As someone who watches two football games per year – the Super Bowl and the Grey Cup – it took me the better part of the first quarter to sort out who the Super Bowl quarterbacks were, which teams were good at what, and the various underlying narratives. The second quarter was then spent seeking to identify and cheer on the Canadian medical doctor who had somehow found himself on the Kansas City offensive line. This initially proved elusive until I learned that the offensive line actually defends, while the defensive line attacks!

Throughout, we played the all-too Canadian game of trying to discern which commercials were “real” Super Bowl advertisements versus Canadian fillers. I missed the third quarter entirely as bedtime beckoned for the youngest members of the household. Returning to the television’s glow for the fourth quarter, I bore witness to a one-sided cavalcade of offense, followed by celebration. All in all, a rollicking time. Do I now understand what “breaking the plane of the goal line” means? Yes! Will I be able to remember all of this in a year’s time? Unlikely!

Webcast:

- Our latest monthly economic webcast is now out, entitled “New worries for a new year”.

Update on Wuhan coronavirus:

- The Wuhan coronavirus remains a very serious affair. The number of confirmed cases continue to mount – to 18K – and, alongside 22K suspected cases, the total tally may well be 40K. This is well beyond the 8K who were infected by SARS 17 years ago. While the number of deaths – now nearly 400 – remains shy of the SARS figure, that number should be exceeded in the coming weeks.

- As yet, there is no evidence that the virus is peaking. We expect it to progress somewhat further. As we indicated last week, this is a more serious epidemic than SARS.

- Among other milestones, the virus has now recorded its first fatality outside of China, and it has also spread among victims outside of China. Despite this, the great bulk of the infections and deaths remain within China. Representing little more than a formality, the World Health Organization has now declared a state of global emergency.

- A variety of efforts have been made to limit the geographic spread of the disease. China has famously locked down the city of Wuhan and much of the Hubei province around it, though this has proven quite porous as a remarkable 6 million out of 11 million Wuhan residents have reportedly fled. Russia and Hong Kong have closed their land borders with China. The U.S. and Australia are no longer allowing Chinese nationals to enter. Many airlines have cancelled their flights to/from China and international airports are now conducting enhanced screening on the remaining trickle of travelers.

- In the corporate space, a wide range of stores in China have closed in response to the virus. Prominent western brands such as Starbucks and Apple have attracted particular notice.

- The intensification of the virus happened to coincide with the one-week holiday associated with Chinese New Year. This was bad luck in that Chinese citizens traditionally return to their hometowns, potentially spreading the infection across the country. However, the timing was good luck in that little economic activity usually occurs at that time of the year. However, the latter story changes this week as China would normally be returning to work whereas the government has extended the holiday by several days and – in our opinion – will likely extend it somewhat further. We assume China ultimately remains off work for three weeks, though realistically some regions may return to work sooner while others could be off for considerably longer. Already, some schools have been declared closed until March 1.

- The Wuhan epicenter is of considerable relevance to the Chinese economy, in its capacity as the country’s seventh largest city, its status as a nationwide transportation hub, and its large international manufacturing sector.

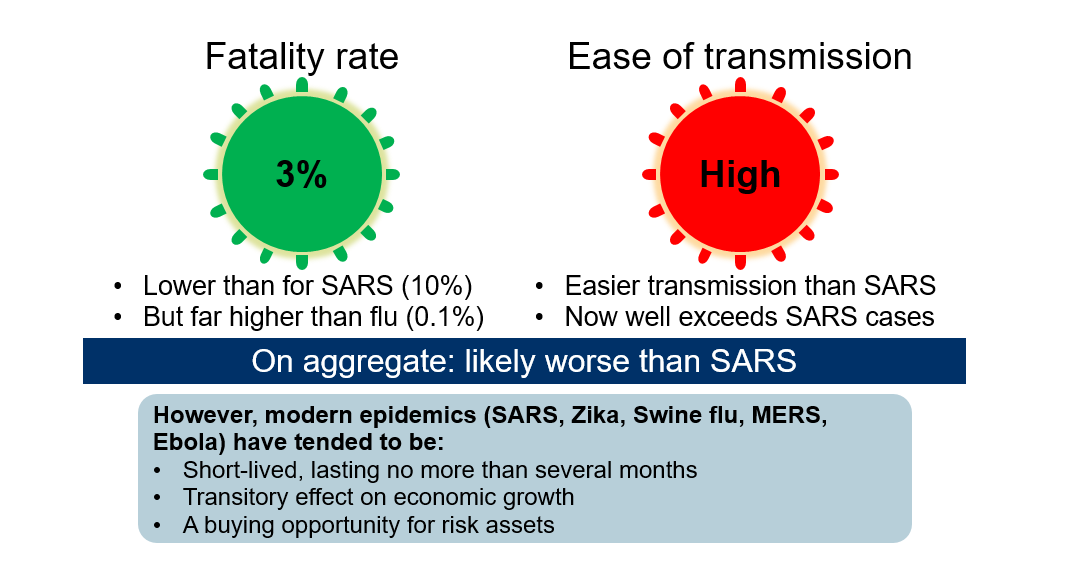

- We continue to operate with an assumed fatality rate of 3% (see first exhibit). The actual number of deaths relative to cases is admittedly somewhat lower than this, but the illness has not fully run its course with many of the infirm and so the figure will likely rise toward our assumption. This is a very high death rate relative to the ordinary flu (<0.1%), but notably below that of SARS (10%). Promisingly for the rest of the world, the fatality rate has been lower outside of China. This could prove an enduring advantage if it is ultimately found to be a function of superior health standards and/or less strained health resources. But it could simply be a temporary advantage related to the delayed arrival of the virus on other shores.

- The truly concerning element of the virus remains its infection rate, which has been pegged in the vicinity of 2.5. This means that the average sick person can expect to infect 2.5 more people. It doesn’t take a rocket scientist to realize that any infection rate greater than one will expand the number of infirm indefinitely. While some calculations purport to claim that SARS had a similar initial infection rate, we find this hard to fathom to the extent that medical preparedness and Chinese hygiene standards have improved since SARS and yet the new virus has spread much more quickly. Furthermore, SARS was not contagious for 4—5 days even after symptoms had appeared; conversely, the new virus appears to transmit more easily, possibly even before symptoms develop.

- Fortunately, the infection rate of the Wuhan virus is almost certainly already declining given that the sick and healthy alike are now taking many more precautions. Whether the infection rate has fallen by the 60% necessary to take it below the magic number of one is still not yet clear.

- Medical advances mean that a vaccine could be developed in a matter of months and theoretically render irrelevant the rate of infection. However, the necessary testing and approval process would apparently make widespread use of a vaccine unlikely in under a year.

-

Wuhan virus assessment – very serious but likely temporary

Source: RBC Global Asset Management

- Some economic thoughts:

- We have downgraded our 2020 growth forecasts by 0.3% for China (down to 5.6% growth) and 0.2% for the rest of the world (to global growth of 3.1%). This has less to do with mortality rates and more to do with absenteeism, temporarily closed businesses, supply chain issues and confidence effects (see chart below).

- The hit to China is actually likely to be much bigger than the aforementioned annual figure suggests. We figure that first quarter Chinese GDP could well shrink by 8% annualized, temporarily taking the year-over-year rate of growth down to 3% from its usual 6%. However, much of this should ultimately prove temporary with the second quarter likely to record an unusually rapid rate of growth. Naturally, stylized assumptions are needed to reach any kind of conclusion, including that the Chinese economy loses 1/3 of its productivity capacity for three weeks and that half of the lost output is then reclaimed over the subsequent 10 weeks. Notably, past modern epidemics have been short-lived, lasting no more than a few months, with the economy usually no worse for wear within a few years.

-

Wuhan virus implications – extent still unclear, but we have incorporated fairly serious assumptions

2020 GDP assumptions:

- Assume 0.3% off Chinese GDP:

- 3 weeks of Chinese output at 2/3 of normal

- Followed by catch-up growth that recovers half of the lost output over 10 weeks

- Realistically, some offsetting fiscal and monetary stimulus

- Q1 GDP could be very ugly (-8% annualized? +3% YoY?)

- Assume 0.2% off Rest of World GDP:

- Some disease spillover, confidence and wealth effects, increased absenteeism, less Chinese demand, less Chinese supply

- Assume 0.3% off Chinese GDP:

-

Market thoughts:

- Stock market effects tend to be magnified – high beta + confidence

- Especially affected: Tourism, gambling, retail, airplanes, oil

- Source: RBC Global Asset Management

- Downside risk: Relative to the SARS episode, not only does the Wuhan coronavirus appear more serious but the Chinese economy is also much more globally consequential by virtue of its remarkable expansion over the intervening 17 years. Furthermore, China is richer than before, such that its citizens take four times more air and rail trips, potentially spreading the virus even further. To the extent that China’s economy has pivoted in a services direction in recent years, it is likely harder to make up for lost output once the epidemic has ended.

- Upside risk: Conversely (and optimistically), Chinese hygiene standards have arguably improved over the past 17 years. The quality of medical care and the state of global science certainly has. And a more service-oriented economy also means that Chinese weakness may impact the rest of the world less than a simplistic global GDP share would first suggest.

- Realism: To the extent that the Chinese economy has long been on a decelerating trajectory, policymakers could use this episode as an excuse to admit to significantly slower growth and they could set a moderately lower growth target at their annual meeting in early March.

- Market implications:

- Risk assets naturally remain concerned, with U.S. equities off a few percentage points from their mid-January highs. However, the response has remained fairly tame outside of China, which experienced a sharp 9% decline on February 3. It is entirely appropriate that the Chinese response be considerably larger than everywhere else to the extent that the problem remains primarily a Chinese domestic issue, though single-day declines of that magnitude are another matter.

- It is hard to draw precise conclusions for the purpose of comparison from SARs. The Chinese stock market fell sharply in late 2002, but this was before there was widespread knowledge of the new disease and as such should probably be attributed elsewhere. Chinese equities then suffered as much as an 18% peak-to-trough decline in the middle of 2003, but the bulk of the drop happened after SARS had already been halted and so again the blame should likely be placed elsewhere. In the end, Chinese equities were up a solid 11% across the infection year of 2003, suggesting no lasting damage.

- The U.S. S&P 500 fell by as much as 14% over the first half of 2003, but most of the decline happened in the context of unrelated growth concerns and before SARS had become a clear pandemic. From when the World Health Organization declared the alarm, the stock market fell by 7%, bottoming within a month of the initial declaration and then rebounding fairly briskly from there.

- Indeed, consistent with the economic analysis, the market decline associated with modern-day pandemics tends to be limited and fairly quickly unwound even before the disease itself has been fully tamed.

- Naturally, the price of oil has also suffered on expectations of weaker economic growth and the realization that transportation is likely to be impeded by worries about the disease. This should also prove a temporary condition. OPEC is rumoured to be considering a production quota cut as a means of making the episode even shorter.

- From a bond market perspective, the moderately diminished growth trajectory for 2020 could well prove sufficient to motivate a further round of monetary easing. This is particularly likely in such countries as Canada and the U.K., which failed to cut rates in 2019.

Business cycle scorecard:

- We have just gone through the quarterly refresh of our business cycle scorecard and related recession risk monitors.

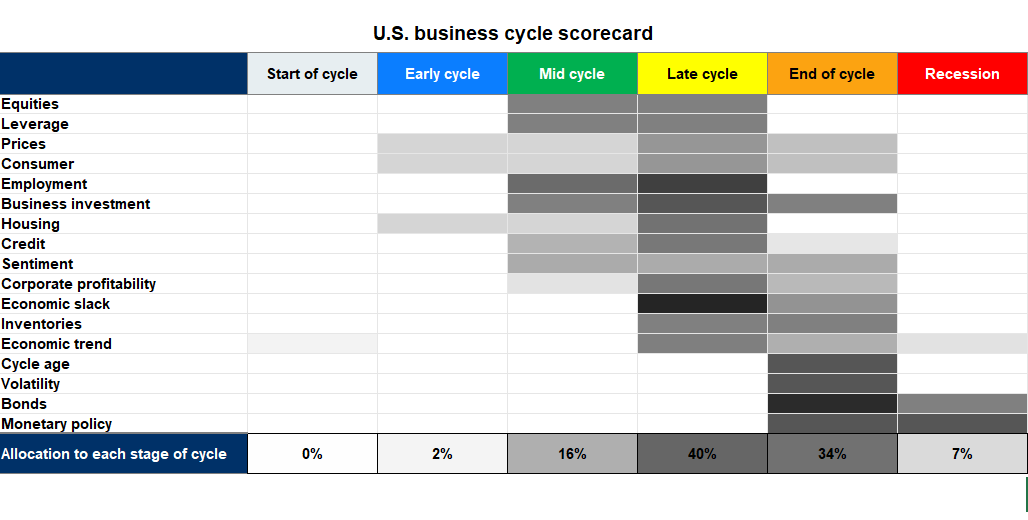

- The business cycle scorecard continues to point to a “late cycle” diagnosis (see chart below). The distribution of probabilities remains roughly unchanged relative to a quarter ago, with the “end of cycle” counterclaim continuing to enjoy significant support.

-

Business cycle: U.S. is still mostly “late cycle,” with significant “end of cycle” claims

As at 01/30/2020. Darkness of shading indicates the weight given to each input for each phase of the business cycle. Source: RBC GAM

- Relative to a quarter ago, negative developments include:

- the ongoing deterioration of the Duncan Leading Indicator

- the falling private investment share of GDP

- falling S&P 500 profit margins.

- Positive developments include stabilizing business sentiment (ISM) and the continued downward trend in the unemployment rate.

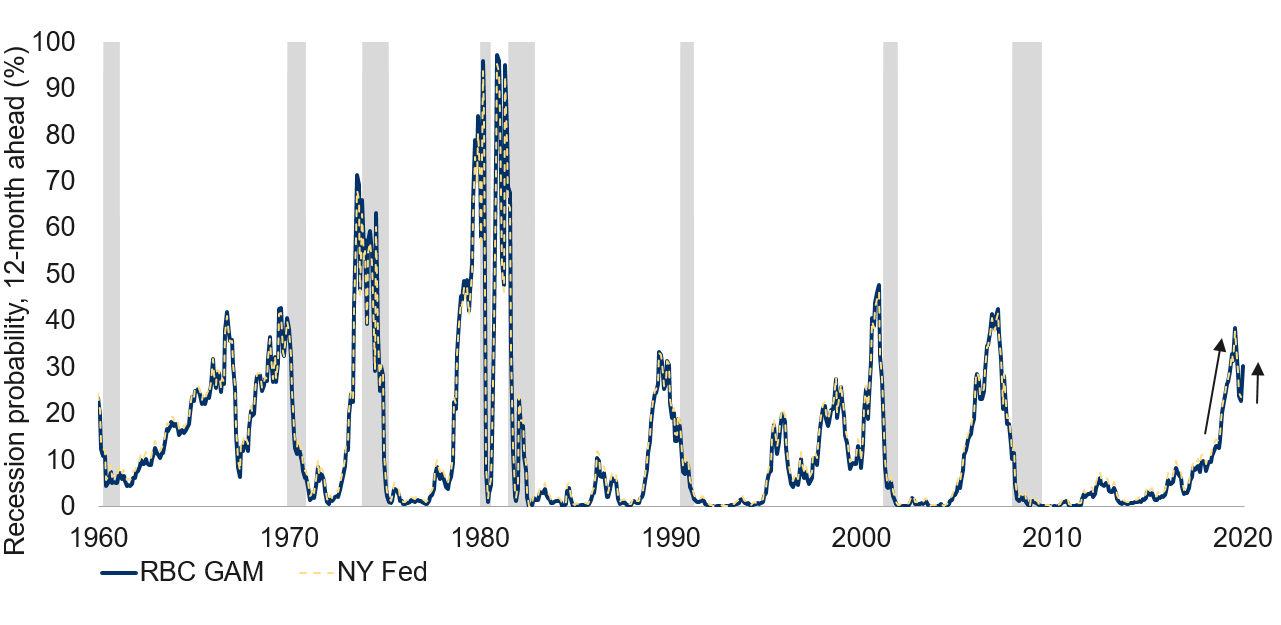

- The recession models we track indicate there is no recession in the U.S. right now. Furthermore, the year-ahead recession risk is lower than it was in the early fall of 2019. However, the year-ahead risk is nevertheless rising again as the yield curve re-flattens, from a low recession probability of 22% in September to 31% today as Wuhan virus concerns and worries about a far-left Democratic nominee mount.

-

Yield-curve based U.S. recession risk no longer falling amid Wuhan virus outbreak

As of Dec 0219 for NY Fed model, RBC GAM estimates as of 1/31/2020. Probabilities of a recession 12 months ahead estimated using the difference between 10-year and 3-month Treasury yields. Shaded area represents recession. Source: Federal Reserve Bank of New York, Haver Analytics, RBC GAM

- We should note that RBC GAM modestly reduced its risk-taking just over a week ago, taking one percentage point out of equities and placing it into cash. In so doing, this partially unwound the additional equities acquired in the fall of last year. The motivation for this adjustment was partially a function of cooling economic prospects (growth is now stabilizing as opposed to plausibly accelerating) and partially a desire to take profit on a successful trade

Quarterly growth profile:

- As we progress further into the New Year, it is worth dwelling on the potential pattern of growth from quarter to quarter across 2020.

- Initially it had appeared to be a fairly clean story in which the lagged effect of significant monetary stimulus would boost growth over the first half of the year and then fade over the second half. Further complexities have since arisen.

- The Wuhan virus should subtract palpably from Q1 global GDP growth, and massively from Chinese Q1 GDP growth. Then, Q2 could enjoy unusually fast growth as economies restart and some catch-up occurs.

- In response to the initial weakness and also the fact that growth is set to slow later in the year, there is now a higher chance that central banks and fiscal policy makers will opt to administer further stimulus by the middle of 2020, diminishing the extent of the second-half slowdown.

- As such, we now look for a particularly poor first quarter, a notable strong second quarter, followed by a return to more normal – though slightly decelerating – growth over the third and fourth quarter. The extent to which growth does or doesn’t slow over the final two quarters will be determined by how much help policymakers opt to provide in the interim. We remain of the view that there are good odds of further stimulus.

Bernie Sanders’ platform:

- In the context of the first U.S. Democratic Primary in Iowa this week and the position of prominence now commanded by far-left candidate Bernie Sanders, it is worth spending a moment on his platform and likelihood of victory.

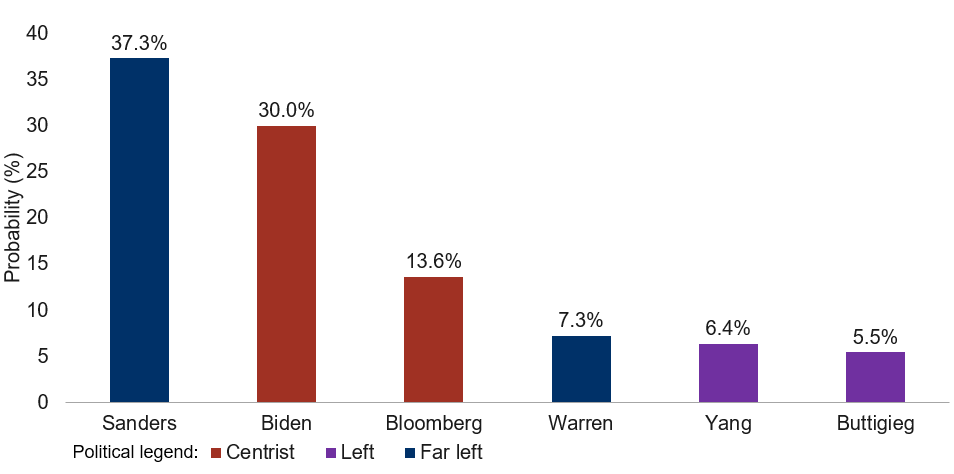

- Certainly, the main story from the Democratic race over the past month has been the ascent of Sanders from an also-ran to a favorite to capture not just the early primaries, but also the eventual nomination (see next chart). Although he is the most likely victor, the market nevertheless believes the field has a cumulatively higher probability of victory. Furthermore, markets tend to think that Trump is more likely than not to beat the Democratic nominee. As such, we might say that Sanders has no more than a 15% to 20% chance of being the next U.S. President. This is low, but not nil.

-

Who will win the Democratic presidential nomination?

As of 1/26/2020. Based on prediction markets data and RBC GAM calculations. Source: PredictIt, RBC GAM.

- Sanders is no stranger to the limelight, having placed second to Hillary Clinton in the 2016 Democratic nomination battle.

- For decades, Sanders has been a consistent voice for a more equal society delivered via big government. Whereas he once occupied the policy hinterland, he now commands a large number of loyal and disproportionately young supporters. Arguably, the very same populist inclinations that elevated Donald Trump to the White House are also a factor in Sanders’ increased prominence (although his policy solutions to address common concerns such as inequality would look very different than what Trump has done).

- A rough comparison of Sanders’ platform to the other Democratic front-runner – Joe Biden – and Trump can be found in the next graphic.

-

2020 Presidential front-runners: A highly consequential race

Bernie Sanders

Far left DemocratJoe Biden

Moderate DemocratDonald Trump

Populist right Republican- Big Government

- Fiscally expansive but big tax hikes

- $51T in additional spending over 10yrs

- Social program expansion including immigration reform, free health care, free college, worker protections, environmental measures

- Higher taxes on individuals (52%), corporations (35%), investment income, wealth tax, estate tax, limited depreciation, worldwide tax system

- Break up banks, big tech, anti-trust push

- Nationalize health care

- Limit fossil fuels

- Skeptical on free trade

- Mid-sized government

- Further to the left than Obama

- Partially reverse Trump tax cuts

- No tariffs/ less China focus

- Carbon tax

- $15 minimum wage

- Expand health coverage

- First two years of college free

- End oil & gas drilling on federal land

- Economy: ST negative, LT neutral

- Equities: Moderately negative

- Yields: ST slightly neg, LT neutral

- Mid-sized government

- Fundamentally an isolationist

- Build Mexico wall; otherwise, has mostly delivered on his agenda

- What does Trump do if unencumbered by re-election considerations?

- Economy: ST positive, LT neutral

- Equities: Moderately positive

- Yields: ST higher, LT neutral

- Economy: ST unclear, LT negative

- Equities Very negative

- Yields: ST lower, LT higher?

The next President will likely be impeded by a divided Congress

BUT

To what extent can executive orders sdie-step Congress?Source: RBC GAM.

- In a nutshell, Sanders is a big government politician who would attempt to implement fiscally expansive policies (paid in significant part, but not entirely, via higher taxes).

- He favours the expansion of a myriad of social programs, including immigration reform, free health care, free college, more worker protections and additional environmental measures.

- From an economic standpoint, he proposes a higher top federal tax rate (52%), a higher corporate income tax rate (35%), plus higher or new taxes on investment income, wealth and estates. He also advocates for more limited depreciation for corporations and a worldwide tax system as opposed to the current U.S.-centric approach.

- At the corporate level, he would break up the big banks and big technology firms, nationalize the delivery of healthcare and limit the production and use of fossil fuels.

- Setting aside the societal benefits of reducing inequality and enhancing the environment (considerable!), some of these policies might prove challenging through an economic lens over the long run to the extent they drive animal spirits out of the U.S. system. The stock market certainly isn’t a fan to the extent that many sectors of the stock market would be substantially impeded.

- It is harder to say how the economy would fare in the short run as business confidence would likely be seriously hurt but an expanding government would likely be delivering significant fiscal stimulus. It is also hard to interpret the bond market. Yields would likely fall in the short run on risk aversion, but could well end up higher over the long run as the country’s debt load soared.

- Realistically, most of the aforementioned policy ideas will not occur even in the event of a Sanders presidency given the checks and balances inherent in the U.S. political system and the strong likelihood that Congress remains divided post-election.

- That said, successive presidents have become increasingly adept at delivering their policy commitments through executive orders, as opposed to legislation. Executive orders provide the on-the-ground instructions as to how to interpret and enforce existing pieces of legislation. As an example, rather than passing a law to eliminate a certain rule, the President has the ability to assign fewer civil servants to enforce the rule, in turn rendering it irrelevant.

- Both Bernie Sanders and Elizabeth Warren have proven adept at articulating ways that they might, for instance, cancel student debt without having to pass legislation. They may well prove capable of delivering some change via executive order, but be aware:

- a) judicial challenges will surely arise that will at a minimum delay this effort and potentially undermine it; and

- b) the subsequent President could immediately reverse whatever executive orders they issue. As such, executive orders are a poor man’s form of legislation – less powerful and less permanent.

Middle East peace plan:

- Briefly, the U.S. has proposed a new peace deal between Israel and Palestine.

- However, the new deal seems exceedingly unlikely to be agreed upon by both parties to the extent it tilts the playing field in favour of Israel relative to the pre-existing Oslo Accords.

- Israel would gain the bulk of Jerusalem and also claim formal possession of its existing settlements on disputed territory.

- Reflecting the unlikeliness of a deal, Palestinian leaders did not participate in the unveiling of the proposal at the White House.

- Ultimately, then, the deal is likely a non-starter. Nevertheless, there is a useful observation to be made regarding Middle East matters: the Palestinians have lost a great deal of clout.

- Not only is the U.S. siding with Israel on these matters, but other Middle Eastern nations – while ultimately rejecting the U.S. proposal – have not done so as forcefully as one might have expected in decades past.

- What has changed? Two things.

- It is Iran that is now viewed as the existential threat for many Middle Eastern nations, not Israel. As such, many nations across the Middle East are now allied not just with the U.S. against Iran, but also implicitly with Israel on this important matter.

- The U.S. has become significantly less reliant on Middle Eastern oil over the past decade. In turn, it no longer needs to appease Middle Eastern nations to the extent it once did. As a result, the U.S. need not pay as much lip service to their long-standing cause of a Palestinian state.

- From a purely economic and market perspective, Iran will remain the Middle East focal point for the foreseeable future.