Technically, my family has several hundred pets. The specific accounting goes as follows: one cat plus around 300 worms. The latter live in a dirt-filled plastic box in our basement, converting our food waste into compost. My wife acquired them – or, more precisely, their ancestors –for an elementary school science project several decades ago. Their upkeep is fairly limited: throw a few carrot scrapings or apple cores into the box every few weeks, and in exchange they provide us with a big bag of compost once a year.

I mention our unusual pet situation because this past weekend was the date of our annual worm harvest. Failing to convince any children to assist, I spent a few hours alone in the backyard, separating worms from clumps of compost so that the process can begin anew. It was surely a strange sight to behold!

Speaking of worms and processes beginning anew, a variety of political items top our #MacroMemo, including U.S. impeachment investigations, the Canadian election and fiscal stimulus at the global level…

October webcast

Our latest monthly economic webcast is entitled “A glimmer of hope” .

Impeachment

- After much dithering, U.S. House Democrats have decided to formally begin an impeachment inquiry into President Trump. At least 224 out of 435 members of the House support the inquiry. The full impeachment process can be expected to last between several months and a few quarters.

- Whereas the Mueller investigation and the Trump campaign’s interaction with Russia had long been the focus of any such inclination, the actual impetus has come from a different angle altogether. The White House is alleged to have withheld U.S. military funds from Ukraine until the country’s president investigated U.S. Democratic candidate Joe Biden and his son Hunter Biden with regard to their dealings with a Ukrainian company.

- Is this an impeachable offense? If Congress concludes that the action constituted bribery, that action is explicitly grounds for impeachment. But ultimately, so long as there are sufficient votes in Congress, anything could be an impeachable offense.

- Given the Democratic majority in the House and barring the arrival of exculpatory evidence, there is a high probability that the House eventually passes articles of impeachment – that is to say, impeaches the president.

- Of course, impeaching a president does not actually remove them from office. It merely brings the case before the Senate chamber, which gets to act as the final arbiter. This is a much higher hurdle to clear, as two-thirds of the members must vote to convict the president. Only then is the president removed from office.

- While two presidents have been impeached in U.S. history – Andrew Johnson in 1868 and Bill Clinton in 1998 – neither was subsequently ousted from office because the Senate in both instances failed to convict. Richard Nixon was on the cusp of impeachment in 1974 when he instead resigned.

- Given that Republicans dominate the Senate, it is highly unlikely that a sufficient number of Republicans will join the Democrats in seeking to oust President Trump from office. In turn, he almost certainly will remain in place.

- The likelihood of his ouster is not quite zero for two reasons. First, there is a small probability that House investigations uncover a deed sufficiently egregious that Republicans feel compelled to act as well. Second, and possibly linked to the first, should Republicans feel they have a materially better chance of re-election in 2020 with someone other than Trump on the ballot, they could view impeachment as an opportunity to achieve that goal. Still, it is quite unlikely.

- Why, then, are the Democrats pursuing impeachment when it is unlikely to actually remove the president? There are a few lines of thought. First, it is a way of rapping the knuckles of the President in response to a litany of perceived improprieties. This would ideally have happened earlier in Trump’s term, but the lengthy Mueller investigation and its inconclusive verdict did not permit it. Second, it could possibly give the Democrats an electoral advantage for the 2020 election in that it might weaken the stature of the president.

- However, on this second note, it is far from clear that the Democrats will actually enjoy a boost if they impeach President Trump. The late 1990s experience with Bill Clinton arguably backfired for the Republicans as they actually lost ground in the 1998 midterms after making impeachment a main issue. One way of interpreting this is that electors believe they should get to choose the president, not other politicians.

- Much as the Democrat base would presumably be energized by President Trump’s impeachment, the Republican base is just as likely to rally around their president. It is hard to say how independents would respond.

- In an interesting twist, the fact that Joe Biden – and his family’s business dealings in Ukraine – will feature centrally in the impeachment investigations may hurt his electoral prospects. His popularity had already been in decline as Elizabeth Warren surged to the front. A continuation of this trend would tilt the Democrats much further to the left, further increasing the enthusiasm of their base, but further alienating the rest of the population. On the net, it likely reduces the probability of a Democratic president.

- From an economic standpoint, Washington will probably be brought to a near standstill. We weren’t expecting any great legislative advances or new economic policies anyway, given the divided Congress, but this further cements that view. The U.S. becomes even less likely to deliver fiscal stimulus in 2020, and passage of the USMCA trade deal becomes even less certain. Meanwhile, the already massive political divide between Democrats and Republicans grows even wider.

Canadian election update

- Canada’s October 21 election is now just three weeks away.

- Despite the revelation of a massive skeleton in Prime Minister Trudeau’s closet, Liberal Party popularity has barely budged, remaining virtually tied with the Conservatives at around 35% support each.

- Furthermore, based on how those voting intentions skew across the country, the Liberal odds of victory are substantially better than for the Conservatives.

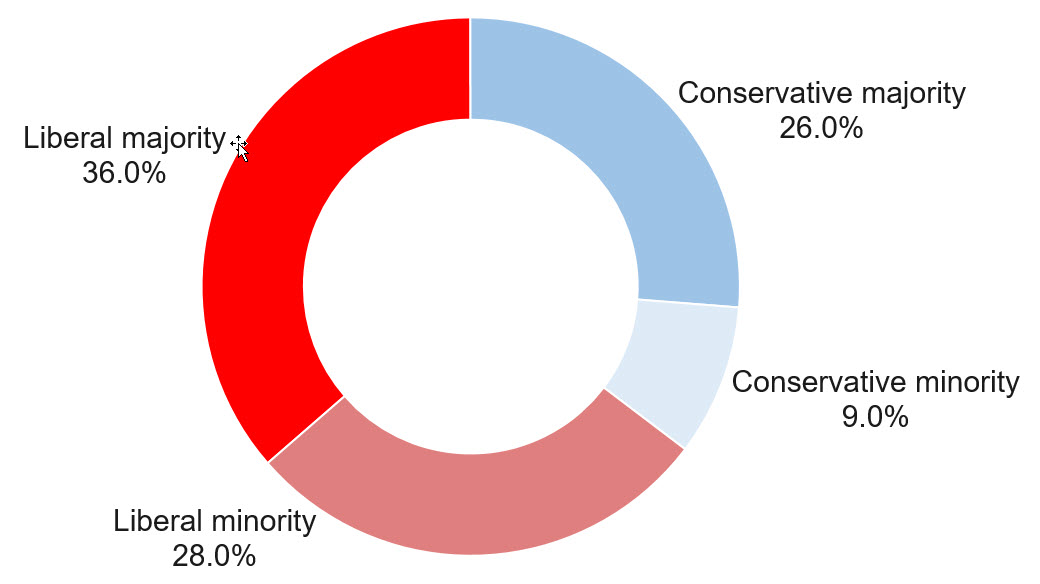

- The CBC Poll Tracker now points to a 64% likelihood that the Liberals capture the most seats, versus a 35% chance for the Conservatives (see chart below). The Conservative are still very much in the race: the odds are gyrating with an unusual intensity and even if nothing changes before the election, the Conservatives would still have a one-in-three chance of winning on election day. Nevertheless, this is the Liberals’ race to lose.

- For the Liberals, maintaining a majority stands at a 36% probability versus a 28% chance of a minority government. For the Conservatives, a majority is a 26% likelihood versus a 9% chance of a minority government.

- Whereas the polls had been pointing to as much as a 60% chance of a minority government of some description quite recently, the odds of a minority government have now shrunk to just 37%. This makes it less likely that the NDP or Green Party will figure centrally in policy-making; any government in which they held the balance of power would naturally tilt toward the left.

The resilient Liberals

Note: As of 9/29/2019. Source: CBC Poll Tracker, RBC GAM - In the most superficial sense, one might argue that there is a 28% chance of Canada’s government pivoting substantially to the left (in the event of a Liberal minority that would presumably bend toward NDP or Green positions), a 36% chance of the next government pivoting slightly to the left (the Liberal platform includes bigger deficits, more environmental measures and more government programs such as Pharmacare relative to existing policies), and a 35% chance of the new government pivoting moderately to the right (a Conservative victory in some capacity).

- Both the Liberals and Conservatives are making a push for middle class votes, proposing modest tax cuts for the group. Both are also planning niche programs that capture votes at the expense of ever more complicated income tax filings. Neither can be said to truly favour “small government”, though the Liberal vision is certainly of a larger government than is the Conservative position.

- From a debt standpoint, the Liberals plan larger deficits while the Conservatives pledge to balance the budget over several years. That said, even the Liberal plan would allow the federal debt-to-GDP ratio to decline over time – a key measure of fiscal sustainability. Of course, the occasional recession has a nasty habit of blowing even the best laid fiscal plan well off course – it would be better if Canada was running a modest surplus with an unemployment rate at the lowest in more than a generation.

Fiscal stimulus:

- Monetary stimulus is well underway around the world as central bankers attempt to stabilize global growth.

- As we have written about in the past, there is a reasonable prospect of fiscal stimulus also lending a hand.

- In fact, we have already seen considerable fiscal stimulus from China – on the order of 1% to 2% of GDP – and some of our indicators are beginning to pick up the economic effect. There remains a good chance that China will do more to help stabilize growth into 2020. China is far more relevant than most countries on this subject given its large economy, nimble policymakers and history of large fiscal actions. It merits continued attention.

- Since we last wrote about fiscal policy, India has joined the party. It has now announced a massive corporate tax cut, reducing its headline corporate income tax rate from 35% to 25%. This brings India roughly into line with the global average – a big step for a country seeking to attract more multinationals and improve its competitiveness. The country further carved out a special tax rate for manufacturers of just 17% -- among the best in the world and nearly as good as hyper-competitive Singapore. A recently imposed tax on share buy-backs was also removed. The net economic boost is unlikely to be massive, but may pay a dividend of roughly a quarter of a percentage point of extra growth per year for some time. On a less happy note, the rumour is that Indian economic data may soon take a turn for the worse – possibly the motivation for this hastily put-together stimulus.

- In Europe, Germany has announced 54 billion euros of green stimulus spread over the next four years. Specific measures include tax exemptions for electric cars, more charging stations, lower taxes on train tickets and incentives to pursue renewable energy. The specific sum of money rhymes with a recent claim from Germany’s finance minister that the country could deliver 50 billion euros of stimulus in the event of a sharp economic slowdown. Given that the German economy has almost completely stalled out, might this be that effort? In actual fact, no – they appear to be separate. This green stimulus is spread over four years, and so not the sort of stimulus that would be used to try to fend off an imminent recession. Furthermore, it is at least partially offset by the announcement of a new and rising carbon tax for certain sectors that begins at 10 euros per ton in 2020 and rises to 35 euros per ton by 2025. Germany has been careful to emphasize that while these cumulative efforts may provide a modest boost to German growth, it will not push Germany’s public finances into deficit.

- Meanwhile, the Netherlands has announced a stimulus plan worth a substantial 1% of GDP in a transparent attempt to improve economic growth. The Dutch government cited the difficult external environment as a motivation. The stimulus should put the Netherlands into a modest fiscal deficit of 0.6% of GDP – technically in violation of Dutch fiscal rules, but not a problem by EU standards that allow a deficit of up to 3% of GDP.

- As discussed in the prior section, Canada could soon deliver modest fiscal stimulus as both major parties pledge small tax cuts.

- Aside from China, none of these nations are doing enough fiscal stimulus to materially revive global growth prospects. However, should countries continue to jump aboard, the effect could become more visible over time. A central attraction for many nations is surely not just that their economies are soft, but also that the cost of borrowing is so stunningly low right now.

Brexit update:

- The Brexit deadline is now just one month away, and nothing whatsoever is clear.

- Prime Minister Johnson’s grasp on power has weakened as he has booted Conservatives from caucus and others have resigned. He no longer has a governing majority.

- Meanwhile, the remainder of parliament is reluctant to congeal around Labour Party leader Corbyn as he is viewed as being too far to the left by many.

- In turn, despite little time left on the clock and parliament back in session after Johnson’s effort to prorogue was thwarted by the British Supreme Court, there is no clear path forward.

- Recent legislation means that the U.K. cannot easily opt to crash out of the EU on October 31. An extension must be requested (though there is at least a small chance that it is not granted).

- If former Prime Minister Theresa May’s original proposal were to be brought to another vote, it would stand a reasonable chance of passing, but neither the Labour nor the Conservative Party leadership much like it.

- There is a small chance that Johnson manages to negotiate a few tweaks to Theresa May’s deal – enough to put his own stamp on it – and presents that to parliament for a vote. But the EU has not been particularly inclined to budge so far, and there remain significant technical hurdles to creating a Northern Irish border that controls the flow of goods and people to EU standards without interfering with the Good Friday Accord.

- Normally, one would imagine that an election would be the natural step given this deadlock. However, the Conservative Party now has too few MPs to trigger this outcome and the Labour Party doesn’t necessarily want one as polling shows that whereas the Conservatives have lost their grip on parliament, their popularity with the public has only mounted.

- We conclude this update with the view that an extension beyond October 31 is quite likely, but it remains entirely unclear what happens after that. The risk of a no-deal Brexit has shrunk considerably over the past month, from perhaps 45% to 25%, but it is still far from zero (and could yet happen at a later date after October 31).

- Meanwhile, the corrosive uncertainty surrounding the entire endeavor continues to eat away at the British economy.

Assorted desserts

- Japan raised its sales tax on October 1, from 8% to 10%. The prior two times the tax rate was increased, Japan suffered a sharp economic decline immediately thereafter as the consumption of big-ticket items dried up. There is a negative and an optimistic perspective on how this next episode may proceed. The negative view is that while in the past the economy shrank after the sales tax was imposed, at least beforehand it enjoyed a significant boost as people frontloaded their consumption. That hasn’t happened this time, hinting of a feeble economy. But the optimistic view is that because the Japanese didn’t bother frontloading their purchases this time, there will be less of a hole in demand after the tax goes up. Either way, Japan’s timing is poor as many other countries are looking at delivering more stimulus rather than doing the opposite like Japan. Of course, Japan has a huge public debt and a sales tax is among the most efficient ways of reducing the country’s structural fiscal deficit.

- The U.S. is said to be evaluating additional ways to limit China’s clout, including delisting Chinese companies that operate on U.S. stock exchanges and limiting the extent to which U.S. government pensions can purchase Chinese investment securities. Whether actually implemented, this represents a cooling of trade sentiment that had previously been warming as the two countries prepare for face-to-face negotiations.

- The Eurozone unemployment rate has fallen to 7.4%, its lowest level since the financial crisis. Germany’s unemployment rate is just 3.1%. This demonstrates that while European growth has slowed and worries are mounting, the economy remains tight for the moment: significant damage has not yet occurred.

- Looking forward to the data ahead, the U.S. ISM (Institute for Supply Management) Manufacturing Index and U.S. payrolls are set to be extremely important for markets. The consensus expectation is entirely reasonable – a slight rebound in both, to 50.0 for the former and to 150K for the latter. We have no particular reason to think the outcome will be worse than the consensus, but the reaction could be asymmetric – a miss, particularly a miss that continued the downward trend in both series could result in a violent recoil, whereas a slight beat might yield less than proportional enthusiasm to the upside.