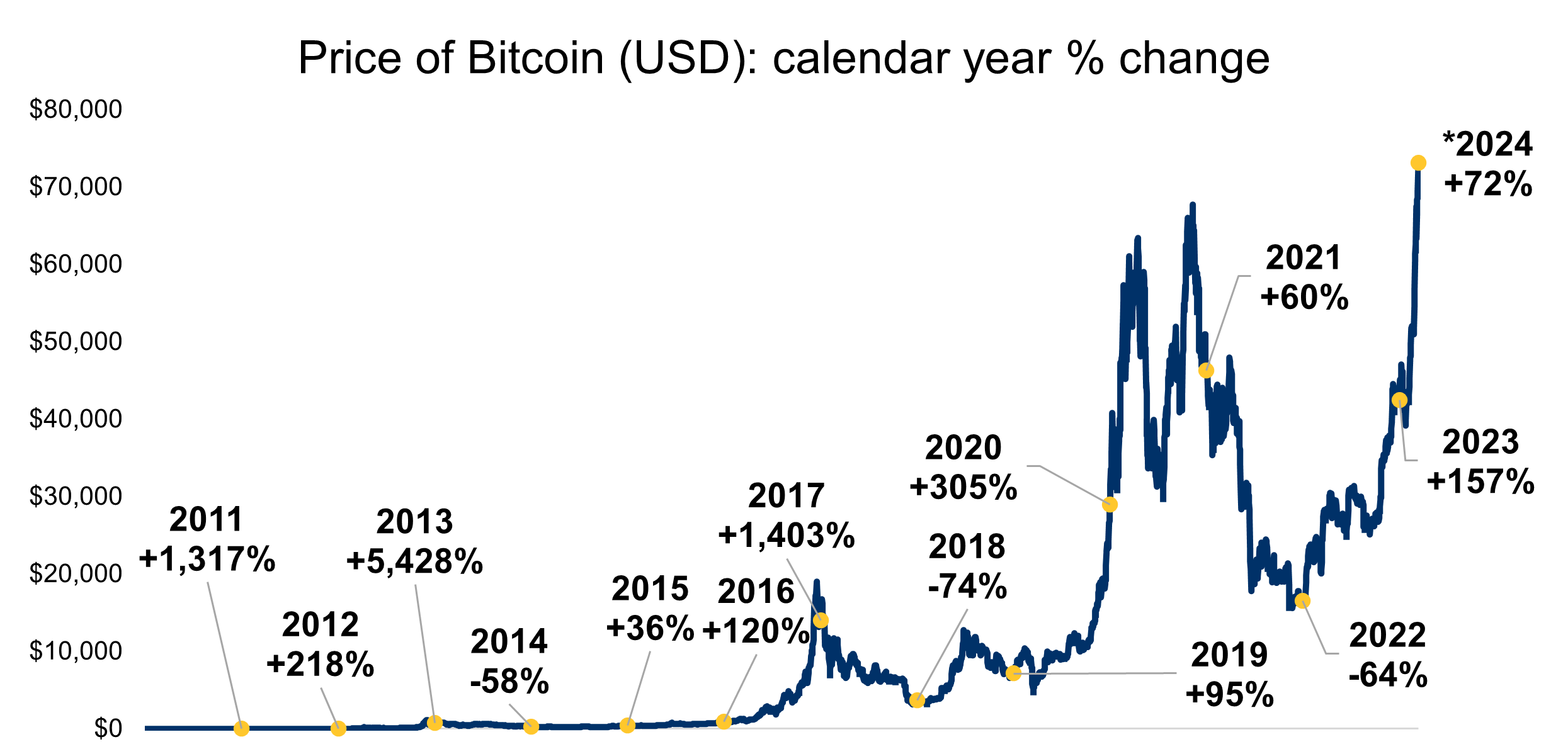

Bitcoin has seen some price swings, extreme at times, over the years. Below we plot the wild ride.

Price of Bitcoin (USD): calendar year % change

Source: RBC GAM, Bloomberg. Bitcoin price in USD as of January 1, 2011 to March 13, 2024. *2024 calendar year % change as of March 13, 2024.

The investment characteristics of Bitcoin are best captured by two features:

- High returns. The price of Bitcoin has risen in 10 of the past 13 calendar years, posting triple-digit or greater returns in seven of those years. We note Bitcoin’s volatile track record is highlighted by a 5,428% gain in 2013. Notably, Bitcoin reached a new all-time high in March 2024.

- High volatility. Achieving these high returns has not been easy. The price of Bitcoin has experienced seven different peak-to-trough declines of more than 70% in the last 13 years. What’s more, high levels of volatility are often seen quite frequently. Most recently in January 2024, the price of Bitcoin fell in excess of 15% in just two weeks.

There are also a number of challenges faced by cryptocurrencies, including the following:

- Cryptocurrencies still aren’t very fungible – there isn’t all that much one can practically buy with them. This is a pre-requisite for acting as a proper unit of exchange. Additionally, the pseudonymity and decentralized nature of cryptocurrencies are attractive characteristics for those looking to launder money or conduct other illicit activities.

- Cryptocurrencies may not be sufficiently stable to be a currency. In some cases they’ve experienced substantial volatility, destabilizing at precisely the moment that stability would be most prized. Stablecoins (another type of cryptocurrency) pursue price stability by maintaining reserve assets as collateral or through algorithmic formulas that are supposed to control supply. In some cases, these stablecoins can be pegged to the U.S. dollar to provide stability, assuring those who accept it that it will retain purchasing power in the short term. Though, they do present some risk to credit markets. Defending the stablecoins from depreciation can require administrators to liquidate reserve assets held in traditional credit vehicles. Furthermore, a stablecoin named TerraUSD (UST) which was pegged to the U.S. dollar collapsed in May of 2022, causing investors to lose much of their initial investment.

- Overall, cryptocurrencies lack sufficient liquidity. Though, with the launch of Bitcoin ETFs in the U.S. it has given investors more access to Bitcoin as they can now hold these products in traditional investment vehicles. However, from the perspective of Bitcoin’s use as a currency the theoretical Bitcoin transaction limit is a paltry 7 global transactions per second. Compared to Visa’s capacity to handle 56,000 transactions per second. The cost of transacting in Bitcoin is currently US$1.25 per transaction – not bad, but not massively cheaper than existing technologies. And the cost of transactions can vary wildly, briefly rising to a startling $63 per transaction on some exchanges just over a few years ago.

- The environmental impact of Bitcoin has also come under scrutiny. The supply of Bitcoin is capped at 21 million, with new fractions released to the market through a process called “mining.” However, as the supply moves toward 21 million, it becomes harder and harder to mine. Currently, only the most expensive computer hardware can mine Bitcoin above marginal cost. This in turn consumes a significant amount of energy which seems to be specific to Bitcoin as other cryptocurrencies have largely resolved this issue.

High levels of volatility and promotion by social media “influencers” have been associated with cryptocurrencies since their inception. This is not likely to change anytime soon.

While the Bitcoin database is very secure, the history of crypto is plagued with stories of fraudulent entities stealing funds and major exchanges being hacked. This has led to significant losses for investors with little recourse, as owners are anonymous by design. Ownership is established through a private key or password. If that key is lost or stolen, the associated crypto is also lost. This underscores the importance of working with best-in-class partners to avoid potential fraud. Notably, in November 2022, the former cryptocurrency exchange FTX, was found to be participating in fraud and other illegal activities causing major losses for users and investors.

The venues that cryptocurrencies trade on are not as regulated or mature as the exchanges on which other financial assets trade. As a result, there is a potential risk of market manipulation. This may be difficult to monitor and correct under current rules.

The regulatory environment for cryptocurrencies is constantly evolving. Enhancements – particularly related to anti-money laundering – are required to bring crypto regulations closer in line with that of other assets. These changes could impact the ease of trading and the price of certain cryptocurrencies. In addition, there have been some attempts from government agencies around the world to regulate and monitor the flow of cryptocurrencies. However, the anonymity and global portability of cryptocurrencies may make added regulation difficult.

Though crypto headlines tend to be dominated by Bitcoin, there are over 9,000 cryptocurrencies in the world today. Each one relies on the breakthroughs made by Bitcoin’s blockchain network. However, they are individually optimized for different uses. The list includes Ethereum, the largest competitor which offers some usability and environmental advantages over Bitcoin.

In conclusion

Despite the progress and growth we’ve seen in recent years, it’s still relatively early days for cryptocurrency and blockchain. While the future is not clear, it’s becoming increasingly apparent that the underlying technology offers many benefits. In fact, many large public companies are exploring uses for blockchain technology. These innovations may offer investors another way to participate in this growing arena. But as an investment, the role of cryptocurrencies in a portfolio remains in question given their extreme levels of volatility.

Read more now about different investment strategies – including gold and traditional currencies.