Nouvelles des relations commerciales entre les États-Unis et la Chine

- Deux des trois problèmes macroéconomiques qui ont inquiété les marchés l’an dernier sont en grande partie réglés : les taux d’intérêt ont cessé d’augmenter et le ralentissement de la croissance est moins prononcé.

- Le troisième problème, en l’occurrence le protectionnisme, demeure entier. Il est vrai que certains éléments se sont améliorés depuis la fin de 2018. Ainsi, l’application de tarifs sur les automobiles a été repoussée de six mois ; les tarifs sur l’acier et l’aluminium ont récemment été levés pour le Canada et le Mexique ; et le Congrès semble de moins en moins réfractaire à la signature de l’AEUMC.

- Par contre, la composante la plus importante des échanges commerciaux, soit les relations entre les États-Unis et la Chine, s’est considérablement détériorée.

- Durant l’hiver et le printemps, les échos des négociations étaient pourtant très prometteurs. On avait même annoncé la rédaction d’un document de 150 pages, dans lequel la Chine s’engageait à revoir son système de sociétés d’État, ses pratiques relatives à la propriété intellectuelle, les exigences applicables aux coentreprises et le contrôle des capitaux, de façon à mettre le pays sur un pied d’égalité avec ses partenaires.

- Cependant, le président Xi aurait supprimé 45 pages du document qui lui a été présenté par les négociateurs, notamment la majeure partie du texte promettant d’inscrire les changements dans la loi chinoise. Sans ces garanties, la proposition d’accord commercial s’est révélée substantiellement réduite, mais surtout largement inefficace.

- Il est compréhensible que la Chine ait refusé de signer cet accord, dans la mesure où il prévoyait beaucoup plus de concessions de sa part que des États-Unis. Pourquoi la Chine l’accepterait-elle ?

- D’un autre côté, son modèle commercial actuel lui confère des avantages importants par rapport aux autres pays. Le reste du monde lui demande simplement de rétablir l’équilibre. Or, pour cela, la Chine doit entreprendre des changements.

- Au final, la résolution de ces divergences dépendra du temps pendant lequel la Chine et les États-Unis pourront supporter les effets négatifs des tarifs sur leur économie. Après que la Chine eut modifié le projet d’accord, les États-Unis ont riposté en augmentant le taux des tarifs applicables aux importations de biens chinois (et la Chine a mis en place des mesures identiques).

- Il reste une lueur d’espoir, les présidents Trump et Xi devant se rencontrer au sommet du G20 prévu pour la fin de juin.

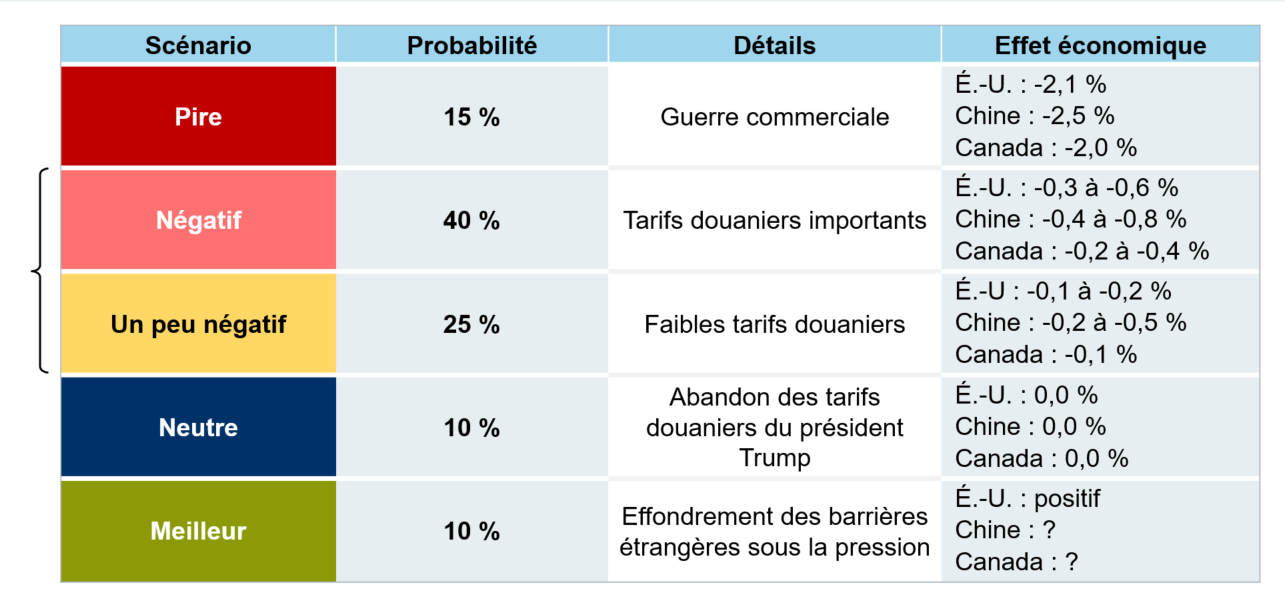

- Cependant, notre scénario de base table maintenant sur le maintien de la dernière ronde de tarifs. Par conséquent, nous avons actualisé les divers modèles qui nous permettent d’évaluer les dommages économiques causés par le protectionnisme (voir graphique). Les estimations générées par ces modèles se situent généralement parmi les moins élevés des calculs sommaires que nous avons communiqués au cours des dernières semaines. Par exemple, si les tarifs actuels sont maintenus, la production des États-Unis baissera de 0,3 % à 0,6 % (alors que nous anticipions auparavant une diminution de 0,6 %). L’effet négatif sur le PIB de la Chine sera de 0,4 % à 0,8 %.

-

Les scénarios relatifs au commerce se détériorent

Sources : RBC GMA, Oxford, Bloomberg, OCDE, Nomura, Goldman Sachs, UBS, Barclays, Fajgelbaum et al.

- Ces chiffres semblent peu élevés, mais il convient de noter plusieurs éléments :

- Premièrement, les entreprises ont naturellement pour but de maximiser les profits. Elles continueront à importer un produit assujetti à des tarifs douaniers élevés seulement si elles ne peuvent trouver un substitut moins cher au pays, un autre fournisseur étranger ou un moyen de se passer complètement du produit. Il n’est pas rare que l’une de ces options soit réalisable.

- Deuxièmement, les entreprises américaines capables de prouver qu’il n’existe aucun autre fournisseur national peuvent demander une dispense de tarif : 80 000 demandes de cet ordre ont été présentées rien que pour les tarifs sur l’acier et l’aluminium. Le traitement rapide de ces demandes pose toutefois problème.

- Troisièmement, les gouvernements viennent souvent en aide aux industries touchées. À titre d’exemple, les États-Unis ont injecté des milliards de dollars pour aider leur secteur agricole à résister aux tarifs de la Chine. Les répercussions économiques sont ainsi remplacées par une hausse de l’endettement public.

- Cela dit, nous avons des raisons de penser que les modèles pourraient ne pas rendre compte de l’étendue des dommages.

- Premièrement, même les modèles reconnaissent que la perte de prospérité des ménages et des entreprises est supérieure à l’incidence économique négative cumulée. Il en est ainsi parce que le secteur public est souvent favorisé par les recettes fiscales supplémentaires qu’il peut percevoir grâce aux tarifs douaniers. D’autres secteurs accusent donc un retard encore plus grand.

- Deuxièmement, certains groupes nationaux sont avantagés quand les concurrents étrangers sont privés de l’accès au marché. Cela signifie néanmoins que les consommateurs et les sociétés tributaires des intrants étrangers sont encore plus touchés que ne l’indiquent les données économiques globales.

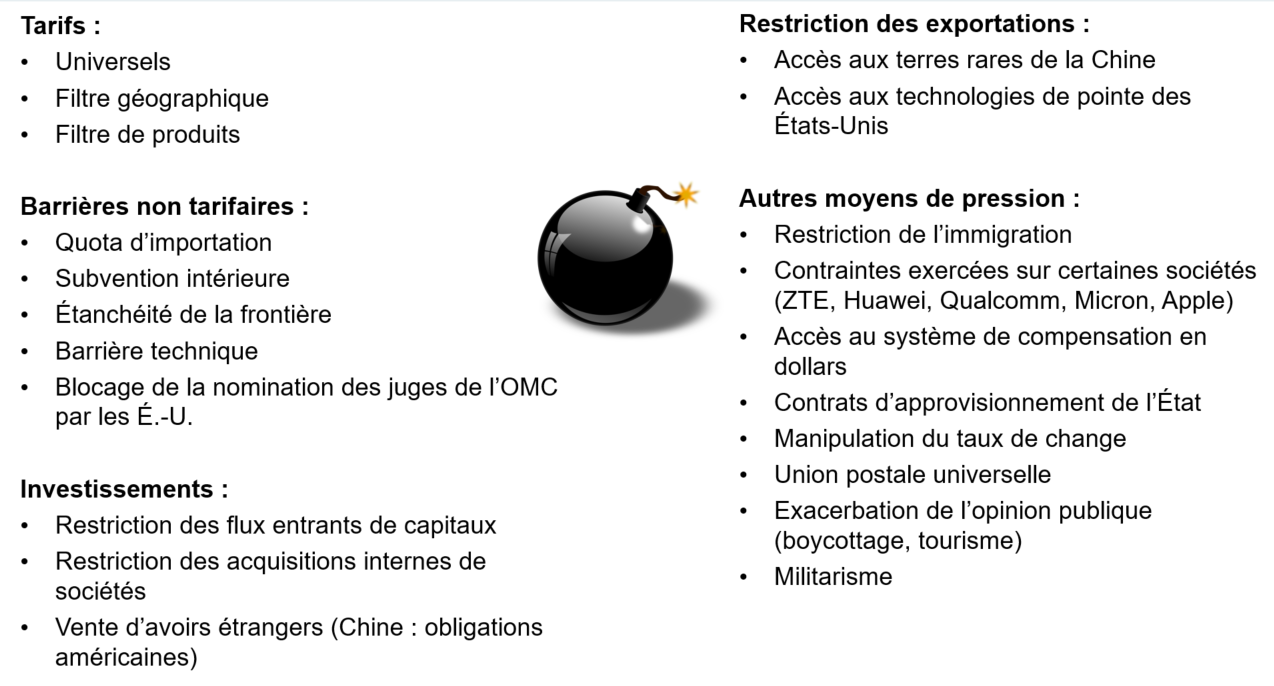

- Le troisième point est le plus important : les modèles éludent complètement le fait que les gouvernements pratiquent aussi le protectionnisme par des voies non tarifaires (voir le graphique suivant). Ces répercussions ne sont pas chiffrées, mais elles sont somme toute très réelles.

- Quatrièmement, le marché boursier a tendance à réagir beaucoup plus fortement à de tels chocs que l’économie. Ainsi, une fluctuation de plusieurs points de pourcentage du marché boursier est tout à fait normale pour un choc protectionniste qui ne fait que soustraire un demi-point de pourcentage à la croissance économique.

-

Les armes de la guerre commerciale ne se limitent pas aux tarifs

Source: RBC GMA

- Parmi les barrières non tarifaires, les attaques contre des sociétés représentent la manifestation la plus évidente d’antagonisme transfrontalier. Les États-Unis s’en sont d’abord pris au géant chinois des télécommunications ZTE l’an dernier. Cette année, comme tout le monde le sait, ils ont ciblé Huawei, le chef de file de la technologie. De leur côté, les autorités chinoises ont bloqué une proposition d’acquisition de Qualcomm, lancé des allégations antitrust à l’endroit de fabricants de puces, comme Micron, et limité la vente de certains produits d’Apple en Chine.

- Huawei monopolise particulièrement l’attention. Son chef des finances a fait l’objet d’accusations de tribunaux américains et ses produits 5G ont été interdits aux États-Unis et dans d’autres pays développés. Les entreprises américaines doivent désormais obtenir l’approbation des autorités avant de faire affaire avec cette société, dont l’expansion des affaires sera ainsi entravée. Par conséquent, Huawei ne peut plus compter sur de nombreuses technologies américaines essentielles qui entrent dans la fabrication de ses produits. Signalons les autres problèmes suivants :

- Du côté des logiciels, les règles restreignent la capacité de Huawei de continuer à utiliser le système d’exploitation Android dans ses téléphones. Huawei est notamment le deuxième producteur de téléphones mobiles en importance au monde.

- Les fournisseurs de technologies de l’extérieur des États-Unis font désormais preuve de prudence en ce qui concerne Huawei.

- La société ne pourra plus prendre part aux travaux de deux organisations de normalisation technologique qui établissent les protocoles universels pour certaines technologies, comme les réseaux sans fil et les cartes mémoire SD.

- Jusqu’à présent, Huawei n’a toujours pas été inscrite dans la liste noire du système de compensation en dollars. Une telle décision avait presque causé la faillite de ZTE en 2018, avant que les États-Unis s’empressent de renverser leur décret.

- Huawei est vraisemblablement visée pour diverses raisons :

- La Chine est à l’avant-garde de la vague 5G et Huawei n’a pas de concurrent aux États-Unis. Par conséquent, les efforts des Américains visent peut-être simplement en partie à réduire l’ampleur des avancées technologiques des Chinois.

- Huawei est accusée d’avoir acquis de façon douteuse une part appréciable de sa propriété intellectuelle de base, souvent au détriment de chefs de file de pays développés.

- Les Américains l’accusent de ne pas respecter les sanctions imposées par les États-Unis contre l’Iran, ce que Huawei dément.

- Les Américains s’inquiètent de la proximité de Huawei et des autorités chinoises, qui pourrait entraîner de l’espionnage si des pays mettaient les produits 5G de la société au cœur de leurs réseaux de télécommunications.

- Les restrictions imposées à Huawei pourraient bien être levées par la conclusion d’un accord commercial entre les deux pays. Les restrictions imposées à ZTE avaient finalement été allégées pour plaire au président de la Chine. Cette décision sans précédent avait été prise pour des raisons strictement politiques plutôt que juridiques.

- Les mesures prises par les Américains risquent de se retourner contre eux si elles sont mises en œuvre trop longtemps. Plus longtemps les Chinois n’auront pas accès aux technologies américaines, plus il est probable qu’ils reproduiront ces technologies. De même, toute perte d’accès au système de compensation en dollars se traduira par la mise sur pied accélérée d’un système chinois rival, de sorte que les Américains seraient moins en mesure d’exercer la même influence dans l’avenir.

- La Chine possède aussi la capacité de frapper les États-Unis en adoptant des mesures non tarifaires, par exemple en vendant des titres du Trésor américain, en restreignant la vente d’iPhone ou d’autres produits de prestige fabriqués en Chine, ou même en interrompant ses exportations de terres rares (dont elle a le quasi-monopole), métaux qu’on retrouve dans tous les appareils électroniques modernes.

- En fin de compte, l’imposition de nouveaux tarifs douaniers élevés et de mesures non tarifaires musclées cause de graves dommages à l’économie. Pour l’instant, nous tenons pour acquis que les mesures déjà en place le resteront, mais nous ne prévoyons pas d’allégement ou d’intensification considérable à court terme.

Politique au Royaume-Uni

- La première ministre britannique Theresa May a annoncé sa démission ; elle quittera son poste le 7 juin 2019.

- Cette annonce n’a surpris personne. Theresa May subissait depuis quelque temps de la pression de la part des membres de son cabinet et avait déjà promis qu’elle abandonnerait ses fonctions au cours des prochains mois. Son annonce survient toutefois légèrement plus tôt que prévu.

- Rappelons-nous que les projets de Brexit qu’elle avait négociés avec l’Union européenne (EU) ont été officiellement rejetés à trois reprises par le Parlement. Le premier d’entre eux l’a été par une marge record. Les efforts de négociation au-delà des lignes de parti n’ont pas porté leurs fruits ; Theresa May semblait être en voie d’essuyer un quatrième revers au début du mois de juin, malgré les quelques modifications apportées au plan.

- Le prochain chef du Parti conservateur et, par conséquent, premier ministre sera choisi d’ici la fin de juillet. Il s’agit d’un processus intéressant : les députés voteront lors de plusieurs tours, de manière à éliminer chaque fois le candidat le moins populaire. Lorsqu’il ne restera plus que deux candidats dans la course, leurs noms seront annoncés aux membres du Parti conservateur, qui éliront le vainqueur.

- Le dernier sondage place l’ancien maire de Londres et ex-ministre Boris Johnson largement en tête ; il obtient trois fois plus d’appuis que le candidat qui le suit. Johnson est favorable au Brexit, mais il se situe plutôt au centre au sein du parti, ayant déjà voté en faveur de l’un des accords avec l’UE proposés par Theresa May.

- Dominic Raab arrive quant à lui en deuxième place. Plus à droite, il affirme qu’il préférerait un Brexit chaotique, sans accord, aux options qu’offre actuellement l’UE.

- Étant donné la nette avance de Johnson dans la course à la chefferie, on pourrait croire que le tour est joué. Par contre, les marchés des paris ne lui attribuent que des chances égales par rapport à l’ensemble des autres candidats. Il ne faut pas oublier que les membres du Parti conservateur se situent plus à droite sur l’échiquier politique que l’électeur moyen de ce parti, qui est à son tour plus à droite que le citoyen britannique moyen. De plus, même si Johnson jouit d’un grand avantage dans une lutte contre de nombreux candidats, le vote final ne comportera que deux options. Les partisans d’un Brexit dur pourraient être en mesure de se rallier à un seul candidat qui se trouve actuellement submergé dans un océan de candidats dont l’idéologie est similaire.

- Le départ de Theresa May augmente indéniablement le risque de durcissement du Brexit. Un premier ministre ne peut certes pas conclure à lui seul un accord de Brexit dur avec l’UE, mais il pourrait en théorie forcer une sortie sans accord. Il s’agirait d’un scénario défavorable sur le plan économique. Cependant, des issues positives sont également possibles. Le Parlement a toujours son mot à dire dans la plupart des scénarios et les membres qui le composent continuent de pencher vers une version allégée du Brexit. En raison des avantages que lui offrirait un tout nouveau mandat, Boris Johnson pourrait, en tant que premier ministre, avoir plus de facilité à concrétiser un accord du même type que ceux proposés par Theresa May.

- On oublie souvent que la majeure partie des négociations sur le Brexit sont toujours axées sur la nature de l’entente de transition plutôt que sur l’avenir de la relation entre le Royaume-Uni et l’UE. Ce dernier aspect est pourtant bien plus important que le premier. Nous sommes toujours en faveur d’une union douanière, qui pourrait permettre d’éviter les problèmes liés à la libre circulation des personnes ainsi qu’à l’imperméabilité de la frontière avec l’Irlande.

- Pour le moment, la date limite du 31 octobre 2019 pour la conclusion de l’entente de transition est toujours en vigueur. L’Allemagne est favorable à un nouveau report, au besoin, tandis que la France l’est un peu moins. Les marchés des paris évaluent à 50 % les chances que la question du Brexit ne soit pas réglée avant 2022. La saga se poursuit donc…

Politique européenne

- Les résultats des élections dans l’Union européenne ont été rendus publics au cours de la fin de semaine. Bien qu’ils favorisent les populistes, ce ne sont pas exactement les résultats auxquels on s’attendait. Tandis que les partis centristes ont perdu des votes et que les partis d’extrême droite en ont considérablement gagné, contre toute attente, la popularité des partis d’extrême gauche a contre toute attente été encore plus marquante.

- L’extrême droite, qui possédait 20 % des sièges avant les élections, a réussi à obtenir 25 % des sièges, et non 33 % comme prévu.

- Le populisme est clairement en plein essor, mais n’est pas encore parvenu à vaincre le centrisme.

- Il semble qu’une coalition des partis centristes leur permettrait de conserver le pouvoir au parlement européen, bien que le soutien d’un parti de gauche puisse être nécessaire pour gouverner efficacement. Il en résulterait une diminution des mesures législatives en général, et peut-être un virage vers des politiques plus respectueuses de l’environnement.

- En ce qui concerne le Royaume-Uni, les résultats du vote ont été conformes aux attentes. Le Parti du Brexit a recueilli 32 % des suffrages, soit près de deux fois plus que les libéraux-démocrates, qui se sont classés au deuxième rang. Le Parti travailliste a tiré de l’arrière, arrivant en troisième place, tandis que le Parti conservateur a subi une cinglante défaite, terminant la course en cinquième place avec seulement 9 % des votes. Qu’est-ce qui explique le mouvement particulièrement contestataire des Britanniques ?

- Ce n’est pas parce que la majorité des Britanniques appuient maintenant le Brexit. D’ailleurs, les sondages indiquent continuellement que le statu quo est légèrement plus populaire que le Brexit.

- Ce mouvement est plutôt attribuable à plusieurs facteurs. Le taux de participation est toujours faible, ce qui signifie que seuls les électeurs les plus motivés se donnent la peine d’aller voter. Les Britanniques accordaient encore moins d’importance que d’habitude à ces élections, car les députés élus, peu importe lesquels, ne devraient pas rester à Bruxelles longtemps si le Brexit a lieu. Seules les personnes ayant des motifs de plainte se sont donné la peine de voter. Il n’est donc pas surprenant que les partisans du Brexit, mécontents après deux ans d’inaction, se soient fait entendre. Même les personnes ayant des opinions contrastées au sujet du Brexit ne peuvent s’empêcher de punir l’Union européenne pour avoir joué dur dans les négociations jusqu’à maintenant. Cela explique également pourquoi le Parti conservateur, qui est responsable de l’échec des négociations du côté britannique, a obtenu des résultats médiocres.

Élection en Inde

- La plus importante démocratie du monde vient de conclure la septième étape de son odyssée électorale, au cours de laquelle 600 millions d’électeurs ont voté, soit un nombre sans précédent dans l’histoire. Au fait, le deuxième événement démocratique périodique le plus important au monde est la tenue des dernières élections de l’Union européenne, que nous avons précédemment abordées.

- La grande nouvelle en Inde est qu’en plus d’avoir remporté la victoire, le premier ministre Modi et son parti BJP ont obtenu à la chambre basse une majorité encore plus importante qu’aux dernières élections. Durant la majeure partie de la période préélectorale, on s’attendait plutôt à une marge réduite.

- Ce résultat a eu un effet positif sur le marché, non seulement en raison de la continuité qu’il assure, mais également parce que l’économie indienne s’est plutôt bien comportée sous la direction de M. Modi. La croissance du PIB s’est maintenue aux alentours de 7 % par année, même si les mesures du marché du travail se sont avérées moins encourageantes.

- L’un des aspects à surveiller est le penchant nationaliste occasionnellement montré par M. Modi, premièrement à titre de ministre en chef du Gujarat, puis en sa qualité de premier ministre.

Aperçu du PIB au Canada

- Les résultats du PIB du Canada pour le premier trimestre seront publiés cette semaine. Il y a de bonnes chances qu’ils surpassent les prévisions modestes de la Banque du Canada. Le PIB pourrait avoir crû à un rythme annualisé d’environ 1 %, surtout grâce à un gain potentiel de 0,3 % (non annualisé) durant le dernier mois du trimestre.

- Précisons toutefois qu’une croissance de 1,0 % ne constitue en rien un bon trimestre. Ce taux, qui est environ deux fois moins élevé que la normale, signale une contre-performance pour un deuxième trimestre consécutif.

- En ce qui concerne l’économie canadienne, il est étonnant de constater que les données du marché du travail sont au contraire exceptionnellement encourageantes.

- On ne peut manifestement pas concilier les deux : ces résultats n’ont simplement aucun sens et la situation ne s’éternisera certainement pas. Bien que l’économie et le marché du travail puissent se rencontrer quelque part à mi-chemin, nous sommes plutôt d’avis que l’embauche ralentira plus rapidement que le PIB n’accélérera.

Avant-goût de la décision de la Banque du Canada

- Lors de la réunion qui aura lieu cette semaine, la Banque du Canada devrait décider de maintenir son taux à un jour.

- Certains facteurs négatifs sont récemment entrés en jeu, dont la détérioration des relations entre les États-Unis et la Chine, et un léger recul des prix du pétrole.

- Les facteurs positifs pèsent toutefois davantage dans la balance. En voici quelques-uns :

- Le dollar canadien s’est légèrement déprécié depuis la dernière fois.

- L’économie mondiale montre certains signes de reprise.

- Le PIB du premier trimestre s’établira probablement au-dessus du faible seuil établi par la banque centrale.

- La croissance de l’emploi est vigoureuse.

- Ces facteurs dénotent un contexte qui s’est globalement amélioré, comme en témoignent les attentes du marché, qui tiennent maintenant compte d’une modeste chance de hausse des taux d’intérêt (bien qu’encore peu probable), et d’aucune chance de baisse des taux.

- En revanche, on s’attend à une baisse des taux de 0,25 % d’ici septembre, par rapport à une faible probabilité de 8 % de hausse des taux.