Brexit vote:

- Another Brexit milestone looms this coming Tuesday January 15th, when British Parliament will vote on Prime Minister May’s proposed Chequers deal with the EU.

- Recall that this vote was delayed from December, when it had become evident that the proposed deal would not pass. May subsequently survived a harrowing leadership challenge.

- Expectations are low that Parliament will endorse the proposed deal, though it is not utterly impossible. Much depends on the extent to which parliamentarians fear a “no deal” Brexit and are willing to compromise.

- Any rejection of the existing plan will have to be met by the tabling of another plan within a week. That will leave scant time to negotiate any such deal with the EU. In turn, one would imagine it will have to be an off-the-shelf version, either tilting toward a harder Brexit (ala a free-trade deal) or a softer Brexit (akin to the European Economic Area).

- Of course, this second option may also prove unpalatable to parliamentarians. So another referendum or even another election could ultimately result.

- Whereas previously the Prime Minister had refused to entertain a second referendum, she recently refused to rule out that option. Betting markets assign around a one-in-three chance to another referendum. It is unclear whether any such referendum would simply ask the original yes/no question again; or, instead, would it have voters choose among the various ways of exiting without the option of opting out altogether; or alternately present the full suite of possibilities.

- If Labour were to succeed in triggering and winning a non-confidence vote, another election would be held. But this wouldn’t add much clarity, at least initially. Election polling points to a nearly balanced probability of the incumbent Conservatives versus the opposition Labour winning the most seats. While a switch toward Labour could unstick Brexit, the market fears that this could also bring far-left economic policies that challenge the U.K. in other ways.

- One thing is clear: it is unlikely that a clean break will actually occur on the anointed deadline of March 29th, 2019. Betting markets agree. This doesn’t mean that Brexit is expected to be avoided altogether (though that remains a possibility). Rather, given the enormous uncertainty that remains and therefore work to be done, the U.K. would likely seek to either negotiate a delayed exit date with the EU or revoke Article 50, thereby putting the exit on hold until a coherent plan could be worked up. And recall that even if the Parliamentary vote succeeds next week, that deal includes a delay in the effective timing of Brexit until the end of 2020.

- We continue to believe that the most palatable Brexit option remains the one set to be voted on by parliament imminently, as it doesn’t violate the two key goals of limiting immigration and minimizing the Irish border. Although there is a sizeable probability that the upcoming vote will fail, a version of the plan could be revived later.

- The “No Brexit” option is also becoming ever-more conceivable, particularly with the possibility of another referendum.

- It is commonplace for uncertainty to reign supreme in the immediate run-up to a political deadline such as this one. Pressure can be useful for securing a solution.

- While all of this uncertainty and any eventual Brexit deal will take a toll on the British economy, we continue to think that the market has already priced much of this in. Moreover, the variety of Brexit ultimately chosen is more likely to be softer than expected, rather than harder.

Government shutdown:

- The U.S. government shutdown continues.

- As of January 12th, it will be the longest such episode in U.S. history. That isn’t saying a great deal, however, as the prior record was only 22 days: shutdowns simply don’t tend to last for very long, as demonstrated by the two lightning-quick shutdowns of early 2018.

- The key impasse remains. President Trump wants $6B in funding for a border wall with Mexico, while the Democrats in the Senate and the House are opposed.

- There are a few ways the deadlock could resolve itself:

- Moderate Republicans have proposed work permits for illegal immigrant “Dreamers” in exchange for border funding. So far, President Trump has not bitten.

- The White House is thought to be searching for ways to stand down from the conflict without “losing.” This might include funding additional border security via unconventional means through the Federal Emergency Management Agency (FEMA). The argument goes as follows: the U.S. is experiencing an illegal drug emergency, some part of that crisis is the result of illegal drugs flowing across the Mexican border, and therefore any effort to plug the hole represents a form of emergency management. It is indisputably a stretch when compared to the agency’s traditional mandate of handling natural disasters like hurricanes and floods. It also isn’t clear that this would be a durable solution, as any FEMA spending excesses would eventually have to be approved by the very same Congress that is currently gridlocked.

- Alternatively, the mounting pain of unpaid public servants (to whom Democrats are particularly attuned) and any shutdown-related dyspepsia on Wall Street (a key consideration for the White House) could broker a compromise.

- We estimate the U.S. economy is suffering a 0.05% reduction in GDP for every week of the shutdown. This is tiny, but has now accumulated for three weeks and as such represents a 0.05% hit to 2018 and a 0.1% hit to 2019.

- There are starting to be other economic complications from the shutdown:

- The federal government is not able to publish its full suite of economic data releases. Already, several publications have been delayed, including the monthly releases for international trade, factory orders, construction spending and new home sales.

- Employment reports continue to be published, but if the shutdown lasts through January 29th there will be a large reported decline in U.S. employment in the next monthly report. The 380,000 federal workers on unpaid leave will fall out of the payroll figures. To the extent that such a decline is likely to more than offset any organic growth in the rest of the economy, this would halt the unprecedented run of uninterrupted monthly job gains at an agonizing 99 months. Of course, those jobs would immediately return whenever the shutdown ends.

- Between the modest economic damage being done by the shutdown plus the potential for a negative economic impulse from recent financial market woes, we flag the risk that U.S. GDP growth in 2019 could drift closer to 2.25%, versus our official 2.5% forecast.

Seasonal gremlins:

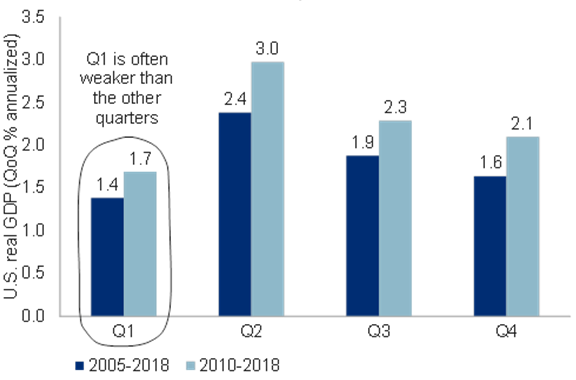

- The calendar has now turned to the first quarter of the year – a period in which U.S. economic data has tended to be weirdly weak. Case in point, Q1 GDP growth was the weakest quarter of the year in each of 2016, 2017 and 2018. Not coincidentally, the second quarter of each of those years was subsequently the strongest as this distortion unwound. We call it “weird” because economic data is already seasonally adjusted to eliminate such patterns.

- This recurring weak patch is not merely a recent phenomenon, as demonstrated by the chart below.

-

A soft Q1 normal

Note: As of Q3 2018. Source: BEA, Haver Analytics, RBC GAM

- Recent government analysis of this phenomenon yielded some technical gremlins that have been partially addressed. However, we budget for at least a shadow of this distortion to remain in the Q1 2019 data.

- Q1 2019 could be quite a mess to interpret for a trio of reasons:

- First, some seasonal weakness will likely manifest, but to an uncertain degree.

- Second, for the moment at least, some economic data simply isn’t being released due to the shutdown.

- Third, the shutdown is also distorting some indicators that do get released, such as payroll employment.

- This reduction in the economic signal-to-noise ratio comes at a time of heightened sensitivity to economic data: central banks are perched on the fence between tightening and pausing, recession concerns are running high and financial markets are skittish.

Bank of Canada:

- The Bank of Canada left its policy rate unchanged on January 9th, as expected.

- This represented quite a pivot from a mere two months ago, when a hike at this meeting had been more than 50% priced in.

- Over the intervening period, global financial markets convulsed, Canadian leading indicators weakened and the Fed sent a dovish message of its own.

- Capturing less attention, but no less dovish in its implications, Canadian GDP growth in prior years was revised downward, implying more economic slack in the system today and thus less urgency to tighten.

- Low oil prices were a focus in the Bank of Canada’s analysis, estimated to slice around 0.5% off Canadian growth over the next few years. To that end, the Bank of Canada cut its 2019 growth forecast from 2.1% to 1.7%. Confusingly, however, the Canadian price of oil has actually increased since the last Bank of Canada meeting. This can be reconciled by the fact that a) Canadian oil price shocks operate with a lag; b) the prior BoC decision was not a major one, and so offered no opportunity to formally revise the forecast; and c) Canadian oil prices are still fairly low even after their recent rebound.

- From a language perspective, the Bank of Canada is clearly dragging its heels, adding “over time” to its prediction that “the policy interest rate will need to rise.”

- We continue to be concerned by the Canadian trifecta of the oil shock, competitiveness challenges and a wobbly housing market. Despite this trepidation, cautious rate hiking seems more likely than rate cuts for 2019.