There are three forces driving the current changes to the way we consume food: climate change, changes in diet and technology advancements. Per capita meat consumption grew 93% in the period 1990-2018, as countries became richer and meat became an affordable source of protein.1 As household incomes in emerging markets (EM) continue to grow, demand for meat-based products will also increase. The supply of meat globally faces bottlenecks as food production is not keeping pace with population growth. According to the Harvard Business Review, by 2050 the world’s population is set to reach just under 10bn and food demand is expected to increase by between over 50%.2

The food sector is being put under increasing pressure as a result of climate change. In fact the United Nations (UN) warned of an impending food crisis where the challenges facing agriculture and food systems are so stark that to continue with ‘business as usual’ is not an option.3 Resources are already over-stretched and arable land is becoming scarce. If, as estimated, food demand increases by over 50% between 2020 and 2050, food systems will have to undergo significant changes because the current methods are not sustainable.4

As is usually the case, when change happens it is because of a confluence of factors which all collide to make the perfect storm. The seven major challenges facing the agriculture industry and food production are:

- Environmental factors, such as greenhouse gas (GHG) emissions and scarcity of water;

- Safety concerns, such as pandemics like Swine flu or COVID-19, and the growing resistance to antibiotics in humans;

- Scarcity of land;

- Food security and the negative impact of globalization (almost all countries globally are net food importers relying on trade);

- The already huge – and growing - demand from EM that cannot be met;

- Food waste: One third of all food produced globally goes to waste;

- Consumer demand and availability. Consumers not only want to eat more healthily, but are also concerned about the planet – the conscious consumer.

All these factors lead to food price inflation. Whilst there have been cycles in food prices, the general trend has been upwards for the last three decades and this has only been accelerated due to the COVID-19 pandemic and anti-global sentiment which will result in short-term supply disruption.

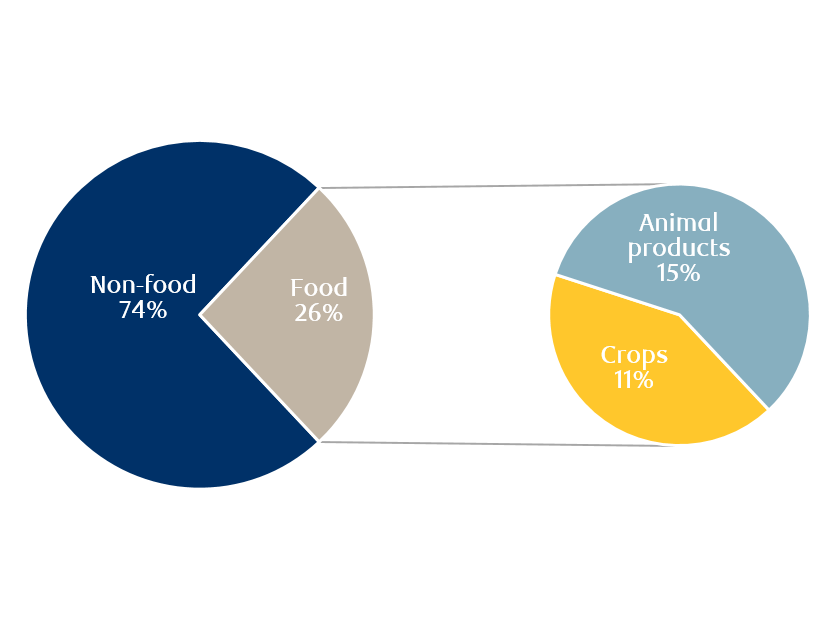

When looking at each of these factors in turn, we can see the impact of agriculture on the environment (Exhibits 1 and 2). Exhibit 1 shows that food accounts for 26% of all global GHG emissions, and animal products represent 58% of that, equating to 15% of total global GHG emissions. This makes it the single biggest GHG emitter of any single industry - bigger than electricity production, industry or transportation.

Exhibit 1: Food accounts for 26% of global GHG emissions

Source: Poore & Nemecek (2018), Science, BBC, BofA Global Research. Data as at April, 2020.

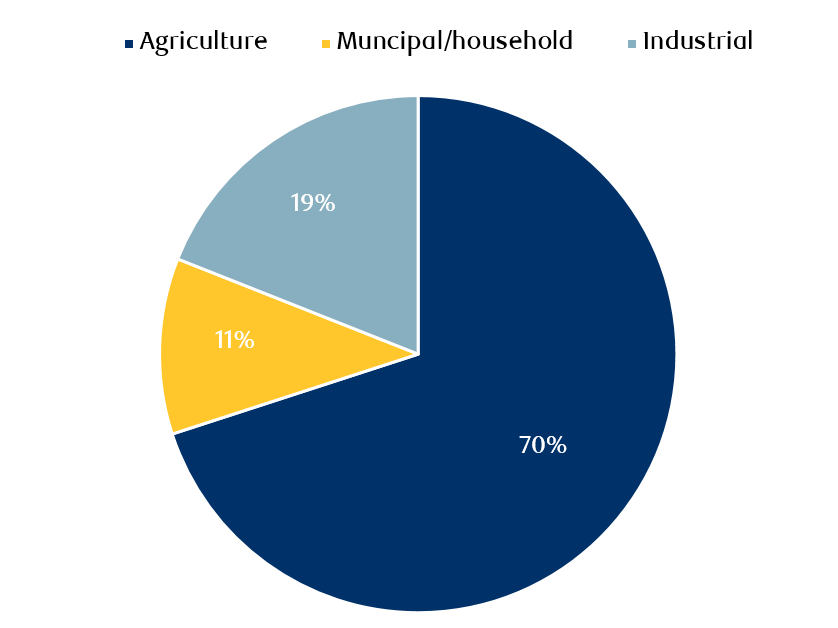

Exhibit 2: Global water withdrawals by use

Source: UN FAO. Data as at December, 2016.

Not all GHGs are created equal. The main GHGs are water vapour, CO2, methane, ozone, nitrous oxide and chlorofluorocarbons. In fact the most important GHG emissions from animal agriculture are methane and nitrous oxide. Methane, or CH4, mainly produced by enteric fermentation and manure, is a gas which has an effect on global warming 28 times more powerful than that of carbon dioxide. Nitrous oxide, arising from manure and the use of fertilizers, has a global warming potential that is 265 times higher than that of carbon dioxide.5 Therefore, whilst methane and nitrous oxide are actually more harmful, CO2 is still considered to be the most potent because it is produced in greater quantities and most often released into the atmosphere. As a reminder, GHGs trap heat within the atmosphere, thus making our planet warmer and causing climate change.

Further environmental pressures include land and water scarcity. 50% of the world’s arable land is used for agriculture, of which the vast majority – 70% - is used for the rearing of livestock (and as a comparison a mere 1% is used for urban spaces).6 The reason this is so high is because the feed conversion ratio (the efficiency with which the animal converts feed to output), is so high. For example, 2.3kg of feed is required for 1kg of fish, 4.5kg for chicken, 9.1kg for pork and 25kg for beef!7 This means we will need significantly more land for livestock farming if EM’s desire for meat products continues to grow exponentially as expected. As shown in Exhibit 2, 70% of freshwater withdrawals globally are consumed by agriculture (only 10% domestic, 20% industrial) and it is livestock farming rather than the growing of fruit and vegetables that consumes by far the most water per unit produced. Global water stress levels are only low in Canada and the Arctic but India and China have medium-to-high stress levels, but that is not an entirely accurate picture as in China 70% of the groundwater is not even suitable for industrial use, let alone for drinking, and the country has 20% of the world’s population with 5% of the world’s water sources.8

As people become wealthier their diets change from being based predominantly on starchy staples to diets that incorporate increasing amounts of complete proteins in the form of meat and dairy. In emerging countries the annual per capita consumption of meat has doubled since 1980.9 Meat consumption has increased every year since 1990 and much of this growth has been driven by EM in Asia, as growing populations and incomes have increased the demand for meat-heavy diets.10

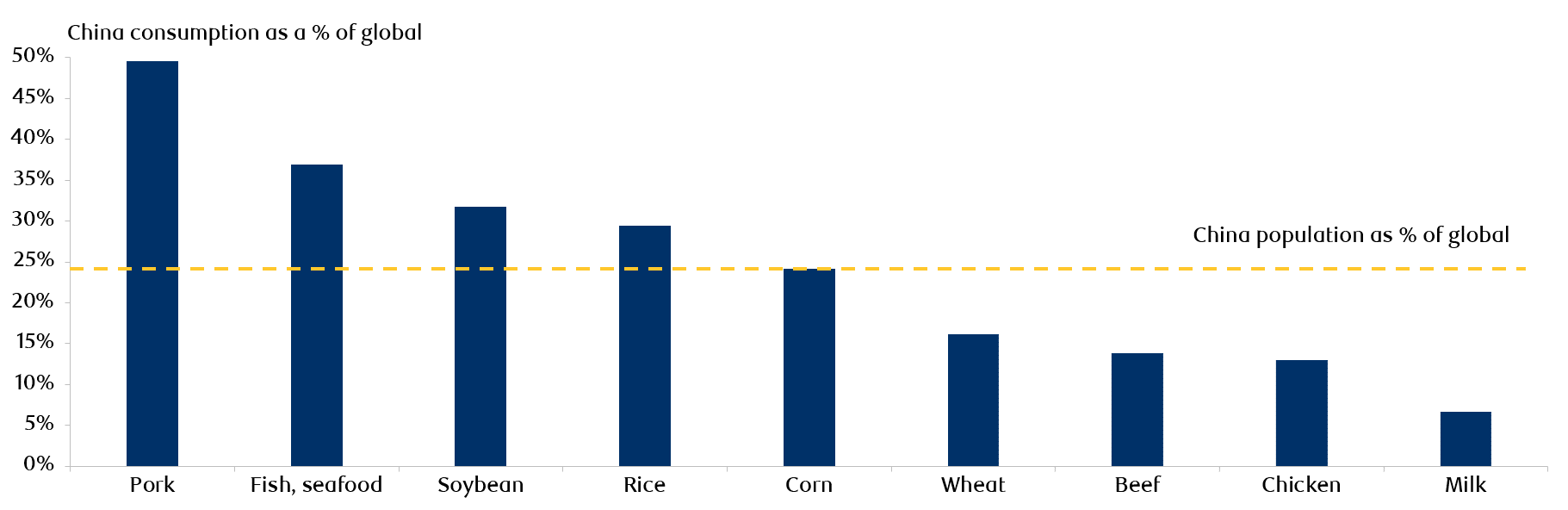

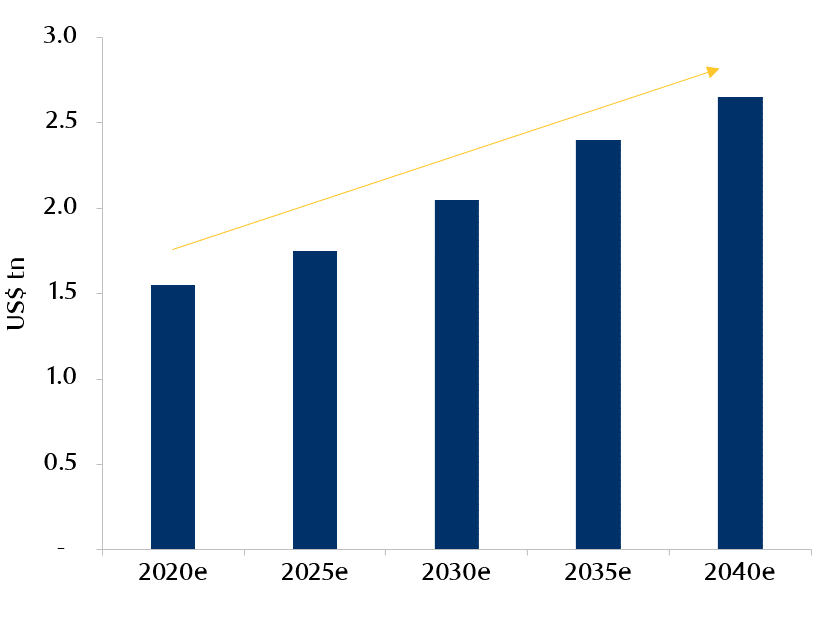

In developed markets (DM) meat demand has peaked, in part driven by trends like vegetarianism and veganism as people become more health and climate conscious, but meat demand from EM will sustain growth in the global meat industry. According to estimates from a joint study done by the UN FAO and the OECD, global beef consumption will increase by 8% in the period between 2018 and 2027, but growth in EM is expected to be nearly triple that number, at 21%, and most of this growth will come from China.11 Although China is already the largest consumer of meat in absolute terms, meat consumption per capita is still lower than in the DMs of the E.U. and the U.S. In particular the consumption of high-quality animal proteins such as beef, chicken and milk remains low in China. (Exhibit 3). In the coming decades, it is predicted that the Chinese will become more concerned about improving the quality of what they eat. As income levels in EM grow, we think per capita meat consumption levels will catch up with those of DM. Estimates vary but currently it is thought that the global meat industry’s total market size is between US$1.2tn and US$1.5tn, and it is expected to almost double between 2020 and 2040 as shown in Exhibit 4.12

Exhibit 3: China’s share of global food consumption (2017)

Source: USDA, FAO, Goldman Sachs Global Investment Research. Data as at July, 2019.

Exhibit 4: Global meat sales forecasts (2020-2040e)

Source: Beyond Meat and Jefferies estimates. Data as at September, 2019.

Problems will arise if China is unable to supply its rising demand; costs in China’s agricultural sector are twice as high as peers. China’s rapid urbanization and high labour costs have meant that land and labour account for over 40% of the cost of food production versus only 3%-5% in the U.S. and Brazil.13 Taking into account the multiplier effect of basic crops required to produce animal protein, this means that China’s basic crop demand (soybean and corn) is expected to grow by 40%-60% and this will be met mainly by imports. On current projections it is estimated that by 2030 imports from Australia, Brazil, the U.S. and New Zealand combined would not meet even half the required amount.14

Given what we know about the pressure on resources and consumer preferences it is important to ask what could offer the best solutions. We believe these are five-fold, namely: 1) plant-based alternatives, 2) laboratory-grown meats, 3) insect consumption, 4) livestock vaccines, and 5) new farming techniques. The potential impact of regulation could also accelerate these changes. It has been suggested that some countries are looking at introducing a meat tax -, much like a sugar tax - to try to encourage people to consume alternative sources of protein.

First, plant-based alternatives, such as plant-based meat, offer a good solution especially when complete proteins such as soy or peas could be used, or alternatively the plants themselves. Many plant-based meats have come on to the market in recent years with supermarkets and restaurants serving an increasing gamut of non-meat options; 2019 was the year veganism went mainstream in DM. New plant-based burgers hit the market and were popular with consumers both for health and sustainability reasons. The alternative-meat market is a huge addressable market because the entire meat-based sector, plus the existing vegan and vegetarian base, would combine to create a market opportunity of US$1.2tn-US$1.5tn, so we can expect huge future growth in the plant-based meat segment.15

A second solution is the consumption of insects which are the only totally sustainable and ethical food source. Gram-for-gram they have up to twice the amount of protein as beef and they are already being eaten by 2bn people in 80% of the world’s countries.16 Even if this might be unpalatable for consumers in Western markets initially, there has been considerable investment in this segment and for the first time the E.U. has provided large-scale funding and subsidies for insect farming.

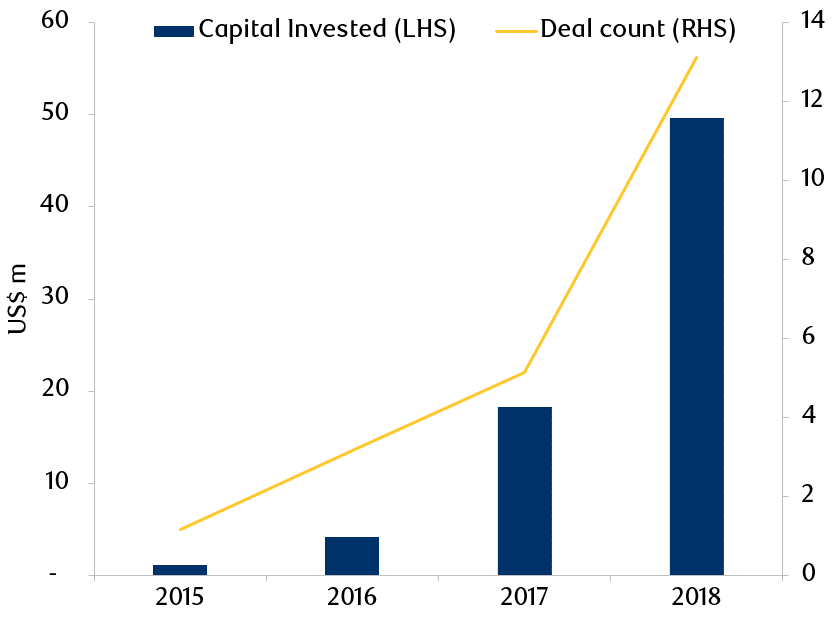

Similarly, there has been substantial investment globally, mainly by technology companies, in laboratory-based or cell-based meat (Exhibit 5). Back in 1932 Winston Churchill wrote that “we shall escape the absurdity of growing a whole chicken in order to eat the breast or wing, by growing these parts separately under a suitable medium.”17 It’s as if Churchill had a crystal ball because cell-based meat is in fact stem cells that are grown in a culture medium in a laboratory; this saves land and water, eliminates the use of antibiotics, and reduces GHG emissions. Laboratory-grown meat is not currently available commercially, however with the substantial investment from cash-rich technology companies and private equity firms around the world it is expected that operations will be scaled up for it to become a viable commercial alternative.

Exhibit 5: Investment in cell-based meat companies

Source: Good Food Institute, Jefferies Equity Research. Data as at September, 2019.

In addition, new types of farming are quickly evolving including techniques such as hydroponics, aquaponics and vertical farming which is more efficient than traditional open field farming. In fact the first Asia-based vertical farms are already commercially operational. Vertical farms also offer solutions for smart cities: indoor farming in climate-controlled environments, locally-grown food without using pesticides and a product that is quick to market.

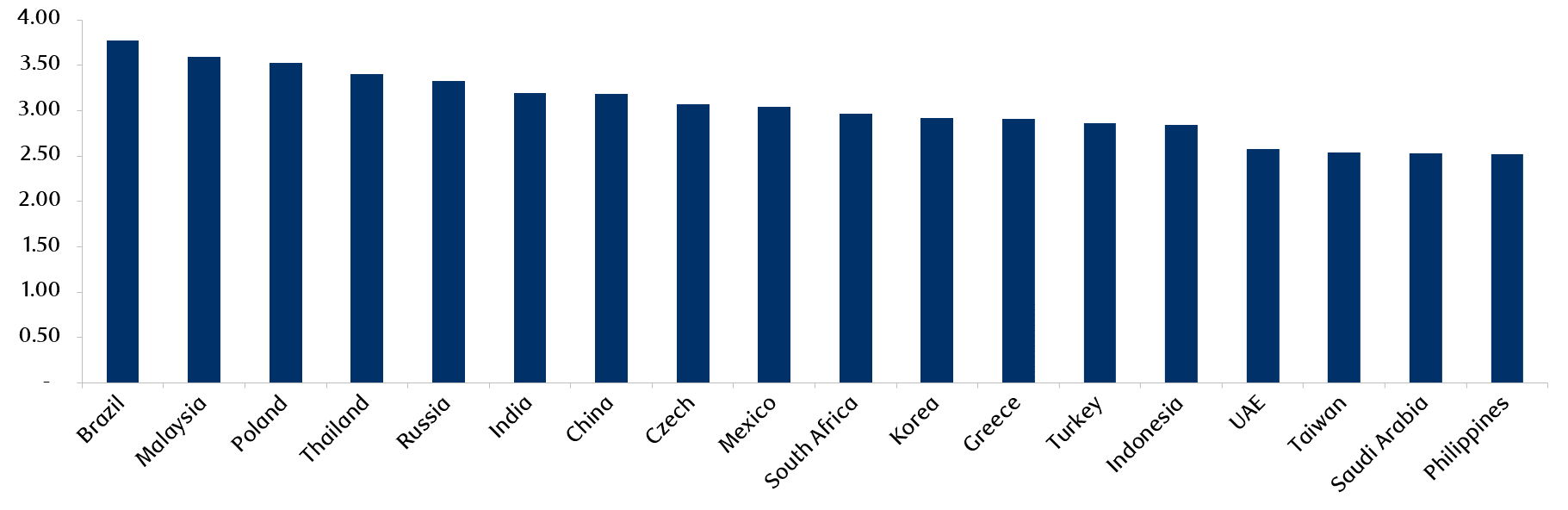

RBC EM country scorecard

In order to assess the opportunities and risks of the future of the food industry in EM, we formulated a country scorecard. The scorecard incorporated 21 different parameters across three sections 1) positioning to face the future of food, 2) environmental impact, and 3) food health. The findings were then combined into one composite index score with weights assigned based on the perceived significance of each parameter. The countries were scored on a scale of 1 to 5, with 5 being the most attractive. Exhibit 6 summarizes our findings.

- Unsurprisingly, Brazil ranked highest as one of the largest food producers and net food exporters in the world. The country has significant resources and has received significant venture capital (VC) funding for food agri-technology. Brazil has strong capabilities in cold storage transportation and refrigerated warehousing which means it scores highly on food sustainability due to low levels of food waste.

- A more surprising finding relates to advanced EM economies like Taiwan and South Korea which we expected to score highly due to investment in food technology and agri-technology. Although they have seen noteworthy amount of VC investment, both countries are net importers of food, have relatively large food trade deficits per capita, no existing sugar taxes, have high agriculture emissions, and use high amounts of pesticides in agriculture. These factors all weighed on their scores.

Exhibit 6: RBC EM country scorecard

Source: RBC Global Asset Management, Emerging Markets Equity team. Data as at June, 2020.

Investment implications

In terms of the investment implications, we concluded that ‘the future of food’ is a globally investible theme and relevant to both developed and emerging markets. While many dynamic and innovative start-ups are emerging in response to the significant challenges faced by the food industry, as with any structural shift there will be both winners and losers and it may be many years before the winners begin to reap the rewards of their significant investments.

We prefer to access the opportunity through incumbent companies with sufficient scale and resources to exploit the opportunities. In particular, we highlight food ingredients, enzyme and flavouring companies which have been in business for many decades and could benefit significantly. In addition, many of the incumbent meat and dairy companies are diversifying their product line-ups to include plant or nut-based alternatives. Those companies that embrace the changes have a much better chance of future success, whereas those that do not are more likely to be left behind.

Watch the latest Future of Emerging Market webinar to learn more about climate change and food production trends in emerging markets.