The optimist’s guide to the business cycle:

- Our business cycle scorecard and the inverted yield curve both argue that this is a late point in the U.S. business cycle. That is our base-case scenario.

- But the vagaries of the business cycle are such that we cannot speak with precision. How else might the cycle play out?

- The worst-case scenario would involve the cycle stumbling to an immediate close, perhaps because of an Iran-induced oil shock, a further bout of tariffs, or simply the consequence of a drum-tight economy bumping up against its natural growth limits.

- Conversely, the best-case scenario would see the expansion tack on another two or three (or more) years of growth, defying the odds given a cycle that is already the longest in history.

- While the possibility of a sudden drop into recession has received ample attention, the optimistic scenario has not. Let us flesh it out.

- There are a number of arguments in support of a longer expansion:

- As we have discussed in past #MacroMemos, the significance of the inverted yield curve is subject to some dispute. Why?

- - The 2yr-10yr spread has not yet inverted and the absence of a term premium in the bond market muddies the interpretation of the inverted 3m-10yr spread.

- - The inversion of 1998 provided an (admittedly rare) false signal.

- In a globalized world with an aging population and rapid technological change, the structural downward pressures on inflation are intense. To the extent that inflation usually rises to problematically high levels at the end of the business cycle, contributing to the economy’s eventual decline, this threat seems unusually small this cycle.

- As we argued in last week’s #MacroMemo, a variety of special factors have already helped to stretch out the current expansion. These include:

- - Expansions usually last longer when they come after a financial crisis and when growth is unusually sluggish.

- - The expansion of the social safety net, the improvement of financial regulations, the professionalization of central banks and an increased adherence to Keynesian fiscal policies relative to a century ago that should theoretically reduce the choppiness of growth.

- - The rising service-sector share of GDP is helping to smooth the economic trajectory. This hardly means the business cycle is dead. But it does mean the average expansion should be longer than in the past.

- With the U.S. Federal Reserve now on a rate-cutting trajectory, it is entirely reasonable to make the claim that more stimulative monetary policy should translate into more economic growth, that additional growth should reduce the risk of recession, and that a diminished recession risk should lengthen the business cycle. Of course, to play devil’s advocate, one could just as easily argue that rate cuts might bring the cycle to a premature close since more growth overheats the economy, lowering unemployment, increasing inflation and triggering the cycle’s end. It ultimately comes down to whether the additional growth from rate cuts translates into demand-side or supply-side growth. If the former, the cycle could end more quickly. If the latter, it could end later. Economic theory argues the cycle is more likely to be shortened than lengthened, but there is no guarantee it plays out this way. Suffice it to say, it is at least conceivable that rate cuts extend the cycle.

- It is possible that the U.S. economy is not quite as tight as it currently looks. This argues for more tolerance before the economy overheats. While the unemployment rate is just 3.7%, this exaggerates the tightness of the labour market.

- - There are still discouraged job seekers sitting on the sidelines who are failing to be picked up in the traditional metric of labour slack. Illustrating this, just 60.6% of the U.S. population aged 16+ is currently working, below the 63.4% peak of last cycle or the 64.7% peak of the cycle before.

- - Furthermore, the average education level of the population rises from one cycle to the next and it is reliably the case that more educated workers participate in the workforce to a higher extent. Providing an example, the employment rate for people with a bachelor’s degree (or more) is 72%, versus just 44% for those without a high school degree. Arguably, then, the peak employment rate should rise from one cycle to the next.

- In theory, then, there may be several million additional workers who need to be absorbed into the workforce before it can truly be claimed that the economy has reached its full capacity. This is just a simplistic analysis that probably exaggerates the hidden reservoir of labour since the population is simultaneously aging and older people work less. But the basic point that the unemployment rate isn’t as low as it looks is probably still valid.

- Finally, while recessions can simply happen because growth has overextended itself, there is frequently a catalyst of some sort involved. The prior cycle was brought to a close by a housing bubble that ignited a debt crisis. The cycle before that ended in large part because of a tech stock bubble. The current expansion is hardly without vulnerabilities – leveraged loans are a prominent risk – but the magnitude of these risks seem smaller.

- As we have discussed in past #MacroMemos, the significance of the inverted yield curve is subject to some dispute. Why?

- The bottom line is that there are a variety of coherent arguments that support the current economic expansion continuing for several additional years. This is not our base-case forecast, but it needs to be acknowledged. It represents one reason among many why abandoning risk assets altogether could prove unwise.

North American central banks:

- We don’t usually critique the U.S. Federal Reserve and Bank of Canada side by side, but that treatment is arguably justified this time.

- U.S. Federal Reserve:

- The U.S. Federal Reserve published its latest Fed Minutes and Fed Chair Powell testified before Congress last week.

- Nothing shocking transpired, with the Fed continuing to signal near-term rate cuts.

- Specifically, the testimony said that “uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook.” Worries about the upcoming U.S. debt ceiling and British Brexit were also cited.

- Consequently, the market has now fully priced in a 25bps rate cut for the Fed’s upcoming July 31 meeting (with a 25% chance of a 50bps rate cut now priced for that meeting), and more at later meetings.

- We have two thoughts on this:

- - The U.S. economy hardly screams out for rate cuts. The unemployment rate is quite low, inflation readings are near normal, and the Fed’s latest growth forecast is both adequate and unchanged from when the Fed was seemingly content to remain on hold. This proposed easing is therefore very much intended as an insurance rate cut in the event that conditions deteriorate, rather than as something that the base-case forecast demands. In this environment, reading the tea leaves – tracking Fed speeches and the like – is now the more important skill than processing economic data.

- - Economic stimulus is certainly a mathematical positive for economic growth. But, equally, it is historically associated with the end of the business cycle. The question is thus whether the Fed is acting sufficiently early and with enough force to push off the end of the cycle, or instead is simply fulfilling the recessionary prophecy. In theory, a handful of rate cuts is only capable of adding perhaps a quarter to half a percentage point of economic growth. But possibly the psychological benefits are greater than normal this time, as per the stock market’s enthusiastic embrace so far.

- Bank of Canada:

- The Bank of Canada’s decision last week was substantially different than the utterances of the Fed and other central banks. The Canadian central bank expressed satisfaction with its current policy rate of 1.75%, saying it “remains appropriate.”

- The Bank upgraded slightly its growth forecast for 2019, while tweaking the 2020 outlook slightly lower.

- Concerns were expressed about global weakness and trade, but domestic strength was celebrated in the form of a healthy labour market, a stabilizing housing sector, more stimulative financial conditions and lower mortgage rates.

- As a result, the market prices in a 30% chance of a rate cut by the end of 2019.

- The Bank of Canada did acknowledge a degree of asymmetry to Canada’s risks, with a text box in the Monetary Policy Report estimating a potential GDP upside of 2% if all tariffs were to vanish, versus a whopping 6% downside should a full trade war breakout.

- Compare and contrast:

- It is fascinating to juxtapose the Fed and the Bank of Canada because both made a similar assessment of the economic situation, yet signaled a radically different monetary policy prescription.

- This is to say, both were concerned about slowing global growth, recognized protectionism as a drag, and acknowledged decent domestic economic conditions. And yet the Fed concluded that rate cuts are appropriate while the Bank of Canada landed upon an unchanged policy rate.

- To some extent, the disagreement is slightly trumped up as it is fair to acknowledge that Canada is starting with slightly more stimulative monetary policy than the U.S. One could argue that rate cuts in the U.S. merely bring it into closer alignment with Canada rather than the reverse. But direction also matters, and the two central banks are not going in the same direction. What explains the disagreement?

- - It is a function of a differing philosophy more than a differing economic outlook.

- - Canada is conducting monetary policy based on its modal forecast – the most likely outcome. The most probable outcome is decent economic growth in Canada, and that simply doesn’t warrant rate cuts.

- - Conversely, the U.S. is conducting monetary policy based on its mean forecast – a weighted set of scenarios ranging from recession to economic boom. With the recession risk sitting several times higher than usual, this is motivating rate cuts as a precautionary move. Thought of stylistically, if the Fed would normally want to cut rates by 250bps in a recession, a 30% chance of a recession argues for 75bps of rate cuts – roughly what the market has priced in.

- Who is right and who is wrong? It is truly hard to say. The most likely scenario is that the Bank of Canada is right, with ongoing economic growth rendering rate cuts unnecessary and even inappropriate. However, should a recession strike, the Fed will be at least part way toward grappling with it, whereas the Bank of Canada will be caught flatfooted.

- Our sense is that the best strategy may lie somewhere in the middle. The Fed may be planning a bit too much easing given the circumstance, while the Bank of Canada may be more likely to ease policy than the market currently imagines. When push comes to shove, the two central banks are unlikely to be substantially different from one another.

Inflation expectations:

- Worries about low inflation have provided at least a partial motivation for dovish central banks over the past six months.

- To be clear, realized inflation is not actually all that depressed. U.S. core Consumer Price Index (CPI) is currently perched at 2.1% YoY. While headline U.S. CPI is just 1.6% YoY, superior measures of the inflation trend argue inflation is a little high, if anything: trimmed mean CPI is 2.1% and median CPI is 2.8%. All of this is in stark contrast to 2010, when headline CPI was briefly at a rock-bottom -2.0% YoY and core CPI fell to just 0.6% YoY. That was a serious risk.

- For its part, Canadian core and headline CPI are both slightly above their 2.0% target.

- What is the worry, then?

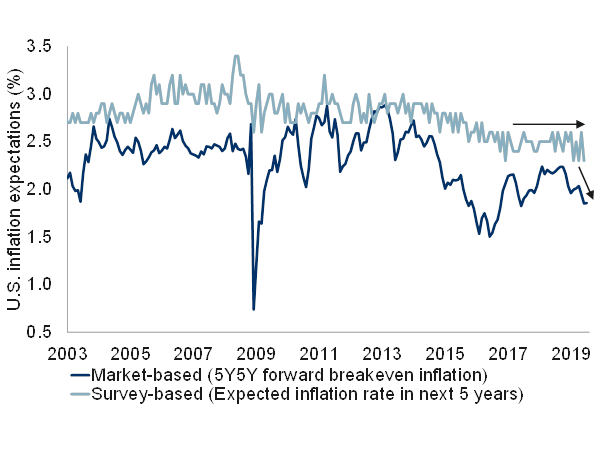

- It is mostly that inflation expectations are low and falling, even for the fairly distant future (see chart).

-

Market-based inflation expectations have fallen sharply; survey-based expectations are lowest in years

Source: Market-based inflation expectations as of 7/12/2019, survey-based inflation expectations as of Jun 2019. Source: Federal Reserve, University of Michigan Surveys of Consumers, Haver Analytics, RBC GAM

- Worries about low inflation are counterintuitive given that high inflation hurts economic growth, limits the application of monetary stimulus, and obliges investors to pay a higher effective tax rate on their real capital gains.

- But suffice it to say that low inflation is still to be avoided given the threat of a deflationary trap and the limitations low inflation places on central banks seeking to deliver stimulus during times of crisis.

- From a market-based perspective, inflation expectations have indeed been declining for some time, with the U.S. 5-year—5-year breakeven (measuring expected inflation between 6 and 10 years from now, conveniently moving beyond the temporary wiggles and distortions that plague shorter-term measures) now down to an unusually low level. That said, it remains higher than it was in 2016, when deflation was easily avoided.

- The downward trend is similar internationally. Canadian, Eurozone and Japanese inflation expectations are all down to some extent (with the latter two structurally lower than North America).

- Survey-based measures do not reveal quite the same profundity of decline, but have declined at least slightly. In some cases they are the lowest they have been over the past 15 years.

- To be clear, no inflation expectation metric indicates imminent deflation, or anything approaching it. But it would seem to be somewhat harder to generate inflation over the long run given an aging population and given rapid technological change.

- Beyond the direct economic implications, this challenges the credibility of central banks, which can undermine the efficacy of monetary policy over time.

- The most obvious solution is to recognize that the true neutral policy rate needed to achieve normal inflation over the long run is likely lower than previously thought, which is quite a statement given that the post-crisis neutral is already acknowledged to be a few percentage points below the prior norm. Our bias is already tilted in this direction.