Is it time to revisit emerging markets Value?

In this report we highlight the extreme underperformance of Value stocks versus Growth stocks in emerging and developed markets (EM & DM) over the past decade. We summarize the key reasons for the poor performance before discussing why we believe the environment for Value should improve in coming years.

Watch time: 22 minutes 07 seconds

Speakers:

Dijani Jelic

Product Specialist, Emerging Markets Equities, RBC Global Asset Management (UK) Limited

Laurence Bensafi

Portfolio Manager & Deputy Head of Emerging Markets Equities, RBC Global Asset Management (UK) Limited

View transcript

Good morning and afternoon, all, and thanks so much for joining us today for our discussion on revisiting value in emerging markets. My name is Dijana Jelic and I’m the Product Specialist for the RBC Emerging Markets Equity team. I’m delighted to be joined by Laurence Bensafi, who’s a Deputy Head of the team and also Lead Portfolio Manager on our value strategy. And before we get started, I’d really like to encourage you all to please send through your questions; hopefully, you’ve got some instructions on your screen. We’ll make sure we leave a couple of minutes at the end to address any of these.

Now, Laurence, you’ve been doing value investing for the majority of your career and I think it’s fair to say it’s been a pretty tough time for the value investor in the last few years. And to put that in context, actually the last two years we’ve actually seen the biggest underperformance of value versus growth really since records began, so since 2000. So I think to start it would be really good to get your perspectives on this recent underperformance.

Yeah. Thanks, Dijana. And you’re right. Both in the emerging market and developed markets value as a style has massively underperformed growth even before COVID-19 accelerated the trend last year. Over 10 years actually the underperformance reaches close to 80%. This is huge. There are several reasons for this really, such as very low interest rates, the sluggish economic growth we have experienced since the global financial crisis that has really led to a quest for growth. But really, the main reason, in the end, is the ongoing shift we have from manufacturing to services, from consuming physical goods to consuming data online. Our world has become digital.

We consider we are going through like the fifth technological revolution. This one brought by the internet. The first entrance managed to deliver huge revenues and returns due to the scalability of the operations. We’re talking about acquiring hundreds of millions of users very quickly and also the asset-like models. There’s also a complete lack of regulation in completely new businesses that massively head to create quasi-monopolies. Many industries are being disrupted from retailers to media or banks as those new entrants, using the power of the internet and data collection. Companies which have not been able to adapt, and many just can’t in a short period of time, have suffered massively. This revolution has made those giants extremely attractive to investors and they are now the largest companies in the world.

As of today in emerging markets, the top nine stocks by market cap are all new economy stocks in Northeast Asia and add up to 30% of the index. Other sectors have been out of favour. They haven’t been able to match the growth level or worst, they’ve been impacted by low interest rates for financials or the increase in the shale gas industry for energy. Those are traditional value sectors that have underperformed because of that. This explains why growth stocks did so well the past few years. And obviously, COVID-19, in 2020, just accelerated this trend with people working, shopping, entertaining from home whilst buying very few physical goods. And those stocks just went through the roof since last March. Well, since March last year. That’s really the main explanation, Dijana.

Yeah. That’s really interesting and it definitely has been a very narrow market, and clearly COVID has really accentuated the gaps between the winners and the losers. So I guess with all of that in mind, where does that leave value and what’s your outlook for 2021?

Well, as we said, I think the growth outperformance and the value of the performance is completely justified the past few years as really those incumbents are almost quasi-monopolies in e-gaming, e-commerce, and grow extremely fast and in a very profitable way. However, the gap of valuation and performance has reached an extreme level, as you mentioned at the beginning. Value stocks have never been as cheap and growth ones that expensive. Not only that, but if you look also in terms of countries, the riskier countries became last year the cheapest they have ever been with for instance Indonesia, Mexico, Turkey being very, very cheap whilst the ones exposed to the new economy, Northeast Asia, so Taiwan, Korea, or China are pretty much the most expensive they’ve ever been. And the same at other sector levels. Energy, financials are extremely cheap while a lot of sectors exposed to tecnology are now the most expensive.

So now we have had a reset. We enter a new cycle and as the economy grows, it’s forecasted at a high level, with the help also of value stimulus that should help to lower unemployment and increase consumption, we should see a rebound in value names. And actually, this is what we’ve seen since November last year with the two triggers that were the election of Mr. Biden as U.S. President and the results of the first two vaccines for COVID-19 that kind of beat expectations.

So we would expect this trend to continue in 2021 and the gap of valuation between the two sides to narrow at least from a very, very, very large level.

So a more positive outlook for this year. I guess that’s positive to hear. And what about the longer term? I guess there is a view out there that the outperformance of growth is more structural and that perhaps that could continue. So what would be your perspective on that?

Yeah. So look, that’s very, very important and we often hear that this time this is different. And yes, every time something is different. But I think if you look back in history, the first point I wanted to make is that this situation has happened in the past. There has been long periods of value underperformance more than 10 years in the past and afterwards we still rebound on the value side. That happened before.

In history, we’ve seen new hot areas taking the lead for a while before giving back the gains and new hot areas taking over. Just looking at the past 20 years, we had a dominance 20 years ago of telecom companies when the mobile phone was invented. Those companies were the largest companies in the world. Just before the global financial crisis, the largest sector was financials. They were huge, they were extremely profitable, and nothing seemed to be able to stop them and we know what happens.

The reality is that very few companies are able to retain the leadership for a long period of time. Why is that? Because abnormal returns attract competition. For any new area, it can take a while but eventually, whether the technology’s more widely available and/or regulation wreck monopolies, and eventually abnormal returns disappear.

So in the medium term, I think we are closer to the end than the beginning when it comes to this cycle of growth outperformance. And you see the big question mark is on the timing. And again, I think some people believe that the standards is different and the dominance of the internet or autoware manufacturer giant is there to stay. But the reality is that already new entrants have emerged and that should bring down returns through time. We have had many IPOs in the recent months of companies which are fighting for the same advertising revenues of incumbents and the offering for instance of e-commerce is decreasing massively. Regulation is also expected to become tighter. This has already actually happened in China over the past few months even though for now the disruption has been minimal. It remains true that some companies operate in quasi-monopolies, especially—and this a little bit more difficult to follow—but when you look—when you take into account the ownership of many start-ups, you realize that a couple of giants in China on the fintech, e-commerce, e-gaming market, something we feel is not reallysustainable.

So we don’t know how long it’s going to take. We feel like we are closer to the end than the beginning but it’s very difficult to imagine the same companies in five, 10 years’ time will continue to be the leader because that’s never happened in the past really.

Yeah. And it’s interesting. We definitely are seeing a lot more regulatory scrutiny from China, but also the U.S. and Europe. But I guess the overall conclusion is probably the near term is probably uncertain. We’re going to see a lot of volatility in markets but also in terms of style. So I guess in light of that what would be your advice to EM value investors looking to navigate this challenging environment?

Yeah. So I think there’s one big lesson to learn here. Value will have long period of underperformance and for a value investor not to consider the reason for the value underperformance and investing in cheap names without considering other elements could mean a big underperformance to the index for years. So instead, we believe that a value strategy which incorporates the following features can outperform even when value is out of favour.

So the first thing is to focus on undervalued companies rather than cheap names. So this is a very important distinction because for an undervalued company we can identify drivers for re-rating whereas for cheap ones really the driver for re-rating is a style rotation, something that can take years to happen. So what are we calling undervalued companies? It’s a company for which there is a mismatch between the fundamentals and the valuation. So basically cheap stocks but with strong fundamentals that the market has failed to recognize. Maybe because the company has changed recently or is exposed to a new area. There are several reasons.

What we call strong fundamentals often is the company operating in an area of structural growth. This sounds obvious but it is really key to avoid the companies operating in industries in decline as they will remain cheap. Those are the value traps. It’s crucial to be selective and recognize that the world is constantly changing. New technologies develop, habits evolve, companies are created while others are disrupted. Top-down semantic research helps identify areas of structural growth while avoiding dying industries and value traps.

So that is really a key element because if you can identify that a company is operating in those areas of growth, they’re going to be able to sustain potentially superior returns for longer in market share. So that’s important. Another thing that we look very closely at is the importance of the management of the company and even more in a value context. Our research suggests that management quality can make a significant difference to the performance because it’s the ability to navigate challenging market conditions. It is important to evaluate the company management as a core part of the investment process and even more if you are on the value side because when things are difficult like it’s been over the past few years and you are invested in a value, a riskier, maybe more volatile company, the quality of the management is essential there. So that’s really something you need to pay attention to.

Finally, another point when you want to invest in value. It’s really important to identify under-researched opportunities. There are actually many opportunities for value investors even within what we call traditionally growth sectors such as new technologies. They tend to be smaller, undiscovered companies. So a lot of work is needed to identify them but they can offer significant upside. So there are plenty of new economy stocks which are undiscovered and hence undervalued. Notably, in the autoware segment, we find quite a lot. It’s a big segment, and with some research you can really find some kind of hidden gem that would help you to go through this period of difficult performance for the value style.

Thanks so much. That was really interesting. I’m conscious I want to leave a bit of time for questions so maybe if you wouldn’t mind just finishing on a couple of words on the broad outlook for EM equities for this year.

Yeah, sure. So our view really is that on a medium term we would expect emerging markets to outperform developed markets after 10 years of underperformance. Look, stock markets did well overall over the past 10 years, but emerging markets have been lagging developed market. We believe that after the reset we’ve seen this year we should see a reversal of that trend because emerging market countries have fared better when it comes to COVID. Balance sheets are much stronger and you’ve got two big tailwinds for emerging markets, which are a weaker U.S. dollar and superior economic growth compared to developed markets. Those two elements are really turning positive for emerging markets.

Having said that, over the short term, I think pretty much all liquidity markets seem overextended. So we would not be surprised to see a bit more volatility over the next few months, which actually could be a really good entry point to invest into the asset class. But medium to long term, we believe emerging markets will outperform developed markets for the first time in 10 years, pretty much.

Great. Thank you so much, Laurence. Now, we have received a couple of questions here, and so I’ll do my best to go through as many as I can. But I see there are a number of ESG-related questions so I’m going to try and just summarize it in one question. So I guess it’s a very hot topic; I know our team has really had a big focus on ESG. But when you’re specifically looking at the value universe, how do you think about ESG?

Yeah, you’re right. I think ESG is really important. It’s really one of the key elements to avoid value traps. So I mentioned obviously the quality of the management. So having strong quality management is really key and what we need to avoid really is companies with poor corporate governance. Those often are companies that are going to remain cheap. So if you want to avoid this value trap you really need to identify all company scores in terms of whether it’s E, the S, and the G and really to avoid the ones that have a poor score.

Having said that, the companies that we found that sometimes are very interesting on the value segment are the companies that used to have a poor or average ESG level but have massively improved, whether there’s been a change of management or for some other reasons. And investors tend to ignore or don’t believe maybe the change, and you tend to have a period of time where you can identify those companies that have truly changed already and this usually translates into better performance for the company but the valuation hasn’t caught up yet.

So that’s a really nice way of investing in some cheaper names where there’s definitely a catalyst or a driver for re-rating. Sometimes it happens at the entire country level. Korea, I think is one of the good examples. Korea has always been one of the cheapest emerging market countries because it was seen as a very poor ESG country, for good reason, but the country has changed over the past few years. I mean from a very low level to maybe reach an average level. But there’s been pressure from the government, from the local pension funds, from investors like us, and companies actually change. And because the country is really the home of some of the biggest technology companies in the world, what we’ve seen recently, and especially last year, is a neutral rating of that market on the back of those changes. And for that reason, Korea was a best performing country for instance last year.

So it’s really important to identify those changes and it’s really one of the drivers for value creation.

Great. Thanks. And there’s another question which relates to something you were saying earlier. So I guess the EM value universe is more exposed to the old economy kind of stocks and areas and that could justify, I guess, a low valuation. So how do you think about top-down considerations and sectorial views in your investment approach?

Yeah. No, you’re right. A few years ago it was not that extreme but what happened is that through the years the value universe is really pretty much full only of old economy names, as you were saying, when the growth stocks have migrated out of that universe. So you really have to incorporate this top-down consideration. I mean we have to, otherwise, you get stuck with a portfolio of old economy stocks. I’m not saying not all those stocks are going to do poorly. Some actually are going to do well, but it’s very important, I think, to have a value portfolio that is diversified across old economy names and new economy names. And in order to do that, what we do, we identify long-term areas of growth. For instance, in our value portfolio, because we identified digitalization as a theme for a very long time, we have been invested in new technology stocks for years and that really helps in terms of returns. So yeah, again, that’s something really we need to always take into account.

And then just maybe to end with one question. So I guess clearly it’s a pretty rich market at the moment across the board, but where have you been finding opportunities lately?

Yes. So two things. I guess last year when you have a big recession, like we’ve seen last year, it’s actually great for a value investor because the first phase of when the recession hits the entire market drops. So what we’ve seen in March last year, 30% drop in a month, and there were few obvious COVID winners that outperform, but the reality that a huge majority of the market really dropped. So we had the opportunity to get access to really good quality companies that were priced at the very low valuation.

I would say that has pretty much been done now from the summer up to the end of the year, but now I think one of the main opportunity we see and we’ve been doing quite a lot of work, I think, it’s what we could, you know, as a theme, call it as green infrastructure which includes quite a lot of themes. In that theme we have different segments such as the rise of electric vehicles, the rise of renewable energy, and really what we think is that that was obviously something that was just—that was increasing in importance for quite some time. But I think with COVID-19 there’s going to be more thought about protecting the planet and it’s not a coincidence if whether it’s China or the U.S. and Europe have really set up quite really ambitious targets when it comes to decarbonization over the next few years. This is going to accelerate and there’s a really huge demand from people for that trend to accelerate.

So we see some interesting opportunities. For instance, I mean China is the biggest market for electric cars. The biggest market when it comes to renewables, whether it’s a consumption or the companies that are delivering the equipment for renewable energy. So a lot of interesting segments in that and there are still a few value names. They were value a while ago. Now it’s getting a bit more difficult but still some interesting opportunities in that segment.

Great. Thanks so much, Laurence, for those valuable insights and thank you, everybody, for joining us today. We hope you found it interesting. Please feel free to contact your local RBC representative if you have any questions or if you’d like any further information. Have a great day.

In our 2019 article, “Out of Style, why Value is due a rebound”, we identified four factors that would lead to a reversal in the long-term underperformance of Value. These were: increased competition amongst the new economy companies, heightened regulation, higher interest rates and a reset caused by a recession. Interestingly, three out of four of these factors have materialized in recent months. The question now is whether this means the Value style will perform better and claw back some of its underperformance.

Long-term underperformance of Value versus Growth

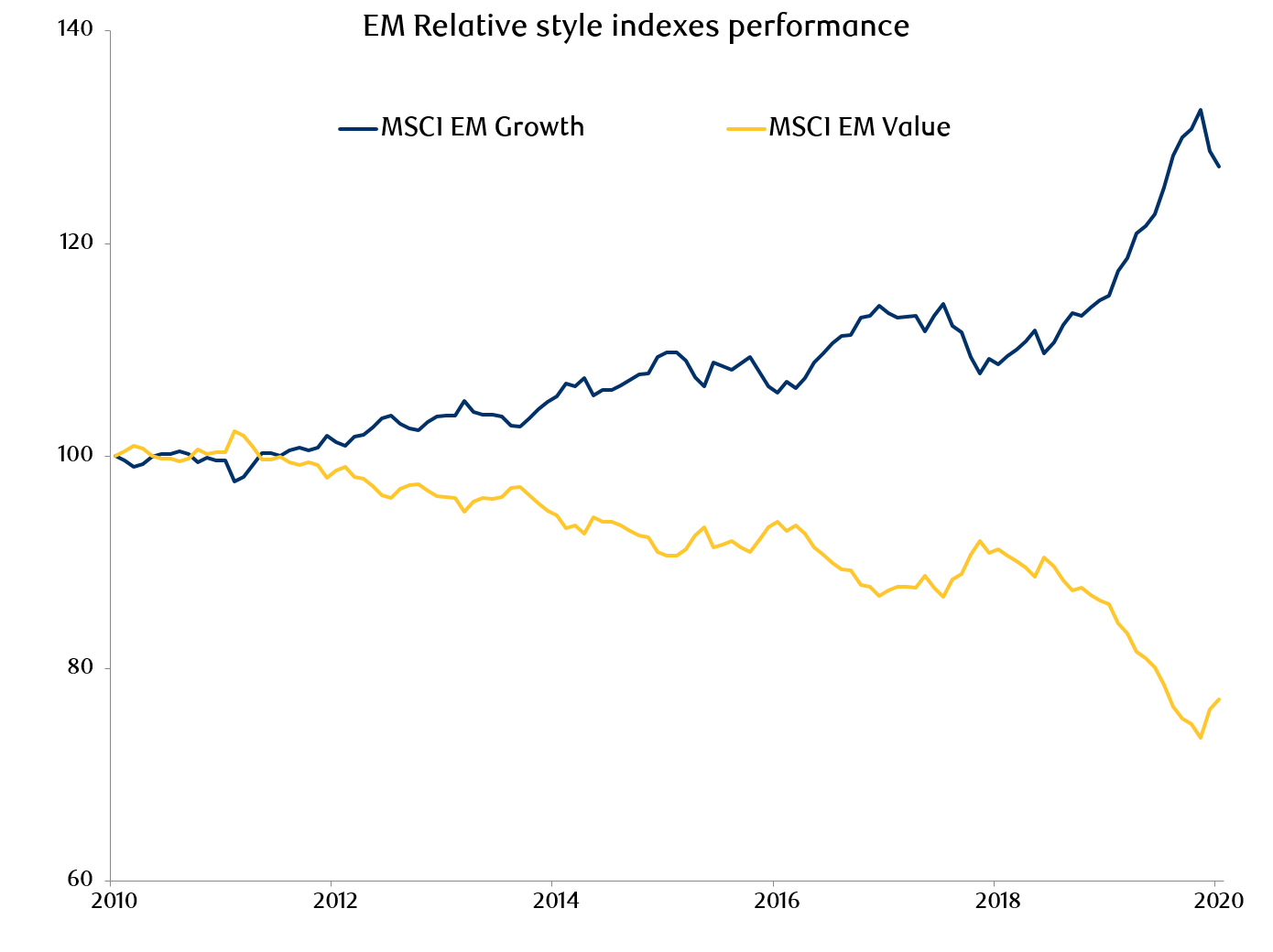

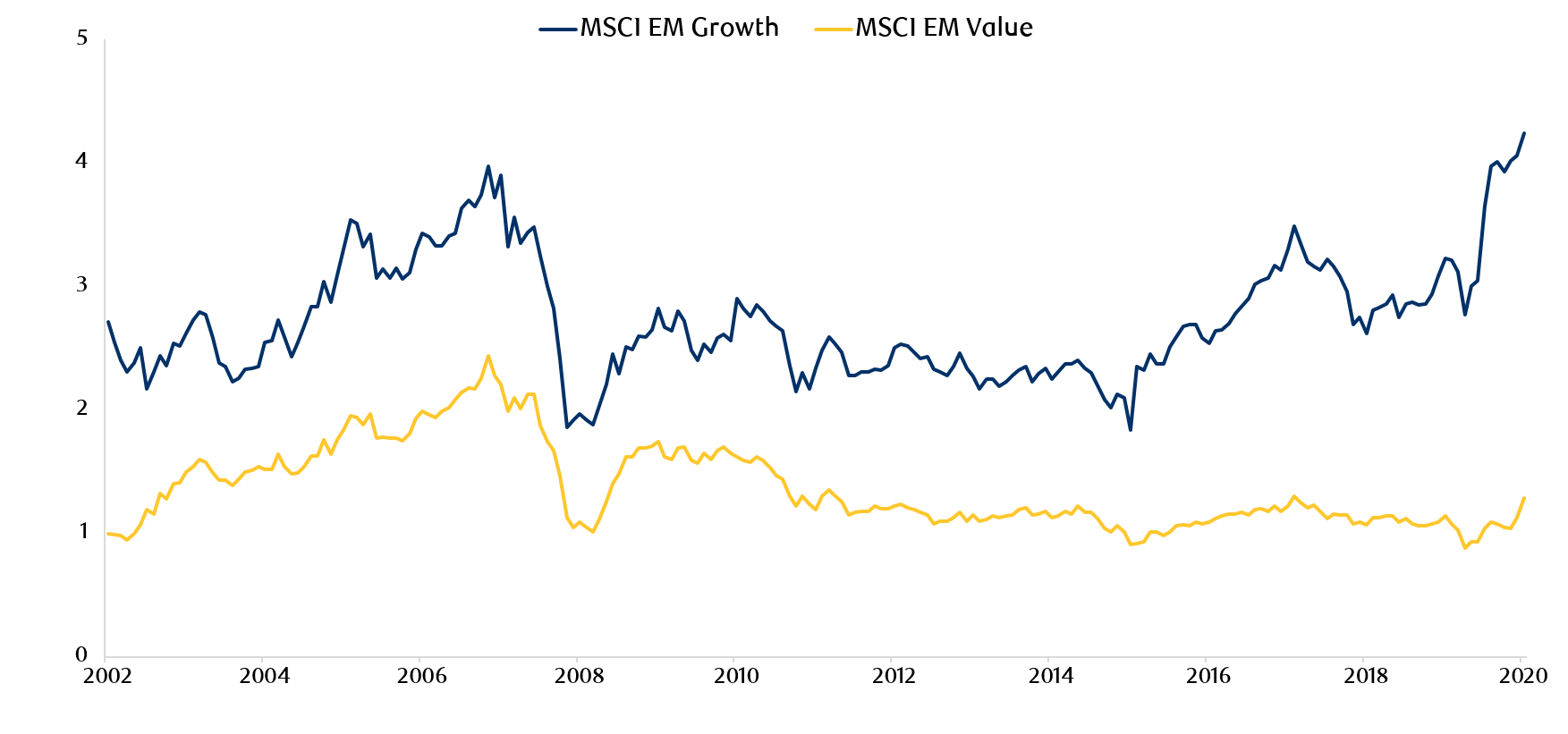

The Value style has been underperforming Growth for most of the past decade, marked by a gradual lag starting in 2012, an acceleration in 2018, and in 2020 the worst yearly underperformance of Value versus Growth since the style indexes were created.1

In absolute terms, the MSCI EM Value Index has actually finished broadly flat in the volatile period since the global financial crisis. Conversely, MSCI EM Growth Index has been the standout performer, gaining 120% over that same period. Exhibits 1 and 2 show the performance of the Value and Growth indexes relative to the core index in EM and the U.S. respectively.

Exhibit 1: MSCI EM Growth and Value Index performance relative to the MSCI EM Index since 2010

Source:MSCI Emerging Markets Growth and Value Index, Bloomberg. Data as at December, 2020.

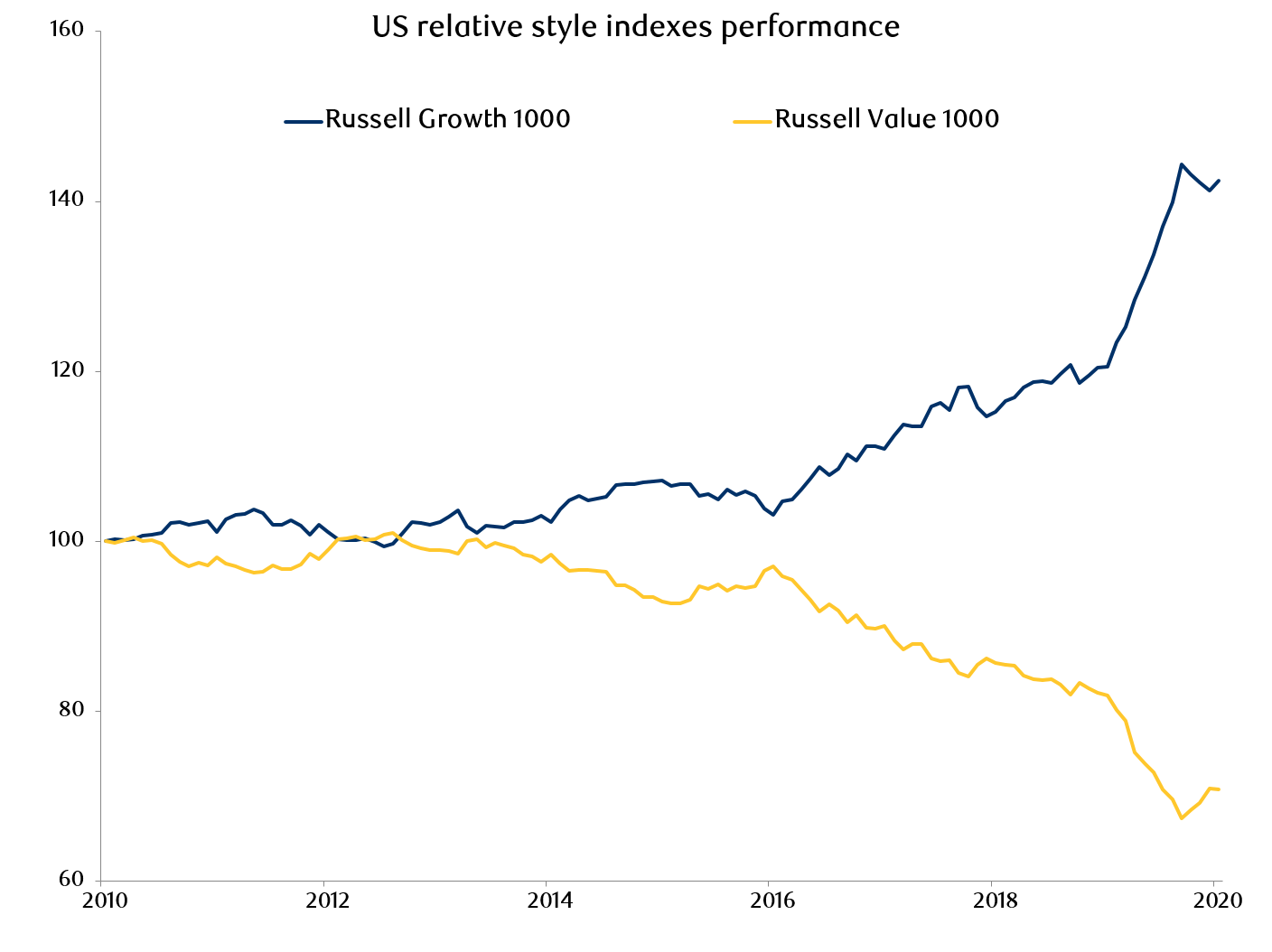

Exhibit 2: Russell Growth and Value Index performance relative to the S&P 500 Index since 2010

Source: S&P 500 Index, Russell Index, Bloomberg. Data as at December, 2020.

Over the 10 years to the end of December 2020, the underperformance of Value stocks compared to Growth stocks stands close to 80% and over the past two years alone at 40%. This differential is now wider than the previous era of extreme Value underperformance in 1998-1999 when the Russell Growth Index outperformed the Russell Value Index by 31%.

The acceleration in the outperformance of Growth and underperformance of Value during the past two years has several causes:

- An artificially prolonged economic cycle: While the end of the economic cycle which started in 2009 after the global financial crisis has been anticipated since 2017, interventions by central banks and governments around the world have kept economic growth artificially high. In anticipation of an upcoming recession, and to protect their returns, investors have continued to favour companies with a strong growth outlook regardless of the seemingly positive top-down environment.

- Technological revolution and index biases: With the rise of the internet, new giants have appeared, disrupting and reshaping entire industries. Over the past two years, those companies have become so large that the top 10 stocks in the MSCI EM Growth Index are now all technology corporations. With an average market capitalization of US$280 billion, they represent nearly 50% of the entire index, as at the end of October 2020. The huge concentration of the MSCI EM Growth Index explains why only a handful of large stocks need to perform well to have a significant impact on the performance of the Growth style.

- Indeed, an analysis we conducted that removed sectorial and regional biases and equally weighted all stocks reduced the growth premium from 40% to about 10%. As noted above, in the MSCI EM Index Growth has outperformed value over the past two years by some 40%. But when we conducted an analysis that removed sectoral and regional biases and equally weighted all stocks, the Growth premium was a much more muted 10%.

- We also find that the entire outperformance of the Growth style comes from China. Over the past few years, China has rapidly evolved from being an out-of-favour stock market, characterized by large state-owned enterprises, to a market that appeals to foreign investors. This is thanks to the emergence of successful, innovative privately run companies and means the weight of China in the MSCI EM Index grew from 22% to 43% in just six years. The largest four stocks in the MSCI China Index are now new economy companies that operate in the areas of e-commerce and e-gaming. Overall, these four stocks represented 33% of the MSCI EM Growth Index.

- The COVID-19 pandemic in 2020 further accelerated the digital revolution, leading to a surge in the adoption of online services such as e-commerce, gaming and working-from-home technology. This further benefited Growth stocks.

- Low interest rates globally has pushed investors into the equity asset class, in the pursuit of returns. Money which might once have been invested in fixed income, is now invested in Quality and Growth stocks as they are as perceived to be safer than Value ones.

- Finally, the rise of retail investors has been remarkable over the past few years and, in 2020, was accelerated by the younger generation. In the U.S., retail stock trading increased from 9% of total shares traded in 2019 to 20% currently, while in China, overall trading volumes have increased by 60% in the past five years.2 Not only have the new zero-commission online apps made trading more accessible and fun, but the millennial generation has emboldened by strong returns from equity markets in recent years. These new investors have probably helped push the handful of stocks highlighted above even higher.

While the performance of the Value style has worsened in recent years, cheaper names have actually been underperforming since 2010. This is mainly because:

- The global economy struggled to recover after the global financial crisis in 2008. While there was no global recession in the ensuing decade, many countries have faced challenges and below par economic growth. Furthermore, the failure of some countries to implement much-needed reforms and the rise of populist governments have led to weaker currencies, poor equity performance and the derating of riskier countries such as Mexico, Indonesia, Turkey and South Africa.

- A prolonged period of low interest rates has negatively impacted Financials stocks with the majority never fully recovering from the global financial crisis. Financials make up a large portion of the MSCI EM Value Index.

- Shale gas expansion in the U.S. coupled with sluggish economic growth in EM countries has hurt the Energy sector, which is a traditional Value sector.

- Reduced spending on physical capex and infrastructure projects over the past decade, following the exceptional growth of the prior decade when China was building its infrastructure at record speed, has hurt the Materials sector, another traditional Value play.

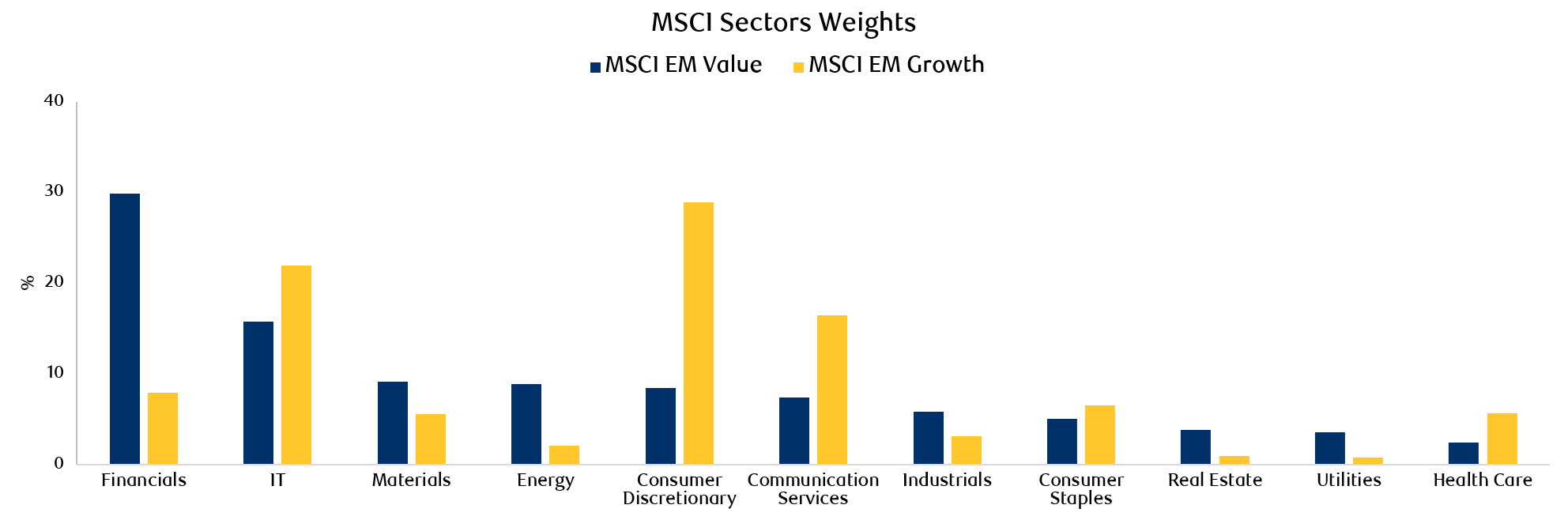

- As the new economy stocks outperformed and became increasingly expensive, the majority left the MSCI EM Value Index. As a result, the MSCI EM Value Index is now mainly composed of old economy areas, notably Financials, Materials and Energy, which together comprise 48% of the MSCI EM Value Index compared to 15% for the MSCI EM Growth Index as of end of November 2020 (Exhibit 3).

Exhibit 3: MSCI EM Value and Growth Index sector weights

Source: MSCI, Bloomberg. Data as at November, 2020.

Was the strong performance of Growth versus Value justified in 2020?

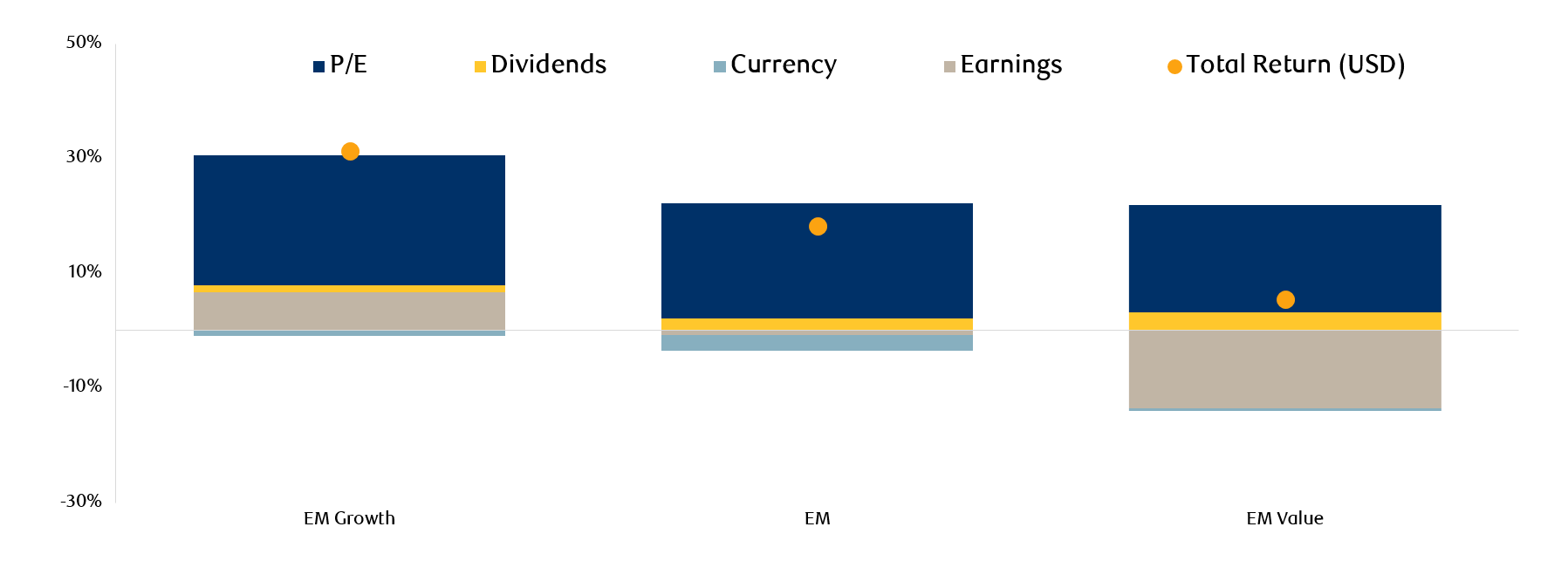

2020 was a challenging year as COVID-19 led to a global recession. Typically in a risk-off environment, it would be expected that Growth would outperform Value. Breaking down the 2020 returns of Value and Growth shows that re-rating (P/E expansion) explains part of the performance, but fundamentals (change in earnings) also played an important role (Exhibit 4).

Exhibit 4: MSCI EM style indexes 2020 total return decomposition

Source: MSCI, Bloomberg. Data as at December, 2020.

The rapid recovery in global equity markets is an important factor in style indexes not being de-rated despite poor fundamentals in what was – at least for a time - the worst global recession in 100 years. The main reasons for this are, the extremely low interest rate environment, which favour equities, and the nature of the pandemic. On this second point we believe the effects of the pandemic may not turn out to be long-term as many economic indicators rebounded very quickly when lockdowns eased earlier in the year.

The MSCI EM Growth Index delivered the strongest absolute returns in 2020, driven by slightly positive earnings growth amid a challenging macro environment. This justifies the strong performance and explains the large re-rating for the year (18%).

As expected, Value stocks, notably Financials and Energy companies, which were adversely affected by the pandemic, suffered a 10% drop in earnings since the beginning of the year. However, it is interesting that the MSCI EM Value Index has not de-rated over the year, hence limiting the underperformance.

Current valuations for Growth and Value

In 2020, the strong performance of Growth stocks over Value stocks was justified by much better earnings, but also the acceleration in the shift to online. This move, fueled by the pandemic, benefitted new economy stocks. The impact on earning of some traditional Value stocks, such as Financials and Energy, meant they performed the worst.

What is now priced in for Value and Growth stocks? Exhibit 5 shows the evolution of valuation since the MSCI style indexes were created. We already mentioned that Value stocks did not de-rate in 2020 while Growth stocks now trade about 18% higher than in January 2020. After almost 10 years of de-rating for Value stocks, and the more recent outperformance of Growth stocks, both indexes now trade at extreme levels.

Exhibit 5: Evolution of MSCI EM style indexes P/B

Source: MSCI Emerging Markets Value and Growth Index, Bloomberg, RBC Global Asset Management. Data as at December, 2020.

The consequence of this year’s historical divergence in performance between styles is that the MSCI EM Growth Index trades at the largest-ever premium to the MSCI EM Value Index at 260%.

What has changed and could lead to better performance for Value stocks in 2021?

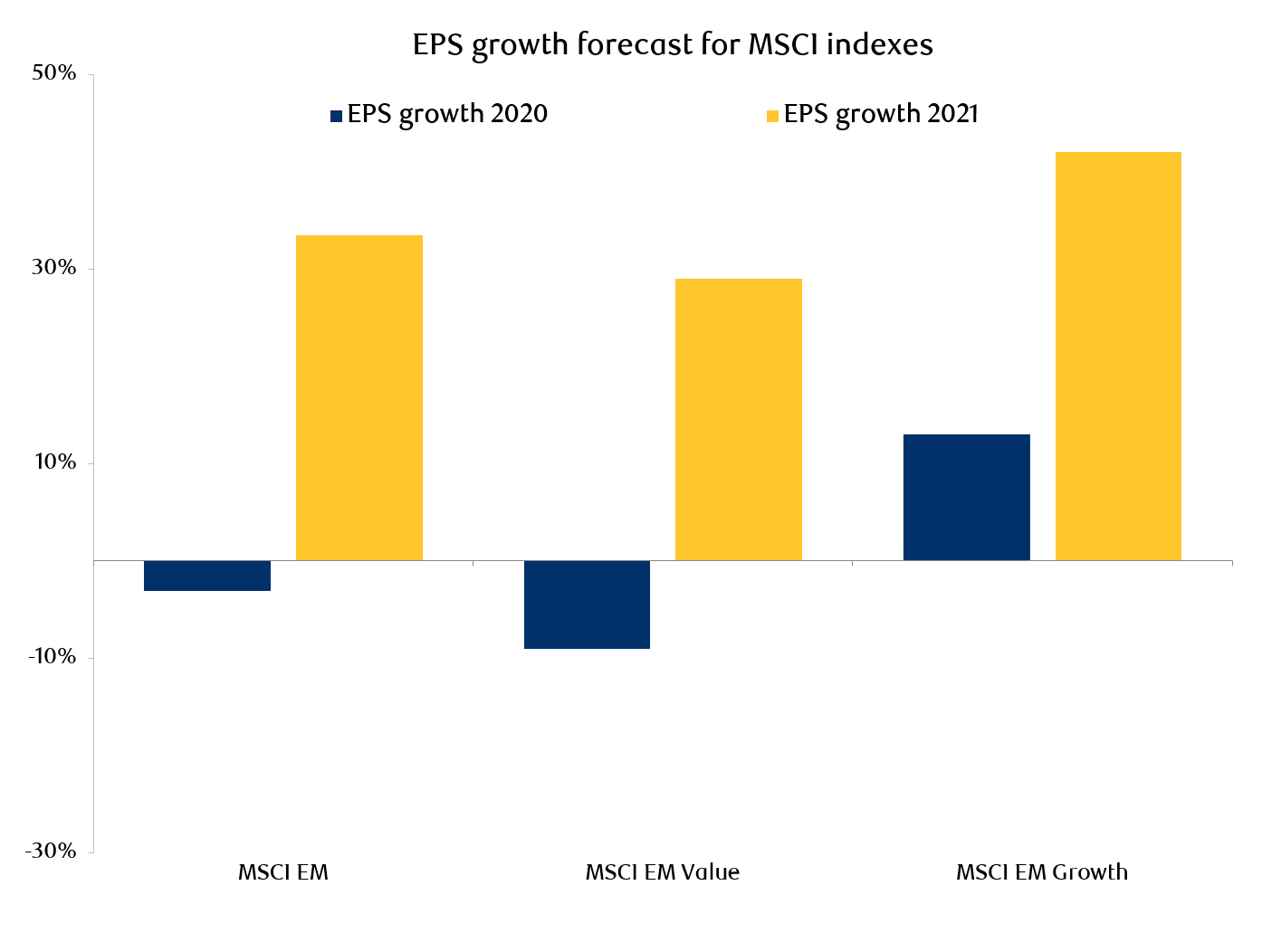

- COVID-19 provided a large boost for new economy stocks as people stayed at home, switching from offline to online very quickly as there was little alternative. However, this also means that the base effect, starting from the first quarter of 2021, will potentially be a negative for many of those companies unable to match the levels of growth reported in 2020. E-commerce penetration in China has now reached 35% and for certain categories, such as apparel and fast-moving consumer goods it is likely the growth rate has already peaked.3 For the Growth stock premium to remain at the current extreme levels, continued superior earnings growth will be necessary. Looking at earnings expectations for 2021, it is very likely that the premium for Growth stocks will narrow. As shown in Exhibit 6, earnings growth expectations for 2021 are 42% for the MSCI EM Growth Index and 29% for the MSCI EM Value Index.

Exhibit 6: Earnings growth expectations for MSCI EM Growth and Value Index

Source: MSCI, FactSet, RBC Global Asset Management. Data as at December, 2020.

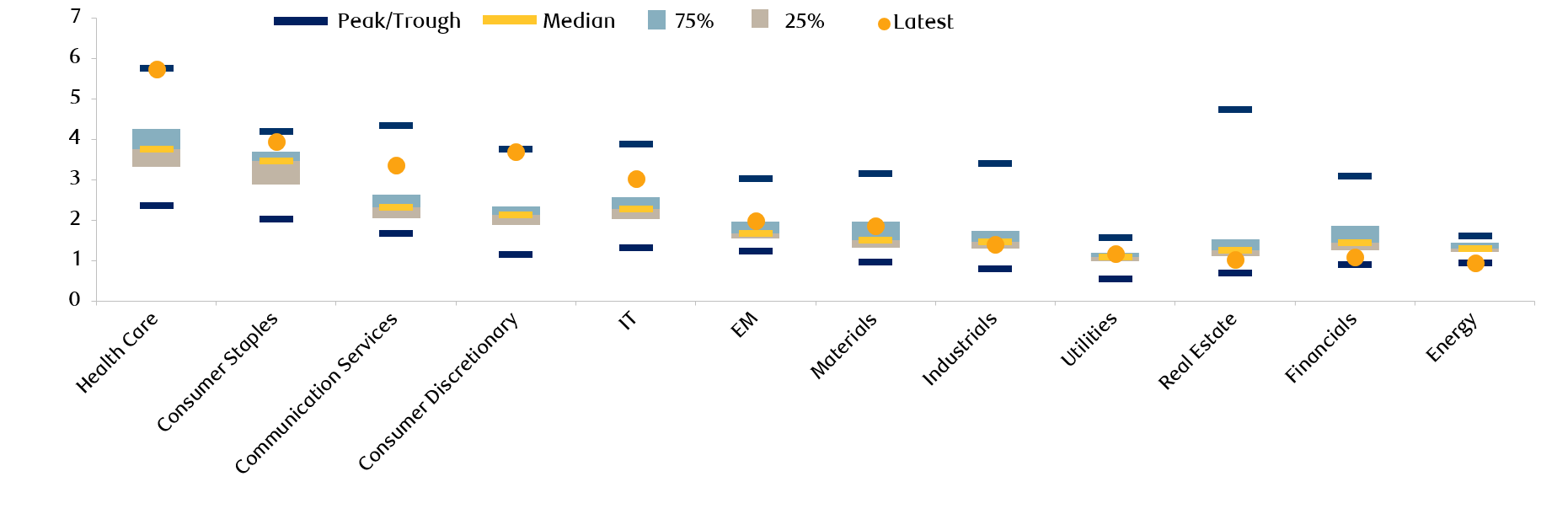

- The situation is very different for cyclical companies. A return to normal will be enough for many of these stocks to show very large top and bottom-line growth as they are starting from a very low base. For instance, the Energy sector is expected to deliver more than 200% earnings growth in 2021 as the oil price has rebounded from its lows of $20 in March 2020 to $55 at the beginning of 2021. Similarly, the Materials sector should see more than 60% earnings growth in 2021. Together those two sectors account for only 7% of the MSCI EM Growth Index but 18% of the MSCI EM Value Index. Currently there is a huge dispersion in valuation between the COVID-19 winners and losers (Exhibit 7). The gap began and has continued to narrow slightly since November but sectors such as Energy, Financials and Real Estate still trade near their 20-year troughs. On the other hand, sectors such as Health Care, Communication Services, Consumer Discretionary and IT are trading near all-time highs. We believe the divergence is too extreme if we consider a return to normal in 2021, and we would expect the range of valuation to narrow. This should lead to the outperformance of Value over Growth.

Exhibit 7: EM sector price-to-book (P/B) valuation relative to history

Source: MSCI, FactSet, RBC Global Asset Management. Data as at December, 2020.

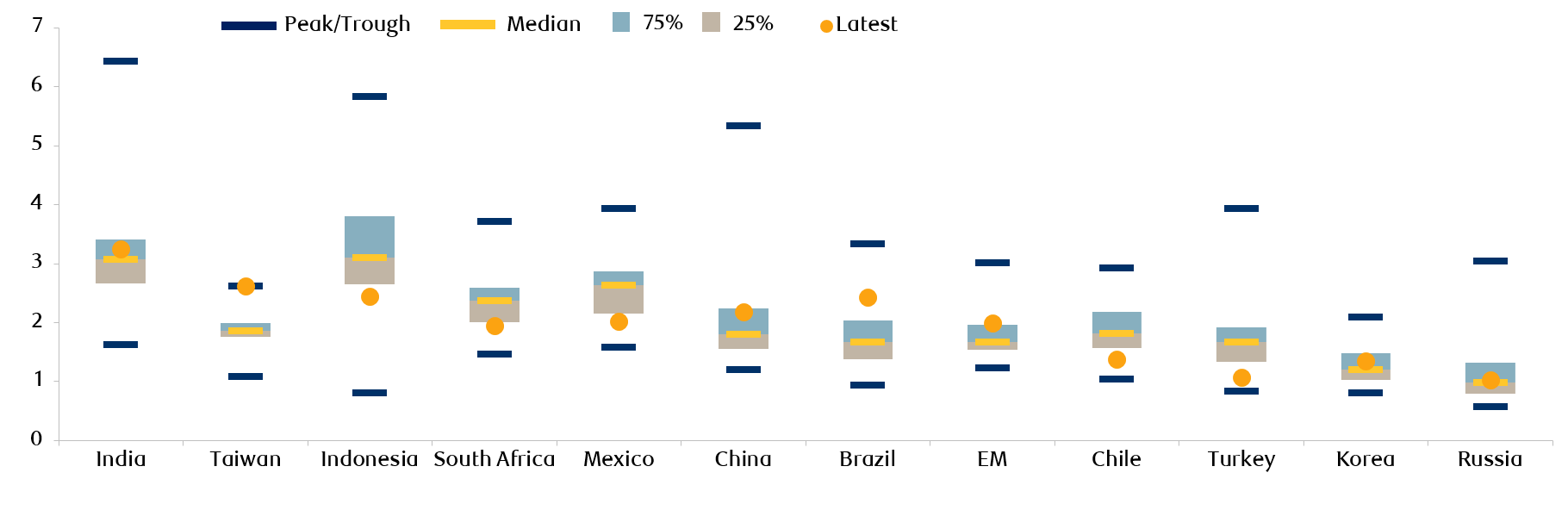

- Similar to sectors, country performance in EM varied largely in 2020. The countries most successful in containing the virus performed the best in 2020. Some poorer countries in EM struggled to deal with COVID-19 and their already precarious economic situations worsened. This led to some countries trading close to their peaks, with others at their troughs (Exhibit 8). In particular, Turkey, Chile, Mexico and South Africa appear very cheap compared to history, while China and Taiwan are close to near the most expensive they have been in 20 years.

Exhibit 8: EM country price-to-book (P/B) valuation relative to history

Source: MSCI, FactSet, RBC Global Asset Management. Data as at December, 2020.

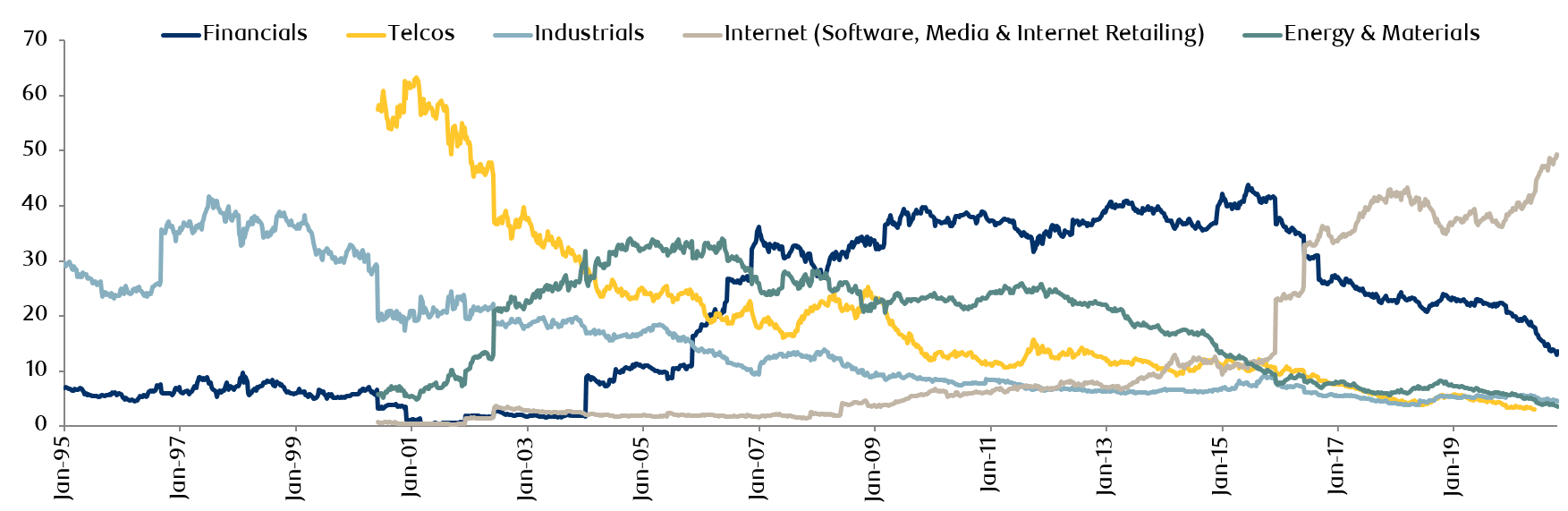

- China has been the key driver for the outperformance of the Growth style and will probably be the main driver of its underperformance if we see a style reversal. As argued previously, the concentration of new economy stocks in the China equity index has become extreme, especially since 2016, when MSCI allowed U.S.-listed Chinese stocks to be included. We have also seen a huge number of new economy IPOs over the past few years. By the summer of 2020, the weight of new economy stocks in the MSCI EM China Index surpassed 50%. (Exhibit 9) This weighting has since come down, after regulators halted the IPO of the Alibaba-backed fintech subsidiary Ant Financial and announced increased scrutiny on monopolistic practices. Those moves triggered a sell-off in new economy names at the end of 2020.

Exhibit 9: MSCI EM China Index sector weights since 1995

Source: MSCI, FactSet, Goldman Sachs Global Investment Research. Data as at September, 2020.

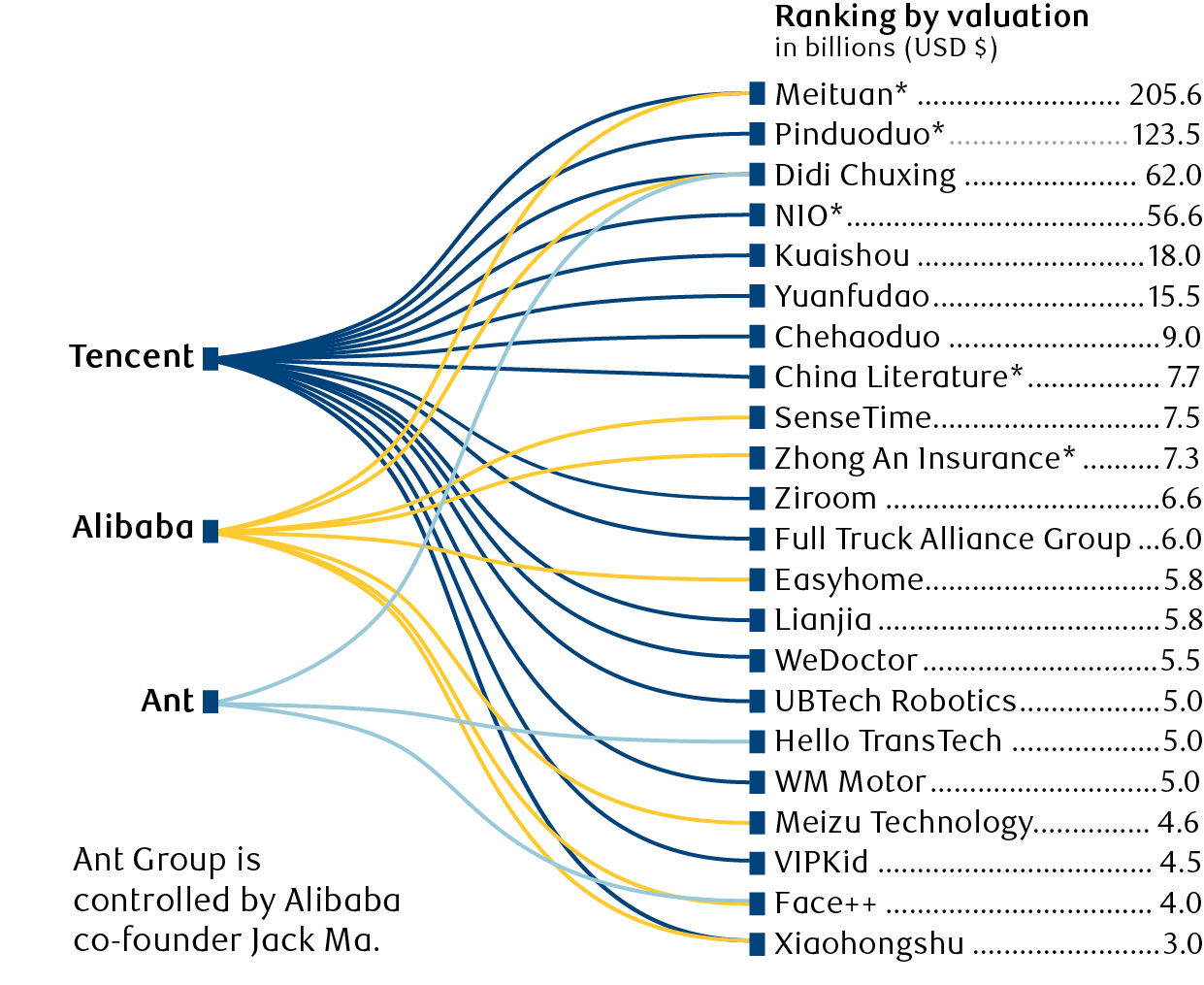

Exhibit 10 illustrates the incredible depth in holdings of Tencent and Alibaba. It is possible that this picture will look different in a few years, as the companies are forced to divest stakes.

Exhibit 10: Tencent and Alibaba have stakes in a vast array of Chinese start-ups and competitors

Source: Bloomberg. Data as at 11 November, 2020. *Listed or applied to list in an IPO

Longer term outlook: Value stocks could embark on a multi-year rally similar to 2003-2008

Relative EM/ DM equities performance: The underperformance of Value stocks over the past 10 years coincided with the underperformance of EM versus DM equities, as Growth stocks would be expected to take the lead in a risk-off environment.

Exhibit 11 shows that long periods of EM versus DM equities under and outperformance alternate, and we have found that the main drivers of this relative performance is the relative economic growth between the two regions as well as the direction of the U.S. dollar. We believe we are at a turning point and that EM could outperform going forward.

Exhibit 11: EM versus DM equities relative performance

Source: Bloomberg, MSCI Emerging Markets Index & MSCI World Index. Data as at October, 2020.

U.S. dollar strength has represented a significant headwind to EM equities performance in recent years. There are several reasons to believe this may be about to reverse due to the U.S. Federal Reserve’s aggressive balance sheet expansion, the surge in U.S. fiscal deficit (24% in 2020) and a rally that looks extended both in terms of duration and degree.

There is also a powerful case that EM currencies can start to perform well, driven by extremely cheap valuations, high real rates and strong current accounts. Beyond currency, relative EM growth looks set to improve from cyclically low levels. The shift is driven by improved productivity, structural reforms and more growth-friendly fiscal policies.

If EM begin to outperform DM after 10 years of underperformance, it is likely that Value stocks would also do better in such a risk-on environment.

- Energy, Materials and Industrials stocks could perform well on the back of the next revolution: Green Infrastructure. Climate change is now a major focus, with the world’s largest nations including China finally realizing that dramatic changes have to be made in the near future. China announced in December 2020 that by 2030 25% of the country’s electricity generation will be renewable and by 2060 the country will be carbon neutral. The government also announced that electric cars would account for 25% of car sales by 2025. Few seem to have appreciated the impact of those announcements. Firstly, when China sets targets, it has historically executed on and, more often than not, exceeded them. Secondly, the amount of commodity products needed to achieve carbon neutrality is huge and exceeds the projected growth in supply for metals such as copper or nickel. This would be coming at a time when capital expenditures have been cut, so we could see huge imbalances in the coming years that could lead to a new commodity cycle. This would be very positive for growth in EM and, in that scenario, cyclicals and Financials would perform well as the rise in commodity prices could also lead to an increase in inflation.

- Many countries are talking about implementing MMT (Modern Monetary Theory) to reduce the income inequality, which has been rising rapidly across the world bringing social unrest and populism. In fact, MMT was already implemented in 2020 in the fight against the pandemic. If this fiscal stimulus continues to grow and target physical assets, this would be very positive for cyclicals, particularly if it led to larger than expected economic growth. Much like the Green Infrastructure revolution, this would be very positive for Value stocks.

- Regulation could disrupt new economy stocks if they are deemed too dominant, insufficiently regulated and monopolistic. Since November 2020 and the cancellation of the Ant IPO, the Chinese government has issued a series of policies aimed at regulating the likes of Alibaba, Tencent and Meituan. Some restrictions have already been put in place, notably around brand exclusivity on e-commerce platforms and lower prices to attract new customers. The largest players could be asked to divest some of their holdings. It is very difficult to assess how far the government will go and the damage this could have on future growth, but this issue may remain an overhang for the sector. This would probably lead to a derating of those stocks and a rotation towards names less impacted by government intervention.

- Increased competition could present another headwind for new economy stocks, particularly in the areas of e-gaming and e-commerce, which have attracted new entrants with the prospect of superior returns. Longer term, the outlook for Growth stocks depends on the ability of these companies to continue to generate superior earnings growth. We computed the annualized earnings growth required for Growth stocks to justify their current premium to Value stocks. Over the next five years, the growth needed is 46.1% per annum. Over 10 years, the number drops to 25.9%, and over 15 years to 19.2%.4 This level of growth seems unlikely considering the MSCI EM Growth Index delivered an average of 18% earnings growth over the past 10 years.

What could go wrong for Value stocks?

- If the COVID-19 vaccines that are being rolled out globally were to fail, then this would present a significant challenge for the world and would likely lead to the underperformance of cyclicals and Value stocks, and allow the COVID-19 winners to outperform again.

- If the global economy remains sluggish even after the pandemic, as a result of high unemployment and weak consumption, central banks could once again apply QE, which would inflate financial assets. In that environment, we would expect Growth stocks to be the most likely to outperform, while the performance of cyclicals notably, Financials, Energy and Materials, could be challenged.

- If there is a lack of political desire or ability to break up the internet giants, or if competition fails to gain market share, we could see continued strong performance of new economy stocks at the expense of the old economy. In this environment, the abnormal growth of recent years could be repeated and competition eliminated. This could lead to the continued re-rating of the internet giants. This is a possible scenario, especially if we consider that the penetration of online services has not yet peaked, even after the COVID-induced boost in 2020. We may see a prolonged performance of new economy stocks, especially if habits do not revert back to pre- pandemic norms. The trend of shopping, working and entertaining from home, may be here to stay and could continue to grow further in the coming years.

Our approach to Value

Style performance will likely remain volatile in the coming years as the world faces multiple challenges in its recovery from the pandemic.

The positive scenario of a risk-on environment and strong economic growth would favour Value stocks, driven by the number of factors highlighted in this report. However, there are risks to this view. We therefore believe it is prudent for EM Value investors to diversify exposure to ensure protection in periods when Value as a style underperforms.

We highlight the following considerations for EM Value investors:

- Invest in areas of structural growth and avoid those in decline: It is crucial to be selective and recognize that the world is constantly changing. New technologies develop, habits evolve, and companies are created while others are disrupted. Top-down thematic research helps identify areas of structural growth while avoiding dying industries and value traps.

- Importance of company management: Our research suggests that management quality can make a significant difference to the performance of a company and its ability to navigate challenging market conditions. It is therefore important to evaluate company management as a core part of the investment process.

- Identify under-researched opportunities: There are many opportunities for Value investors even within what are traditionally Growth sectors. These tend to be smaller and undiscovered companies and segments which, if thoroughly researched, can offer significant upside.

Explore more insights from the RBC Emerging Markets Equity Team.