Global Investment Outlook:

- Our quarterly Global Investment Outlook is now available, including a lead article entitled “ Green Shoots Pruned by Protectionism.”

Fed preview:

- The U.S. Federal Reserve delivers its next interest rate decision this Wednesday June 19. Whereas the narrative last year was one of rate increases, talk has now turned to cuts.

- Financial markets presently price in approximately 20% chance of a rate cut for this week, approximately 80% chance of a cut by the Fed’s July meeting, and nearly three 25bps rate cuts by the end of the year.

- The Fed is certainly behaving in a more dovish fashion, with Fed Chair Powell recently promising to “act as appropriate to sustain the expansion.” This is about as clear as it gets in the Delphic language of central bankers that monetary easing is at least a possibility. Similar language will presumably be inserted into the upcoming statement.

- However, our bias is that the market may be pricing in too much rate-cutting.

- The Fed’s formal mandate requires it to target a mix of inflation and employment. Yet the inflation rate is only a hair below target, while unemployment of just 3.6% is almost certainly beyond any reasonable definition of “full employment.” While U.S. growth has decelerated and many dwell upon the latest payroll print of just +75K and an ISM (Institute for Supply Management) manufacturing index that has continued to fall, it is no less relevant to observe that:

- consumer spending growth has strengthened

- the ISM non-manufacturing index has been rising

- the qualitative Beige Book argues growth is quietly accelerating rather than slowing

- Q2 GDP is now on track for 2.1% growth, well above initial estimates.

- This is not to say that rate cuts are impossible. But they fall short of an 80% prospect by July or three cuts by the end of the year. To necessitate that amount of stimulus, the economy would have to deteriorate significantly further – perhaps due to a further deterioration in U.S.-China trade relations or the rapid conclusion of the business cycle.

- For context (or, possibly, evidence of a profession-wide blindness), a recent survey of professional economic forecasters found that only 40% predict a rate cut by the July meeting.

- To a significant extent, financial markets are trying to push the Fed into a rate cut. This is what makes the coming decision so sensitive. The tail should not be wagging the dog. Unless the Fed is fully committed to a rate decrease in July, it needs to try and pull back on market expectation at this meeting so as to avoid a massive disappointment for the market in July should no cut prove appropriate. The Fed would likely be more comfortable with the market pricing 40% to 60% chance of a cut for July, rather than the 80% currently priced. This will be a tricky thing to achieve, as the Fed must simultaneously acknowledge a worse trade environment.

- The market’s mania for rate cuts is disconcerting in three senses:

- It is a truly bizarre world when the substantial employment miss on June 7 was viewed as an excuse for the S&P 500 to rally because the disappointing data release meant the Fed was more likely to cut rates. The entire reason markets care about central banks is that they can help to deliver solid economic growth. So why celebrate a weak data point?

- Rate cuts are not especially powerful. Loosely speaking, every rate cut should deliver an extra 0.125% of economic growth. This is hardly game changing.

- We worry that a first rate cut – even an “insurance cut” – could ultimately be interpreted negatively by risk assets. Rate cuts are usually associated with a business cycle staggering to a close and macroeconomic trouble ahead.

- This particular Federal Open Market Committee (FOMC) meeting will be accompanied not merely by a press conference. It will also be accompanied by an update to the Fed’s dot plots – its members’ projections for the policy rate in the years to come. Whereas the last set of dot plots pointed to one further rate increase in 2020, the next iteration will presumably erase that. However, we do not expect the median forecast to anticipate a rate cut. Instead, there will likely be an unusual range of forecasts, with some participants anticipating further rate increases, and others forecasting cuts.

Trade tidbits:

- We share a few trade tidbits here:

- Pay attention to the upcoming G20 meetings on June 28—29 in Japan:

- This is when a theoretical U.S.-China trade deal could come together. It is also when President Trump has threatened to levy a further tariff on the remaining $300B of Chinese imports, should a deal not prove forthcoming.

- At present, we imagine a middle road.

- A comprehensive deal seems unlikely given the gaping divide between the two camps. This will take time, if it is to be achieved at all.

- Equally, it isn’t obvious that the U.S. will follow through on its threat to deliver a further tariff hike in the near term. The damage from the prior increase in May is only now starting to be felt, and that likely still exerts enough pressure on China to continue serious negotiations.

- More likely is that existing tariffs will stick, the two countries will announce that they are continuing negotiations, and any deal or further tariff hike will be deferred into the future.

- Recognize that most of the protectionist action continues to happen at the corporate level:

- The U.S. has hammered Chinese tech giant Huawei, and before it, ZTE. China has pinched Qualcomm, Micron and Apple.

- Now, China is cobbling together a so-called unreliable entities list – a blacklist of sorts of U.S. and international companies that cannot be counted upon to provide their wares to China. Presumably, this will include the many U.S. companies currently being instructed not to sell their technology to Huawei.

- It remains something of a dark art to try and map these corporate impingements onto economic damage. To be frank, no one really knows whether the cumulative effect of these firm-level actions is but a sliver of the damage done by tariffs, or several times larger.

- Consider to what extent will multi-nationals move their production out of China now that U.S. trade has been impeded?

- Before the trade dispute began, companies were mostly content with their Chinese sourcing, with 88% planning to continue sourcing from China – substantially in excess of any other country.

- However, it is not impossible that companies will change their sourcing. The average supplier turnover is 27% per year, meaning that more than a quarter of production jumps from one factory to another in the average year. The figure is even higher among large companies. Of course, it is presumably much easier to shift the manufacturing of commoditized items like textiles than auto assembly or highly specialized electronics.

- Now that a tangle of tariffs has been erected, companies are thinking seriously about shifting their sourcing. A significant 35% of producers indicate they will adapt and simply have their Chinese factories focus more on making products for China’s enormous domestic market should foreign markets prove difficult to access. More pointedly, 40% say they are considering or have already relocated production outside of China, with South-East Asia and Mexico as popular alternatives.

- However, let us not expect a wholesale exodus from China: Most other nations are too small to seriously supplant China; China still possesses an attractive domestic market; and China long ago lost its pure cost competitiveness, instead enjoying advantages related to multinationals’ pre-existing factories in the area, familiarity with the country’s rules, good infrastructure and decent governance.

- What about moving production back to the U.S.? After all, the U.S. labour cost disadvantage has significantly shrunk versus China, and the U.S. enjoys low energy costs, low tax rates and has recently engaged in a deregulation push. There are slivers of this happening, including a new Foxconn headquarters and plant in the U.S. Similarly, automation further increases the allure of factories close to the markets they serve. However, in the same survey that found 35% of producers planning to diversify outside of China, a mere 6% indicated they have moved or are considering moving their factories to the U.S.

Canada-US relative vulnerability:

- For a number of years we have made the offhand comment that whenever the next North American recession comes along, Canada is likely to suffer a slightly rougher ride than the U.S.

- This claim is worth expanding for four reasons:

- The most important determinant of Canadian GDP is U.S. GDP. U.S. shocks often impact Canada at nearly a 1:1 rate. Thus, any global or U.S. recession would likely exert a similar drag on Canada, all else equal.

- Canada starts from a weaker position than the U.S., limited as it has been by domestic challenges, including:

- a hobbled energy sector

- a cooler housing market, and

- a handful of competitiveness challenges.

- Commodity prices usually fall during recessions, and this hits resource-rich Canada harder than the U.S.

- The main reason:

- a. The U.S. suffered a deeper recession the last time around in 2008—2009, largely because its housing excesses were unwound at that time. Canada did not go through the same reckoning. To the contrary, Canada’s housing boom continued for another decade, due in significant part to the ultra-low rates brought about by the financial crisis itself.

- b. We estimate that nearly 22% of Canadian GDP is now linked to housing-related activities, several percentage points higher than normal (19%). This is one way of roughly estimating the additional downside GDP that Canada could experience, should the housing market opt to normalize in a weaker economic environment. In contrast, the U.S. housing market is currently a smaller share than normal of its economy.

- c. The Canadian economy has started to give back a modicum of its housing excesses. The aforementioned housing share of GDP is already a percentage point off its high. Were Canadian home prices, resale activity and housing starts to all decline simultaneously and significantly – as they sometimes do during recessions – that would weigh heavily on the Canadian economy in a way the U.S. would not experience.

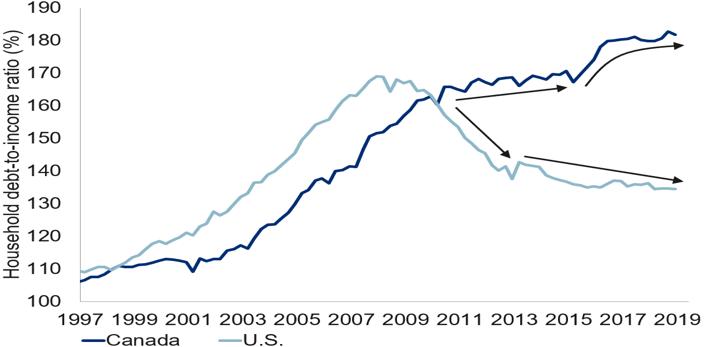

- d. Reflecting Canada’s greater vulnerability, the Canadian household debt-to-income ratio is now much higher than the U.S. (see next chart).

-

Household leverage rising in Canada, declining in U.S.

Note: As of Q4 2018. Source: Haver Analytics, RBC GAM

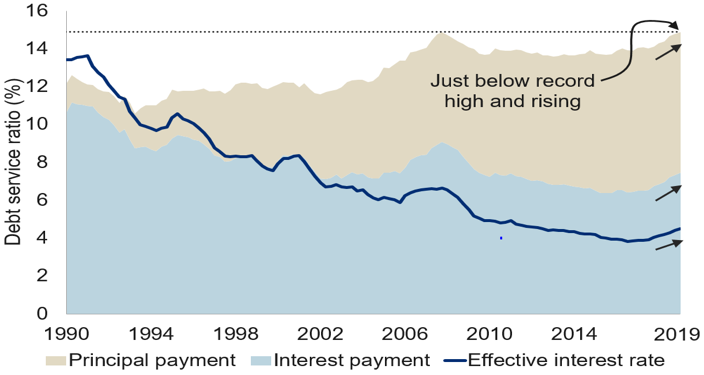

- Unsurprisingly, Canada’s household debt servicing costs are also higher than normal, and rising (see next chart).

-

Canadian household debt service burden rising

Note: As of Q1 2019. Debt-service ratio defined as cost of interest payments on debt only. Average effective interest rate since 1995. Source: Statistics Canada, Macrobond, RBC GAM

- Fortunately, interest rates are unlikely to rise much from here – one way in which housing problems can arise. Unfortunately, a recession would bring with it a higher unemployment rate – the other way from whence housing problems originate. Unemployed people often struggle to service their debts. The specter of falling home prices might simultaneously limit their ability to sell their home without incurring a loss.

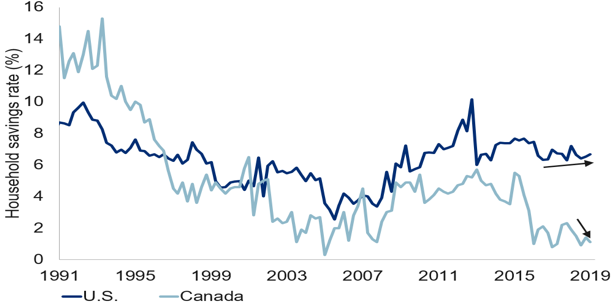

- Canadian households are more financially limited than U.S. households, with notably lower confidence levels. Also contrast a sharply lower household savings rate of just 1.1% in Canada versus 6.7% in the U.S. (see next chart). This means Canadians have a much smaller financial buffer in two ways: they would more quickly slip into dissaving in a recession, and they also haven’t been saving as much to protect themselves from a fallow period.

-

Canadian households have been saving less

Note: As of Q1 2019. Source: Macrobond, RBC GAM

- To be fair, it is not that Canada’s housing market is in crisis, nor that the housing market is likely to induce a recession all by itself.

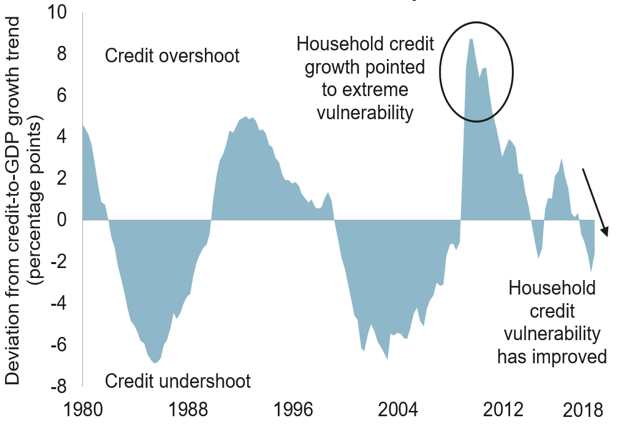

- The pool of especially vulnerable household debtors – those who most recently purchased a home – is unusually small because household credit growth has lately been fairly tame compared to the historical norm. This group is the most susceptible to an economic downturn because they have less equity in their home and often have less tenure and seniority in their employment. As a result, no large-scale disaster is likely, as per a tame-looking credit gap chart below.

-

Household credit vulnerability has ebbed

Note: As of Q4 2018. Trend calculated using HP filter on quarterly data with lambda of 500,000. Source: Haver Analytics, BIS, Bank of Canada, RBC GAM

- Our Canadian Consumer Financial Stress Index is rising, but off a fairly tame base (see chart below). It will be some time before trouble ensues here without a recession to tip the balance.

-

Financial stress for Canadians edging above normal

Note: As of Apr 2019. The Canadian Consumer Financial Stress Index is a composite of four indicators, based on latest data available: % of mortgages in arrears, credit card delinquency rate, consumer insolvency rate, and household debt service ratio. Shaded area represents recession. Source: Canadian Bankers Association, Industry Canada, Statistics Canada, Macrobond, C.D. Howe Institute, RBC GAM

- More generally, residential construction levels are not unreasonable given Canada’s rate of population growth. Some high-frequency housing metrics have even stabilized recently after a swoon over the past year.

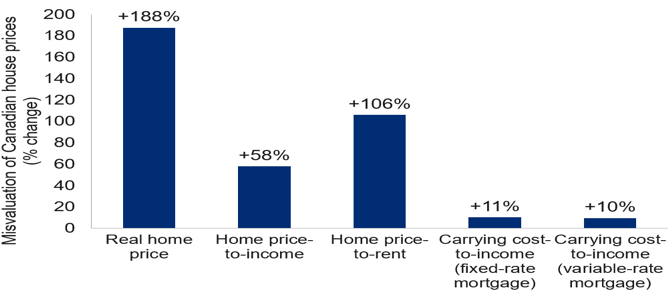

- On the other hand, national home prices – when measured correctly – are around 10% higher than fair-value would normally dictate. This points to a vulnerability from an outside economic catalyst (see chart below).

-

Housing affordability depends on the measure

Note: Real home price (Q1 2019) is % change from 1980 level; price-to-income (Q1 2019) and price-to-rent (Q1 2019) versus average since 1975; carrying cost-to-income (Q4 2018) versus average since 1985. Source: Haver Analytics, RBC GAM

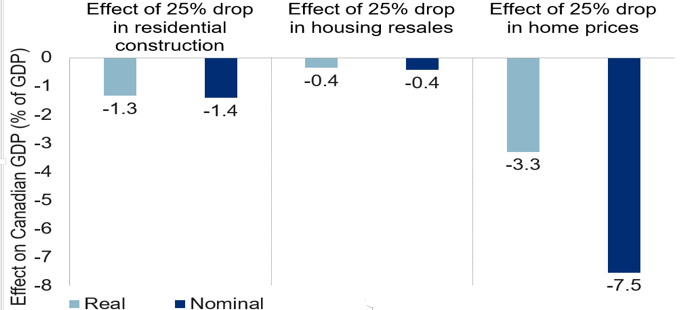

- Home prices are the thing to watch, as they map much more powerfully onto GDP than do housing starts or existing home sales (see chart below). For example, a 10% drop in home prices would be associated with a 1.6% hit to Canadian GDP.

-

Canadian housing elasticity table

Note: RBC GAM calculations. Conducted using accounting approach in isolation for each aspect of the housing market. Realistically, any housing decline would combine several aspects. Source: Haver Analytics, RBC GAM

- To reiterate, there is little to suggest that Canada’s housing market is at particular risk of inducing a recession by itself. If anything, housing has recently stabilized. But the country’s housing market is nevertheless more vulnerable than usual, capable of worsening a recession should a North American recession increase the unemployment rate.

- In fairness, there are also some optimistic counterpoints – arguments as to why Canada could prove surprisingly nimble in the event of a global or North American recession.

- Protectionism – the main economic bugaboo of the world today – should arguably hit the U.S. and China harder than Canada. This is heartening for Canada, though ultimately of limited value given:

- the close economic linkages between the U.S. and Canada, and

- the way that Chinese demand influences commodity prices – of central importance to Canada.

- The Canadian dollar classically weakens during recessions, providing an important economic boost. The U.S. does not enjoy this perk, instead suffering from a stronger dollar on safe-haven flows. Of course, part of the reason for Canadian dollar weakness is that commodity prices usually fall – an offsetting negative.

- Finally, Canada enjoys a considerable amount of fiscal flexibility at the federal level. Furthermore, a majority government would allow the coherent and timely delivery of stimulus, in contrast to a divided U.S. Congress that might struggle to initially construct a major fiscal stimulus program.