We recently caught up with Sarah Riopelle to talk about how she manages the key components within RBC Portfolio Solutions and leverages the expertise of our investment professionals around the world.

You have been at the helm of the RBC Portfolio Solutions for over a decade, managing them through two bear markets during that time. In your view, how important is an active approach to managing the asset mix in this current environment?

Diversification is at the core of our approach to portfolio construction and a key tenet of investing that I talk about often. Ultimately, the goal of diversification is to manage risks and provide a smoother investment experience by investing in a variety of asset classes and strategies. It is built on the idea that asset classes generate different performance outcomes at different times and positive returns from one asset class can be used to offset the returns from another when it is underperforming. To me, diversification is an investor’s most important investment strategy.

However, diversification is not about setting it and forgetting it. Daily market movements will cause the weights to move away from your desired targets, which is something we certainly saw this past year. So it’s important to actively manage the allocations. This is critical to ensuring that the portfolios are appropriately positioned and continue to meet your risk and return goals. We actively manage the portfolios on a daily basis to provide our clients with resilient portfolios that can deliver strong risk-adjusted returns over time.

Given the current environment of heightened uncertainty and more muted return expectations, have your views on the traditional asset mix of a portfolio changed?

It’s true that managing a multi-asset portfolio is much more complex today than it has been in the past. The challenge is not only working through all of the short-term market noise to determine what is important, but also to ensure that the portfolios are positioned to continue to deliver results in an environment of low interest rates and lower expected returns (from bonds in particular). However, we have been building and managing multi-asset portfolios for over 30 years so we have lots of experience. We spend a lot of our time thinking about how these portfolios need to evolve to best position them for the future.

Keeping portfolios current as market conditions change has been and will continue to be key. A variety of changes in the economy and capital markets indicate the need to pay close attention to the strategic asset mix right now. We have to rethink the traditional role of sovereign bonds in a multi-asset portfolio (to provide insurance, income and liquidity) as these investments may not behave as they have in the past given the low interest rate environment. This means considering new asset classes and strategies that mimic the prior benefits of holding sovereign bonds but that can contribute to portfolio returns close to those embedded in investor savings and investment programs. Some of the ways we are doing this is by adjusting our allocations to traditional asset classes, as well as including new asset classes and strategies that can bolster returns, can help to improve income generation, manage volatility and provide stability in the face of equity market volatility.

In early November, we added to our allocation in direct real estate by participating in Tranche II of the RBC Canadian Core Real Estate Fund. We also continue to leverage the global specialty fixed income expertise of BlueBay with the addition of the BlueBay Global Alternative Bond Fund, an absolute-return credit fund and our first allocation to liquid alternatives. These are both examples of how we are evolving our asset mix and diversifying our risk exposures.

Where does managing risk fit into your process and how important is it when managing multi-asset portfolios?

Managing the level of overall portfolio risk over time will yield a smoother return profile which is beneficial to investors. This applies to both our strategic and tactical asset allocation decisions. The key to risk budgeting for multi-asset portfolios is not only understanding the interaction (or correlation) between the asset classes, but also looking within asset classes, between strategies and underlying funds, and between managers.

We have conducted extensive research to determine how much of the risk budget should be allocated to tactical asset-allocation decisions. We concluded that our approach of making small, measured changes around the strategic weight is appropriate for achieving our alpha target (i.e. the additional investment return versus the benchmark) over the long term. Changes to the tactical asset mix that are too frequent or moving too far away from the strategic neutral positions can add significant risk and volatility without providing a commensurate increase in returns.

There are over 200 investment professionals involved with the management of a solution like RBC Select Portfolios on a daily basis. As the lead portfolio manager, how do you leverage the expertise of these teams across the portfolios?

Solutions like RBC Select Portfolios bring together the latest thinking and experience of many of RBC GAM’s investment leaders. An important aspect of managing our tactical asset mix is leveraging the knowledge and expertise of these investment professionals and incorporating their view on their markets and asset classes into the asset mix of our portfolio solutions.

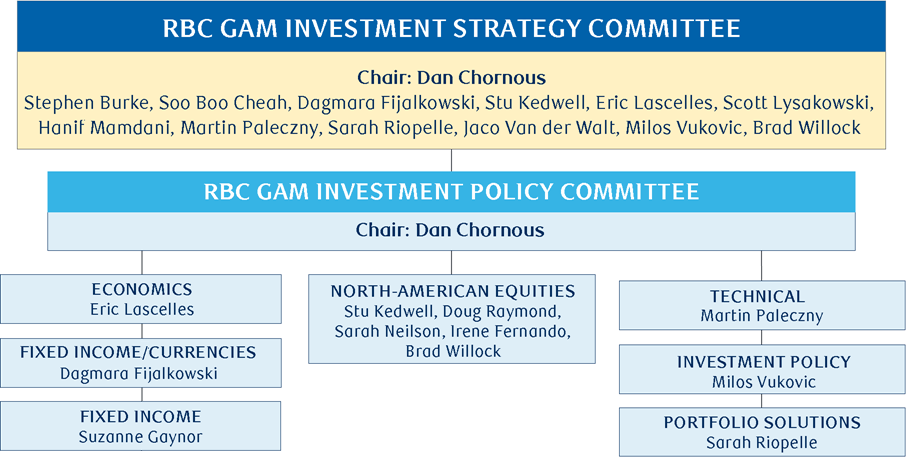

As a member of both the RBC GAM Investment Strategy Committee (RISC) and RBC GAM Investment Policy Committee (IPC), I have direct access to the expertise of senior investment professionals from across the firm. At RISC, we develop economic and market forecasts by assessing global fiscal and monetary conditions, projected economic growth and inflation, as well as the expected course of interest rates, currencies, corporate profits and stock valuations which are all important inputs in managing the asset mix. The views of RISC directly influence the decisions that IPC is making on the tactical asset mix positioning across all RBC Portfolio Solutions.

As lead manager of the RBC Portfolio Solutions, I also work closely with the portfolio managers of the underlying funds to ensure that all of the strategies are delivering the risk and return characteristics that we expect. In my view, each underlying fund has a role to play in the portfolios and, just as I diversify between asset classes, I also diversify across investment teams and managers, strategies and style within the various asset classes. This further maximizes the benefits of diversification and ultimately helps me to position the portfolios for success.

Discover more insights from Sarah Riopelle, Vice President and Senior Portfolio Manager.