I took a WestJet flight from Toronto to Victoria last week as part of a larger business trip. This usually induces mild anxiety on my part as I lack early-boarding privileges with the airline and so fret about finding a place to stow my carry-on luggage. Fortunately, I recently realized that if I book a seat at the back of the plane, WestJet’s algorithm invites me on sufficiently early to reliably snag some overhead space.

And so it was that I settled into my seat on this particular flight, resigned to a lengthy five-hour voyage in steerage with the delicate aromas of the rear bathroom occasionally wafting by. When what to my wondering eyes did appear but a tiny screen providing live play-by-play coverage of Canada’s election night!

I don’t watch much live television, but elections (and sports, if I’m being honest) are the prime exceptions. The timing couldn’t have been better as the election was a central discussion point for the remainder of my trip. In contrast, and to my great surprise, not one client asked a question that would have benefited from watching a superhero movie – the usual airplane entertainment offering. One supposes that the productivity-dampening effects of Kryptonite just aren’t top of mind.

Diminished downside risks:

- We start this #MacroMemo by digging in further detail into a subject touched upon last week: the notion that downside risks have shrunk importantly.

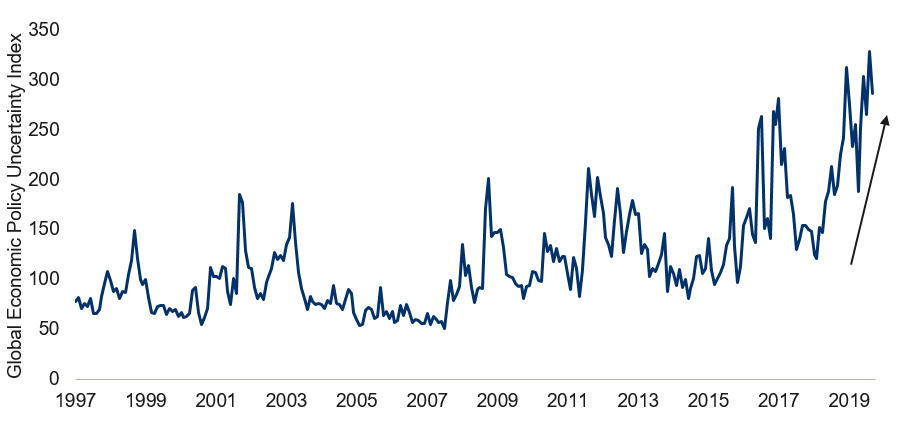

- The usual caveats apply: the level of global uncertainty is still extremely high (see first chart), downside risks continue to outweigh upside risks, and even though several risks have shrunk, they remain among the biggest and most serious in the world.

-

Global economic policy uncertainty quite high

As of Sept 2019. Mean of current price GDP-weighted index from 1997 to 2015 = 100. Source: www.policyuncertainty.com, Macrobond, RBC GAMntage of bonds in Bloomberg Barclays Global Aggregate Bond Index trading at negative yields. Source: Bloomberg, RBC GAM

- We flag four diminishing downside risks: Brexit, protectionism, the business cycle and Chinese growth.

- Brexit risk:

- The risk of a worst-case Brexit outcome – a No Deal Brexit – has diminished substantially since the start of September.

- First, a law obliging the prime minister to request an extension if a deal was not struck before the October 31 deadline made it difficult to go crashing out on that date.

- Next, Prime Minister Johnson struck a tentative deal with the EU, creating a plausible pathway toward a constructive resolution.

- Now, political pundits indicate that approval of the Johnson deal is likely once it has been properly vetted.

- Election complications may yet interfere with that process, but the point is that the risk of a No Deal Brexit is no longer in the realm of 40% to 60% as was once imagined.

- To be clear, Brexit uncertainty is still doing damage and the eventual Brexit choice will also likely impede growth to a certain extent, but it isn’t likely to be as bad as the carnage that would result from a No Deal outcome.

- Protectionism:

- S.-China trade relations improved several weeks ago with the outline of a trade deal between the U.S. and China.

- The U.S. has delayed levying its next round of tariffs, while China has promised to buy more U.S. agricultural products and to tweak its intellectual property practices.

- We note that no official deal has been signed and we are furthermore skeptical that the friction between the two countries is coming to an end given that Chinese structural economic advantages remain a sore point for the U.S. and much of the developed world. For that matter, the giant Chinese trade surplus that so offended President Trump is still largely intact.

- But the two countries have at a minimum managed to avoid further aggravating one another, and discussions are ongoing.

- Business cycle:

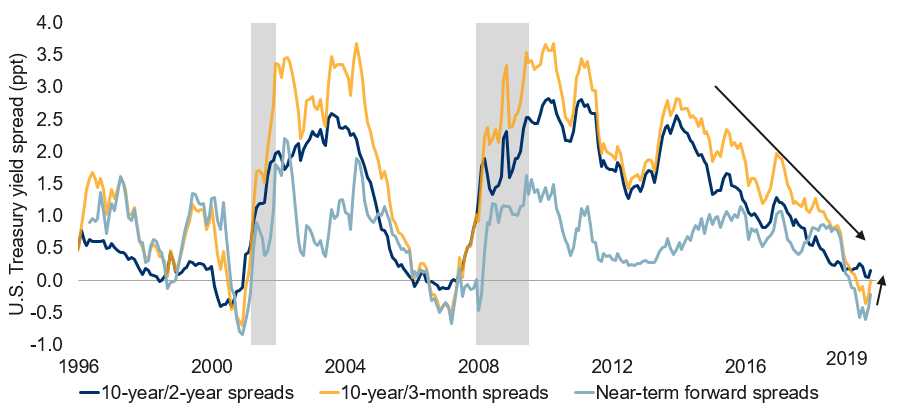

- The risk of recession has arguably diminished since the beginning of September as various measures of the U.S. yield curve have un-inverted or at least become less inverted (see next chart).

-

Recession risks moderated recently according to yield spreads

Note: As of 10/25/2019. Near-term forward spread measured as forward rate of 3-month Treasury yield. Shaded area represents recession. Source: Engstrom and Sharpe (2018). FEDS Notes. Washington: Board of Governors of the Federal Reserve System, Bloomberg, Haver Analytics, RBC GAM

- When we plug the 3m-10yr spread into the New York Fed’s recession model, it indicates that the U.S. recession risk over the coming year has fallen from a high of 43% to just 28%.

- To be clear, 28% is still an unusually high number. But it is materially less than 43%.

- As an economist, the decline in this probability heartens me. However, I am also aware that other measures that gauge the lateness of the business cycle – and thus implicitly the recession risk – are not so easily persuaded. For instance, much of what informs our “late cycle” assessment relates to the fact that the unemployment rate is already extremely low and has historically struggled to continue making headway from this point.

- Still, it is better for one out of the two classes of recession risks to improve rather than for both to remain in problematic territory. Our more holistic view is that the overall recession risk for the next year has fallen from perhaps 40% to 35%.

- Chinese stimulus:

- Lastly, and with the least conviction, we note that there is tentative evidence that Chinese stimulus efforts are beginning to show up in the economy, albeit only in small ways.

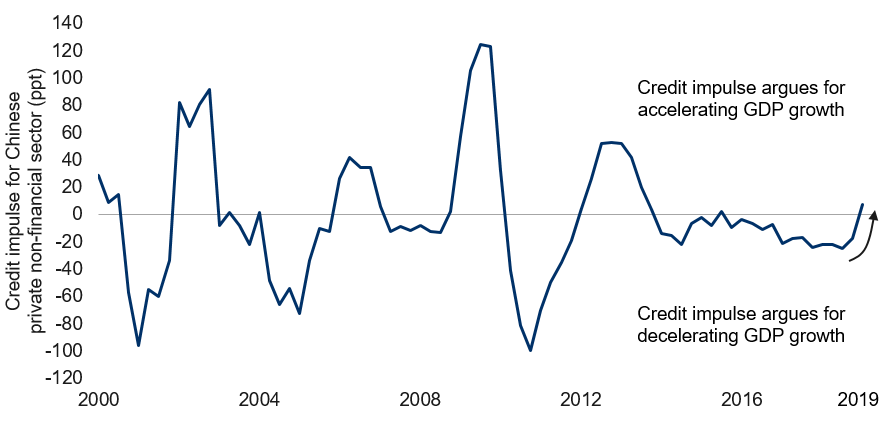

- Most measures of actual Chinese economic activity continue to slow (see our discussion of Chinese employment later). Yet we can see certain measures of credit growth (refer to next chart) and money-supply growth picking up.

-

Chinese credit impulse turned positive

Note: As of Q1 2019. Credit impulse measured as year-over-year change in year-over-year change in credit outstanding as percentage of GDP. Source: IIF, RBC GAM

- Historically, China has used its credit channel to great effect in nudging economic growth faster or slower.

- It would appear that Chinese stimulus is indeed encouraging more credit growth. The test now will be whether additional credit growth helps to stabilize China’s trend of downward GDP growth.

- We flag this as a greater upside risk than appreciated by the market, though not as a certainty.

In conclusion, it is heartening that these various macroeconomic risks have shrunk. This, in turn, suggests that downside investment risks have also declined somewhat.

Canadian election thoughts:

- RBC Global Asset Management’s Krystyne Manzer published a timely commentary on Canada’s election mere hours after the results were known.

- With the benefit of a week’s consideration, here are some additional thoughts on the subject.

- The Liberals lost their majority but managed to retain a plurality of the seats after Canada’s October 21 election. Their 157 seat count is substantially ahead of the Conservatives’ 121, though it was actually the Conservative Party that garnered more votes at the national level. The resurgent Bloc Quebecois came third with 32 seats, while the NDP slipped to fourth with 24 seats.

- Minority governments are not rare in Canada, representing the outcome of 43% of post-World War II elections. If this figure feels strangely high, recall that these minority governments last, on average only about half as long as a majority government, with the implication that Canada is governed for less than a quarter of the time by a minority government.

- Canada has had fairly recent experiences with minority governments, as evidenced by the Paul Martin Liberal government of 2004 to 2006, and two minority Conservative governments under Stephen Harper spanning 2006 to 2011.

- Minority governments in Canada tend not to form formal coalitions. Instead, they operate on an issue-by-issue basis, securing opposition party support where they can. As a result, Canadian minority governments generally get less done in terms of passing laws than do majority governments.

- Technically, the Liberals have three potential dance partners from whom to secure support to pass budgets and other pieces of legislation:

- The obvious partner is the left-leaning NDP, which aligns philosophically with the Liberals on many issues such as the environment and inequality. One could imagine the diminished seat count of the NDP in this election eventually prompting the party to push for another election to increase their representation. That date is unlikely to be soon, however. Moreover, the new government is arguably the ideal outcome for the NDP in that they were highly unlikely to form a government themselves, making a Liberal minority backed by the NDP the most powerful way to inject NDP policies into Canadian public policy.

- But do not completely rule out the other two parties in a similar position: the Bloc Quebecois and the Conservatives.

- The Liberals are likely to shy away from partnering with the separatist Bloc unless absolutely necessary, but one could imagine the Bloc being more than willing to support the Liberals on occasion given the unexpected windfall of seats the Bloc captured in the latest election and the party’s concern that another election might unwind some of those gains.

- Finally, the Conservatives are hardly natural bedfellows for the Liberals and could well spend much of their time trying to pull the government down. After all, the Conservatives won the popular vote and likely feel that another kick at the can could hardly hurt. But on certain issues – most obviously constructing an oil pipeline to the Pacific – the Conservatives and Liberals have aligned interests.

- As a general rule, minority governments tend to be fiscally expansive. After all, they must attempt to deliver the fiscal priorities of multiple parties. And to the extent compromise is needed, parties are usually more than happy to abandon such promises as tax hikes and spending cuts, sticking instead to more popular fare such as tax cuts and spending increases. Historically, Canadian markets have actually done reasonably well during minority governments, likely as a reflection of this fact.

- However, the prior Liberal government was already tilted further to the left than the historical norm and a coalition with the NDP suggests a further nudge in that direction. This brings with it many potential implications, including the possibility that productivity and competitiveness will continue to take a back seat to other issues. As such, whereas Canada’s economy could run a little bit hotter in the short run, it may then run cooler over the medium run.

- While it would be prudent for the government to run a fiscal surplus at this juncture given the lowest unemployment rate in four decades, this is unlikely to happen given the Liberal and NDP campaign platforms. As a result, should a recession strike, the deficit could grow quite large indeed. Fortunately, the cost of borrowing is stunningly low, and so Canada’s federal debt should remain manageable for the foreseeable future.

- The election revealed an even greater regional divide than normal. British Columbia provided a rare balance, electing a significant number of Conservatives, Liberals and NDP, and also accounted for two of the countries’ three Green seats and its only independent member. Alberta and Saskatchewan went almost entirely Conservative, with Manitoba also leaning in that direction. Conversely, the east coast remained mostly in Liberal hands, Quebec opted for a mix of Liberal and Bloc parliamentarians and Ontario ultimately broke the tie by going more than two-to-one (in terms of seats but not votes) for the Liberals over the Conservatives.

- The topic of western alienation is back on the agenda, and it won’t be helped by the fact that the Liberals will struggle to appoint any cabinet ministers from Alberta or Saskatchewan given that they were shut out of the provinces. It is possible they will break with convention and pick someone from the Senate.

- The environment is a central reason for the regional divide, with carbon taxes and pipeline plans proving highly divisive.

- On the subject of the country’s oil sector, the election is unquestionably a hit to the industry as a Liberal-NDP alliance will presumably continue forward with already-initiated carbon taxes and tougher infrastructure regulations. That said, unless the NDP opts to make blocking the Trans Mountain pipeline a do-or-die issue contingent on its support for any Liberal policy, the remaining hurdles are primarily judicial rather than legislative, and for that matter it is possible that the Conservatives could support the Liberals on any votes specifically relating to the pipeline.

- The telecom sector is also nervous about the new government given campaign promises to cut phone bills.

- At this juncture, we assume Canada’s capital gains inclusion rate remains unchanged at 50%. Tongues have wagged on the subject before, particularly in the lead-up to the Liberals’ first budget of the prior term, but no action was taken. The NDP did campaign on a higher capital gains tax. Yet to the extent that only a fraction of its policy goals are likely to be delivered, it seems more likely that the NDP pushes for environmental and social programs rather than higher taxes.

- Liberal promises of another middle class tax cut, the beginnings of a national pharmacare program, more generous pensions and more childcare funding seem likely to be delivered with NDP support.

- From a market perspective, this political outcome is imperfect in the sense that financial markets usually prefer centre to centre-right governments with small-government and business-friendly priorities. This outcome thus represents a moderate step further away from that optimum. Canada’s stock market has accordingly lagged the U.S. by about a percentage point in the week since the election result.

Fed preview:

- The upcoming Fed meeting on October 30 is a “minor” meeting in that there will be no new forecasts or dot plots provided. As such, no radical surprise is likely.

- From an economic standpoint, relevant changes over the past six months include a reduction in the depth of downside risks (good) pitted against a further weakening of economic conditions (bad). Inflation remains slightly below target (1.8% YoY for the core PCE deflator).

- Crucially, the market has priced in 91% of a 25bps rate cut from 1.875% to 1.625%. The Fed has not gone against a market probability that high in many years. Interestingly, “only” 80% of economists predict a further cut, but this still means it is quite likely.

- The Fed will likely seek to limit market expectations for further easing, as these three rate cuts are being viewed as a risk-management exercise rather than in response to devastating developments. The Fed has described them as being part of a mid-cycle adjustment rather than a lengthier easing effort.

- The Fed won’t have to work too hard to convince the market – a further rate cut isn’t more than 50% priced in until April 29, 2020. A moderate pause is thus expected after October as the Fed pivots into data-dependent mode.

- We highlight the chance that the Fed could ultimately deliver more easing. It isn’t so much that substantially more easing is needed so long as the economy avoids recession. Rather it’s that, to the extent the Fed would likely cut rates to the bone in the event of a recession – and the risk of a recession over the next year is in the realm of 35% to our eyes – the market should probably be pricing in something like three rate cuts to acknowledge this scenario.

- Lastly, and as detailed in last week’s #MacroMemo, we view the Fed’s $60 billion per month of money market operations as a form of quantitative easing (QE). The Fed doesn’t. These actions don’t guarantee further QE, but they arguably lower the barrier slightly.

Bank of Canada preview:

- In an unusual turn of events, the Bank of Canada’s policy decision will happen on the same day as the U.S. Canada’s decision is in the morning; the U.S. is in the afternoon.

- The Bank of Canada has been unusually quiet about its intentions over the past six weeks, mainly because it usually goes silent during election campaigns. That adds perhaps a tinge of uncertainty to the proceedings, but in reality the outcome is almost certainly an unchanged policy rate of 1.75%.

- While global growth is slowing and the Canadian dollar has strengthened, domestic conditions remain sufficiently robust to preclude a rate cut.

- Canadian core inflation is running slightly above target, the country’s unemployment rate is at a multi-decade low, the last two monthly job reports have been (weirdly!) strong, and the country’s housing market has now bottomed. The Bank of Canada’s own Business Outlook Survey indicates business expectations are moderate about the future.

- With an economy that continues to chug along and the central bank focused primarily on the base-case outlook as opposed to the downside risks that so occupy the Fed’s mind, now is not the time for a Bank of Canada rate cut. The market entirely agrees, with an unchanged policy rate 99% priced in.

- That said, we still think the Bank of Canada could eventually find its way into policy easing over the coming six months. After all, the global economy is slowing and Canada is a small, open economy highly vulnerable to such machinations. Meanwhile, the world’s major central banks have all been virtually unanimous in opting to cut rates. It would be odd if Canada was able to sit out an entire easing cycle, particular given that we believe any North American recession would impact Canada more than the U.S. due to the former’s housing and household debt vulnerabilities.

- Looking out over the next year, the market only prices in a one third chance of a rate cut for Canada. We flag the risk that this eventually rises.

Brexit update:

- A few weeks ago, Boris Johnson managed to strike a tentative deal with the EU to resolve a lingering disagreement about how to handle the Northern Irish border in the U.K.’s transition deal to exit the EU. The ultimate agreement was fairly similar to what Theresa May had previously negotiated, but – importantly – enjoyed the new prime minister’s stamp of approval.

- Several efforts to push the new Brexit deal through parliament failed over the past two weeks, not so much because parliamentarians were opposed as because they wished more time to evaluate its details before assenting.

- Now, the EU has granted an extension from October 31 to January 31, 2020, meaning that Brexit is no longer up against the wall.

- There is actually a fairly good chance that the Johnson deal – representing something of a middle road for Brexit (not the most damaging economic outcome, nor the least) – eventually goes through. Given that the risk of a No Deal Brexit was extremely high as recently as a month ago, this would be a positive outcome.

- However, the Conservatives have now pivoted abruptly, demanding an election on December 12 as

- a) a means of gauging public support for their Brexit proposal;

- b) to express their dissatisfaction that parliament prevented Brexit from being resolved once and for all on October 31 as per repeated Conservative Party promises; and

- c) to take advantage of strong Conservative Party polling.

- But the U.K. fixed election rules dictate that two-thirds of parliamentarians must agree to any request to deviate from the usual election schedule. This is a high hurdle to clear, and not one that the Conservatives can achieve on their own, particularly given the exodus of parliamentarians from the party in recent months. The Liberal Democrats are supportive, but Labour was initially reluctant.

- In an effort to convince parliament to support an election, the Conservatives temporarily withheld voting on the Brexit bill and threatened to effectively shut down parliament until an election is called. Furthermore, they began to pursue an interesting parliamentary gambit by proposing a bill that would annul the Fixed-Term Parliaments Act. This would only require a simple majority to implement, and then a simple majority could in turn trigger an election.

- The Conservatives hope to strengthen their hand in parliament given polling that has risen from just 25% fewer than four months ago to 36% today, eating into both Labour and Brexit Party support. Betting markets now assign a nearly 50% likelihood to a Conservative majority.

- Perhaps not surprisingly given the recent pivot in the polls, whereas Labour leader Corbyn had called for an election at least 35 times since 2017, he has recently appeared less enthusiastic. Nevertheless, recognizing that an election would be difficult to halt and also that his own criteria has been met (the risk of a No Deal exit is not imminent), Corbyn and the Labour Party have now agreed to support an election call.

- Amid all of this, the most important points are that the Brexit deadline is no longer October 31 and the risk of a No Deal Brexit has declined nicely over the past month. The rest will be informed in significant part by who wins the December election, with a pivot toward Labour or even a minority government requiring the support of the Liberal Democrats rather than the Northern Irish DUP, potentially resulting in a radical re-think of the Brexit path forward.

China employment index:

- We have created a Chinese Employment Index that allows us to better track developments in China’s labour market.

- This is an important measure for several reasons:

- China is massively important on the global stage, generating a third of world growth.

- Chinese policymakers pay particularly close heed to labour market metrics like job creation and unemployment as these measures are believed to closely correlate with support for the government.

- Chinese labour market indicators are notoriously difficult to interpret, with two different indicators providing contradictory unemployment rate claims. Also, some measures are suspiciously stable, and several measures have too little history to afford proper analysis by themselves.

- More generally, it can be hard to properly interpret emerging market labour markets as they often have sizeable informal economies.

- This new measure combines all of the relevant labour market inputs into a single metric. It doesn’t solve all of the aforementioned problems, but it comes close.

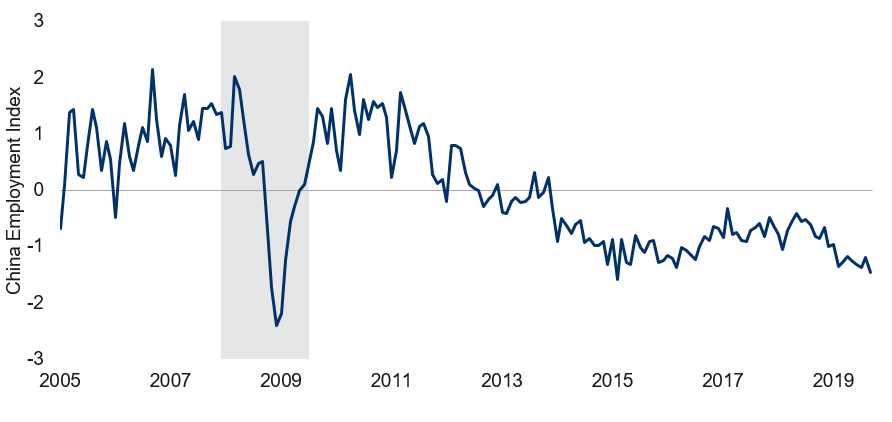

- The index reveal a few interesting things (see next chart):

- The metric is at its weakest level since 2015, and it is notable that 2015 was in turn the weakest point since the global financial crisis. To be fair, Chinese demographics are deteriorating, the ready supply of rural people capable of moving to cities to work is shrinking, and the overall rate of Chinese economic growth is in gradual decline.

- The rate of decline is steady and fairly gradual, arguing that the Chinese economy is hardly in a state of collapse.

- The index does not yet reveal any stabilization or rebound, despite better credit and money supply numbers. This requires further watching.

China Employment Index

Note: As of Sep 2019. Composite index based on employment indices of Manufacturing PMI and Non-manufacturing PMI, unemployment rate and year-over-year job creation. Shaded area represents recession. Source: China Federation of Logistics & Purchasing, Macrobond, RBC GAM

-with contribution from Jack LiuOther data:

- U.S. payrolls for October are expected to come in at just 85K net new workers – a weak reading. However, note that the outcome has been distorted by the GM strike, which temporarily reduced employment levels by around 45K. The strike has since ended, arguing that the subsequent month’s (November) reading should be artificially strong. Census distortions will also make the public sector fraction of the series less reliable than usual. The big question is thus whether private ex-GM hiring continues on its downward trend or not. We suspect there will be some further deceleration, though private ex-GM hiring should remain above the critical 100K mark that determines whether there are enough jobs to absorb new labour market entrants.

- The market expects the U.S. ISM (Institute for Supply Management) Manufacturing Index to rise from 47.8 to 49.0. Recall that an unexpected drop last month sent markets into a tizzy. So long as the reading remains below 50, the manufacturing sector remains on watch.