Last weekend, I was unexpectedly thrust into a game of Laser Quest at a pre-teen birthday party. It was amazing and a little frightening how quickly the thin veneer of civilization washed off me. Within minutes, I had abandoned my youngest child – he apparently survived by taking refuge with a similarly forlorn pack of younger siblings – and was blazing my way through a post-apocalyptic landscape. My (extremely ill-advised) dress shirt was soon drenched with perspiration as I racked up ever more “kills.” No mercy was shown for the birthday boy, nor for the two bewildered twin girls who found themselves annexed into this birthday battle. I may or may not have ambushed my own children.

Finally, I stumbled, blinking, out of the dark warehouse and into the daylight. It was at this moment that I discovered to my great horror that not only had I lost my humanity but I had won a prize -- which I accepted with considerable embarrassment in front of the many disgruntled children whom I had just felled. It was not my finest moment. I am in need of either a competitive outlet or psychological counselling.

Virus update:

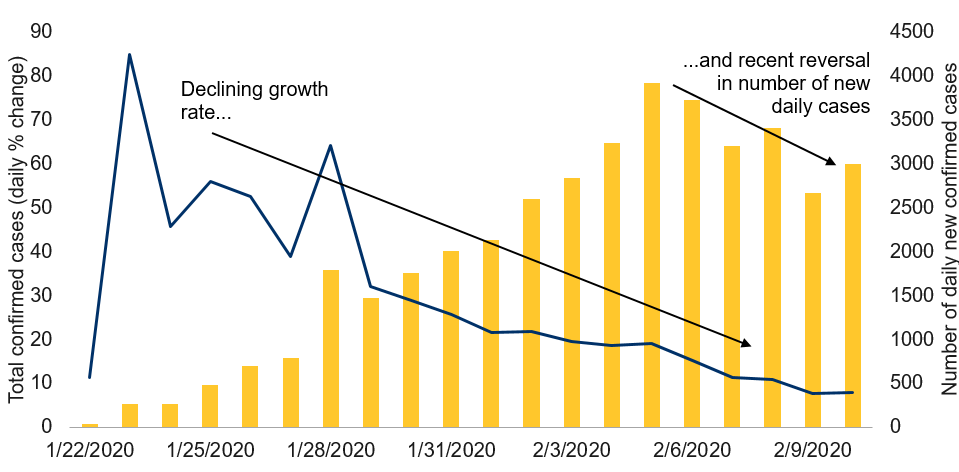

- The Wuhan coronavirus has now grown to encompass 40,574 cases. It has resulted in 910 deaths globally. The great bulk of these remain in China, and disproportionately within the city of Wuhan in the Hubei region.

- Nevertheless, there are positive developments. While the total number of infections continues to rise, the rate of transmission is now declining (see first chart). The daily infection growth rate has declined from a peak of 85% to just 8%. Beginning on February 6, the number of new cases per day finally started to decline as well. All of this strongly suggests that the transmission rate is now declining from the initial estimate of 2.5 new infections from each sick person. It is not yet clear whether it has fallen below the 1.0 threshold that delineates the point after which the disease can fully recede.

-

Spread of novel Coronavirus

Note: As of 2/10/2020. Confirmed cases. Source: WHO, RBC GAM

- We continue to assume a 3% fatality rate. The rate thus far is just 2.2%, but most people have only had the disease for less than a week and so it is premature to say what outcomes we’ll see. Notably, the number of new deaths per day continues to set records. As such, the disease is either becoming more dangerous over time or, more realistically, the fatality statistics are lagging the infection rate statistics and the number of new deaths per day should also peak in the coming week or so.

- Interestingly, the fatality rate is 4% for the epicenter of Wuhan, versus 2% elsewhere in China. Because the virus is radiating outward from Wuhan, it could yet mean that the true fatality rate will eventually be closer to 4% everywhere. Alternately, it could be that Wuhan’s health resources are sufficiently overloaded that the 4% death rate is an approximation for the disease’s danger when left untreated, whereas the 2% rate elsewhere – with what are presumably less stretched medical resources – represents the danger when cases receive proper medical attention. Either way, the fatality rate is well below that of SARS (10%), let alone MERS (34%).

- There are claims that China is not reporting the full extent of the outbreak. Undeniably, the actual number of cases is almost certainly higher than the official figures as there would be very few false positives, whereas many people may be fearful of visiting overburdened Wuhan hospitals and so opting to convalesce at home. But it seems less likely that the actual death rate is being seriously miscounted, and rumours of overburdened crematoriums are hard to fathom to the extent that a country of China’s size already has in the order of 50,000 deaths on a normal day. Even if the actual fatality rate were five times higher than the official 89 deaths over the past day, this would represent less than a 1% increase in China’s daily deaths. Even if these deaths were entirely within the Hubei region of roughly 60 million people, this would simply mean a 20% increase in the need for the services of local crematoriums. As such, anecdotes such as these may not be as useful as they first seem in determining the true extent of the illness.

- The coronavirus symptoms remain mild in 82% of cases, with older people and those with pre-existing conditions suffering the most. Conversely, very few children have been infected.

- With the situation in China seemingly on a path toward stabilization, the next big question is the extent to which the disease can be contained elsewhere in the world. Unlike within China, the rest of the world is continuing to suffer a record number of new cases each day. However, the absolute number is still 10-fold lower than in China, and the growth rate in percentage terms is just 7%. On the one hand, the advance warning provided by China, plus superior hygiene and health standards in the developed world, argue that the infection should indeed have more trouble spreading there. However, let us recall that the rest of the world also includes many poor and densely populated countries that would seem to be highly vulnerable. Furthermore, China is likely far better at ensuring its citizens remain inside and wear masks than are most other countries.

- While the story is far from complete, China’s economy may now be starting the long journey back to normal. After an extended Chinese New Year holiday, a large fraction of the economy was theoretically permitted to re-start on Monday February 10. That said, many businesses have individually opted to extend the holiday. Others are offering work-from-home solutions.

- Some cities are still permitting only one family member to leave the house every second day to forage for essentials. Certain regions are allowing locals to return to work, but still requiring others to continue their self-quarantine. To the extent a large fraction of the manufacturing base is composed of migrants, this precludes many businesses from operating anywhere close to their capacity. In the region of Hubei, the shutdown could last for several more weeks. Furthermore, supply chain connections are such that one offline factory can have a ripple effect. Nationally, most schools are closed for at least another week. Some are shuttered until March.

- From an economic standpoint, we maintain the same assumptions as were presented a week ago. At the highest level, we have subtracted 0.3ppt from China’s 2020 GDP growth rate, and 0.2ppt for the rest of the world. This may seem small, but the effect could – temporarily – be much larger within the first quarter of the year.

- From a political standpoint, some Chinese citizens have expressed considerable discontent at the Chinese response. Some of these criticisms are not entirely fair, as a country cannot build tens of thousands of new hospital beds overnight, nor can a cure be developed over such a short time period. That said, while it has been a superior government response relative to SARS, China has still been accused of initially dragging its heels in acknowledging the presence and extent of the new illness.

Food for thought on U.S. primaries:

- The U.S. Democratic Primary race is now officially underway, though it got off to a rather jerky start. Iowa struggled mightily to tabulate and publish the result of its caucuses due to some combination of faulty software, insufficient training and voting irregularities. Despite all of this, it is still shocking that the tally took the better part of a week to complete.

- The final results indicate that Buttigieg barely beat Sanders, by 26.2% of the vote to 26.1%. In turn, these shares mapped onto delegate counts of 14 and 12, respectively.

- The big winner was Buttigieg in that he not only won but outperformed expectations. Naturally, Sanders is also regarded as having fared well, while moderate Biden badly underperformed.

- The next primary will be on Tuesday February 11 in New Hampshire. Betting markets give a roughly 80% chance that Sanders wins this state, versus a roughly 20% chance for Buttigieg. But recall that Bernie Sanders is a Senator for neighbouring Vermont and also that he beat Hillary Clinton in New Hampshire four years ago. Thus, Sanders arguably needs a commanding victory to be able to claim that he is well on his way to the nomination.

- In contrast, Biden is accorded no better than a 1% chance of winning New Hampshire. That said, he is expected to do considerably better once the voting extends beyond the first two small, homogenous states.

- At this point in the primary battle, the question is always asked as to why we should care at all about the relatively trivial number of delegates elected by these two small states. Fascinatingly, the political analysts at fivethirtyeight.com have a tentative answer. They figure that the enormous profile given to the early primaries means that Iowa is worth about seven times more than it should be in terms of its influence on the final nationwide tally. New Hampshire gets upsized by a factor of six times. In turn, one can argue that the Iowa caucus was the second most important day of the primaries, just after the upcoming March 3 “Super Tuesday”, when a whopping 14 states including California, Texas and Massachusetts vote.

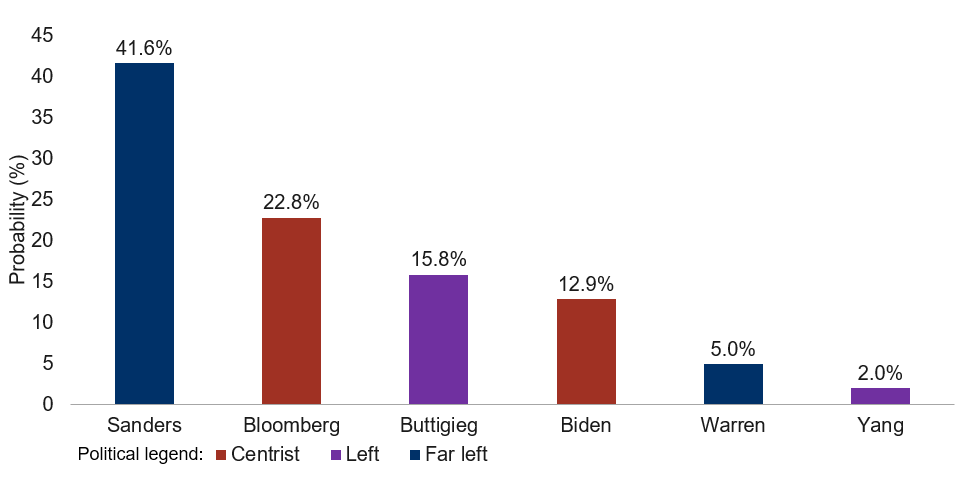

- Betting markets now argue that Sanders is the most likely to capture the overall Democratic nomination, with a 42% chance (see next chart). Fascinatingly, Bloomberg now ranks second (23%), in part because he is financially unconstrained due to his enormous wealth and in part because he stands to benefit as fellow centrist Biden falls by the wayside. Pete Buttigieg has benefited from his early strength, placing third with a 16% chance of capturing the Democratic nomination. He also benefits from Biden’s fade, but his challenge is that he has very little infrastructure or support beyond the first two states. Warhorse Biden sits at just a 13% chance.

-

Who will win the Democratic presidential nomination?

Note: As of 2/9/2020. Based on prediction markets data and RBC GAM calculations. Source: PredictIt, RBC GAM

- Given the large number of candidates in the race, it is possible that a brokered Democratic convention – one in which no candidate has more than 50% of the vote – will eventually be necessary. That would greatly ratchet up the uncertainty. It is, of course, greatly premature to render any verdict on this yet.

- While financial markets continue to fret about the possibility of a far-left candidate given the potential damage to certain sectors and the promise to raise taxes, this concern has been tempered by the fact that Congress is likely to remain divided after this election. Also, the U.S. has extensive checks and balances that prevent radical shifts in policy. The more Sanders surges in the polls, the more markets believe Trump will secure a second term.

- That said, it is interesting to muse about the possible long-term effects of a far-left President. While the short-term effect on markets (and perhaps growth) would be negative, it is conceivable that there could be certain long-term benefits. For instance, the U.S. corporate sector has become highly concentrated over time, impeding competition. Any effort to improve the competitive landscape via anti-trust action or otherwise could well unleash animal spirits over the long run. Similarly, a more comprehensive health care program – ideally unconnected to one’s employer – would theoretically increase labour force mobility and result in a better allocation of labour. Food for thought, in any event.

The challenges of U.S. student loans:

- U.S. student loan debt has been a topic of rising relevance over the past decade. Americans now owe a remarkable US$1.4 trillion in student loans, split across 45 million borrowers. The average student loan is $29K, and roughly two-thirds of recent university graduates incur student loan debt.

- The great bulk of these loans are issued by the federal government, though private lenders are also in the mix. The rate of interest on student loans is not cheap: the federal government charges 5.05% for undergraduates and 6.6% for graduate and professional students; private lenders charge in the range of 7.5% to 10%.

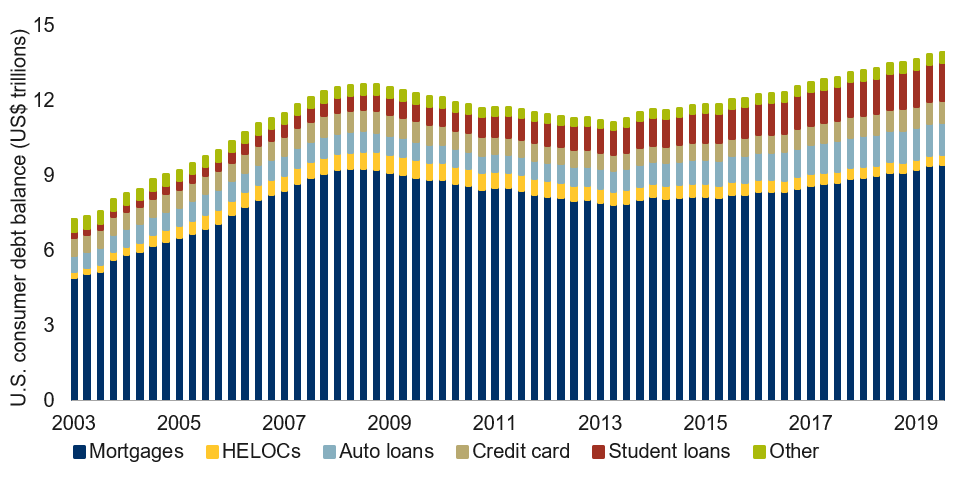

- The overall amount of student loan debt has now grown to the point that it is the second largest borrowing category, representing 11% of all household debt. In so doing, it is now larger than auto debt and credit card debt. Only mortgage debt remains (considerably) larger, representing 68% of the total (see next chart).

-

Total consumer debt balance and composition

Note: As of Q3 2019. Source: New York Fed Consumer Credit Panel/Equifax, RBC GAM

- Unlike other kinds of debt, declaring bankruptcy does not absolve one of responsibility for student loans. The reason for this is that students might otherwise opt to declare bankruptcy immediately upon graduation with little consequence. As a result, student loans can become a very heavy weight for people who fail to secure a well-paying job after university.

- Starkly, roughly a quarter of federal student loans are either delinquent or in default. The federal government must grapple with around $6B in additional defaulted student debt every single quarter. Moreover, whereas someone who defaults on their mortgage will eventually exit the default when they relinquish their home to the lender, there is no such escape from student loans. This helps to explain why the delinquency/default rate is so high.

- It should be noted that student loans are not all bad: from an economic standpoint, going to university provides an attractive return on investment. As such, it should be worth spending money on and even borrowing money to pursue. However, the math is starting to become less compelling. This is in large part because tuition costs have risen so much and possibly also as increased university attendance dilutes the signaling value of a university education. For the U.S., the median return on investment for a university education is now 4% to 6%. This is an acceptable return, but it is significantly undermined when financed by loans that charge a similar interest rate.

- Unsurprisingly, the default rate on student loans varies substantially depending on the institution. Those who obtain a four-year degree default less than those who obtain a two-year degree. Those who finish their program default less than those who don’t.

- There are arguably three reasons student loans have become such a burden:

- The cost of tuition has increased massively in recent decades, well beyond the growth in the value provided by a university education.

- The value of a university degree may have diminished somewhat. The human capital it provides is likely still on par with decades past. But the signaling value of having a university degree has diminished now that so many people possess the same credential.

- Uniquely among debt instruments, it is young people who take out the great bulk of student loans. A 17-year-old likely does not fully understand the implications of incurring a large amount of debt. They may not fully appreciate the obligations associated therein. And, they conceivably do not know the extent to which different fields of study and different calibres of educational institutions will affect their subsequent earnings.

- What are the implications of this great lump of student debt?

For individuals:

- The average student debt is not enormous relative to overall household debt. At the margin, the average household has 12% more debt than it otherwise would. Framed differently, the average $29K student loan diverts nearly $1,500 toward servicing debt each year. Whether the loan and the education it funded was a good investment or not, and/or whether it is the straw that breaks the camel’s back, depends entirely on the household in question. For most, it is not life altering. But for the roughly one-quarter who are delinquent or default on their student loan, it is clearly a problem.

- Whether a borrower defaults or not, it is certainly fair to argue that it is sub-optimal to start one’s adult life under the shadow of a substantial debt. This reduces the ability for people to take chances such as being an entrepreneur.

- To the extent a student loan lingers for many years, it may ultimately limit the ability of young households to save money, buy a home, have children and save for retirement. Indeed, as student loans have grown over the past few decades, Millennials now find themselves with 2.3 times less real estate wealth per capita than Generation X did at the same juncture.

From an economic standpoint:

- From a growth perspective, rising student loan debt is likely slowing the growth rate of consumer spending and home buying. It may slightly impede entrepreneurship and perhaps even modestly depress the fertility rate. All of these things impede economic growth, at the margin. Note that it is not possible to claim that the economy is being hurt by $1,500 per year per debtor because that money is paid to lenders who then repurpose the funds back into the economy.

From a government perspective:

- The good news from a financial stability perspective is that the bulk of the student loan debt is held by the federal government. It is unlikely that a financial crisis will occur despite the high default rate. Truly the only entity in the U.S. economy that could theoretically eat a $1.4T loss in an extreme scenario is the federal government.

- Nevertheless, the situation is not optimal at a time when the public debt is at a record high and soaring, with a deficit of nearly $1T per year.

- At the margin, financing student loans requires the federal government to borrow more money in public markets. This may be pushing the U.S. borrowing cost slightly higher. However, in practice, this sort of effect has proven hard to see over the past decade.

Remedies:

- Some Democratic Party candidates have proposed eliminating all federal student loan debt. That would certainly be one way to solve the problem, though it would of course hurt the federal government’s balance sheet. It would also be viewed as unfair to many, to the extent that others scrimped and saved to avoid taking on a student loan or to repay their student loan. And, it would be highly unequal to the extent that poorer workers without university degrees would receive nothing, while conceivably wealthier workers would receive a large financial transfer from the government.

- A scheme could be developed to provide the enhanced ability for those with truly great financial hardships to eliminate their student debt.

- Other countries around the world have experimented with different repayment schemes, ranging from delaying the accrual of interest for many years to aligning the amount people have to repay with the size of their subsequent income.

- In the U.S. context, greater efforts to tame very high tuition rates would probably be the most practical and universally beneficial step.

- The bottom line is that student loans are now a category of debt worth watching. They are growing substantially, have an enormous default rate, and already represent the second largest source of debt for American households. At the same time, it is not yet a matter large enough to induce a recession or create a financial crisis. Hopefully a policy solution will be found in the coming years.

-Eric Lascelles and Graeme Saunders

Outlook for Indian economy:

- India is a hugely important nation. It has the world’s second largest population (1.34B). It is among the most prominent emerging-market economies. It also now commands a 3.5% share of global economic output (China is at 17%) and is a long-standing democracy.

- Let us review several key themes and developments within the country.

Economy:

- The Indian economy has slowed sharply over the past year, managing just 4.6% year over year (YoY) growth through the third quarter of 2019. This is a far cry from the 8% rate managed in early 2018 and 9% in 2016. The unemployment rate is now 7.5%. That’s a poor figure by global standards, and reflects the country’s ravenous thirst for growth to keep pace with its demographic underpinnings.

- By some measures, the Indian economic deceleration was a bigger drag on global GDP growth over the past 18 months than was the simultaneous and much more widely discussed Chinese slowdown.

- Within Indian GDP, consumer spending growth has slowed notably, with a particularly sharp drop in demand for motor vehicles. In fairness, much of this is the result of tougher regulations and tight credit rather than discouraged consumers.

- Nevertheless, there are other areas of more legitimate economic weakness. Real capital expenditures have fallen by 1% YoY, versus a historical norm of +7% over the past decade.

- Fortunately, the government has provided fiscal and monetary support, discussed later.

- Furthermore, there is now some evidence that the economy is beginning to stabilize or even strengthen. India’s composite PMI has now increased from just 49.6 in October to 56.3 in January.

- We forecast 5.5% real GDP growth in 2020 and 5.9% in 2021. This points to an accelerating trend. However, it still leaves us somewhat below the consensus, so we are hardly economic optimists in an absolute sense.

Inflation:

- Indian inflation has been disappointing of late, having surged to 7.4% YoY in December. This is mostly a function of rising food prices (+12%), related at least in part to a bad harvest. In comparison, core inflation is a tamer 3.7% YoY. It is reasonable to expect inflation to begin trending back down in the near term.

- However, there is always a worry in countries like India – which has only over the past decade begun to tame its inflation excesses – that inflation expectations will de-anchor and leave the country stuck with higher inflation than it should.

Wuhan coronavirus:

- Given India’s large population, high density and low wealth, it is a country that might be particularly susceptible to the spread of the Wuhan coronavirus. So far, only a handful of cases have presented themselves, but this is a risk. Fortunately, India has been surprisingly resilient in the face of prior global health epidemics, and so it may possess some hidden resilience.

Financial sector:

- India’s financial sector has been weak for some time. A spate of bad loans are still being dealt with, and it is only gradually becoming easier to resolve such matters under Indian law.

- Bank credit to the business sector has slowed sharply.

- In an effort to help matters, the Indian central bank has cut rates repeatedly and the government has recently merged 10 state-owned banks.

- Fortunately, non-performing loans are now falling, but a feeble financial sector remains one of the main reasons for India’s recent economic underperformance.

Public policy:

- Prime Minister Modi is now in his second term and has lived up to expectations – he is indeed the economic reformer and political nationalist that was widely anticipated. Arguably, he hasn’t done enough of the former and has done too much of the latter.

- The country did recently deliver large corporate tax cuts and previously introduced a goods and services tax. Various sectors are gradually being opened to competition. The country also introduced identity cards and went through a banknote demonetization process designed to reduce the extent of the country’s underground economy.

- India’s latest bouts of nationalism are concerning from an economic and market perspective.

- The bottom line is that India is a country with challenges galore – a diminished rate of economic growth, troubled banks, and a limited fiscal capacity. However, it is also a country with massive opportunity – a giant population, a high theoretical potential rate of growth and important economic reforms. India will play an ever-larger role on the global stage in the future, and is now akin to the position China found itself in a few decades ago. Whether it can capitalize on this to the same extent as China did is as yet unclear.

Other items:

- U.S. president Trump was acquitted in his Senate impeachment hearing, as had been universally expected.

- Fed Chair Powell will begin his semi-annual testimony to Congress later this week, and is unlikely to reveal any great surprises.

- U.S. job numbers for January were fairly strong and the ISM (Institute for Supply Management) Manufacturing and Non-Manufacturing indicators were good. All of this argues that the U.S. economic stabilization story remains intact for the moment.

- The Canadian job numbers were also solid, with a strong rate of job creation and a good full-time composition, though the new hires entered the public sector as opposed to the private sector.