Business cycle update:

- Our quarterly deep-dive into the U.S. business cycle reveals a familiar conclusion: “late cycle” – but with some fascinating developments on the periphery.

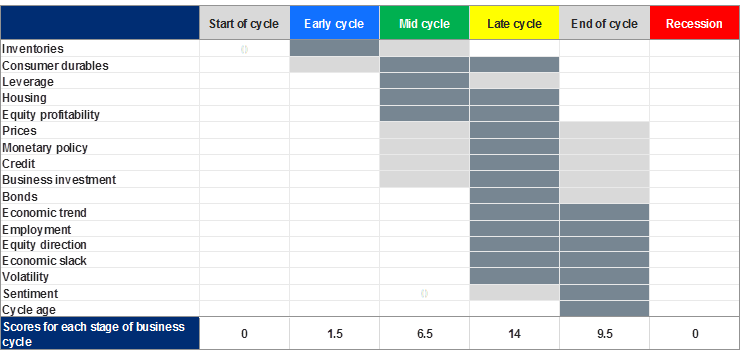

- As usual, many of the 17 inputs that go into our scorecard of the U.S. cycle disagree with one another. Counterintuitively, this is the strength of the approach. Whereas nearly any assertion can be supported by a rogue data series somewhere, it is much harder to be misled (or mislead) when considering many angles at once. This is on evidence in the table, below.

-

U.S. business cycle scorecard

Legend: Dark shading indicates the most likely stage of business cycle (full weight): light shading indicates alternative intrepretation (0.5 weight). Source: RBC GAM

- Amid the disagreements, a clear pattern emerges:

- “Late cycle” is clearly the single best guess, receiving considerably more support than the rest.

- Although this has been the conclusion for many quarters running, there is considerable forward motion beneath the surface. Whereas a year ago “mid cycle” was giving “late cycle” an honest run for its money, the “mid cycle” argument has withered considerably over the past year. Simultaneously, the “end of cycle” argument has strengthened substantially, now representing the second-most plausible conclusion.

- Seven of the 17 inputs advanced over the quarter, versus just two that retreated.

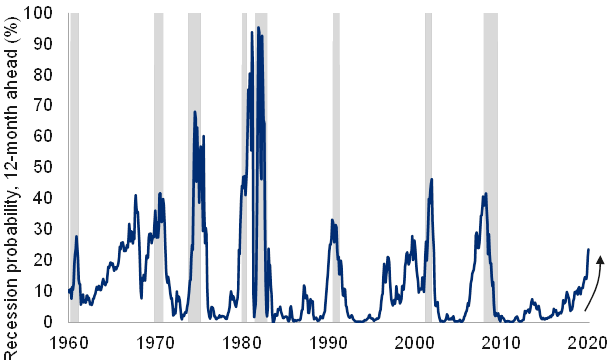

- We also tackle the question of the cycle from a different, more binary, perspective – whether a recession is likely or not. Of the seven models we use, three ask whether the U.S. is presently in a recession. The answer is a definitive “no.” A further, lone, model looks at the extent to which the word “recession” has appeared in Google searches. This is well up over the past year. The final three models calculate whether a recession is likely in a year’s time. None indicates the risk is more than about 30%, but all acknowledge a rising, non-trivial risk. The yield curve model is particularly expressive, as shown here.

-

Yield-curve based U.S. recession probability rises

Note: As of Jan 2020. Probabilities of a recession twelve months ahead estimated using the differnece between 10-year and 3-month Treasury yields. Shaded area represents recession. Source: Federal Reserve Bank of New York, Haver Analytics, RBC GAM

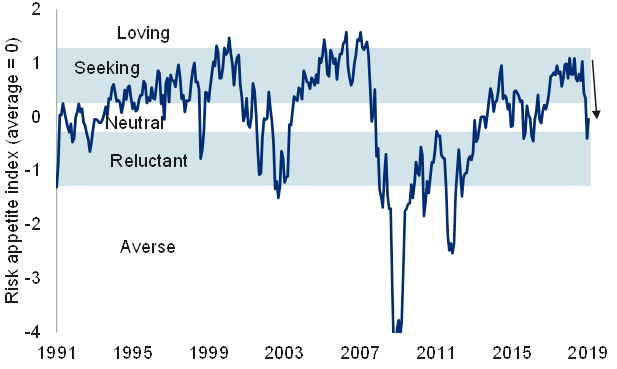

- Lastly, we examine 57 charts to inform the 17 official inputs. Several of the sub-inputs that go into this model reversed direction in the latest quarter. For example, our risk appetite index has fallen abruptly, to its lowest level in several years (see next chart).

-

Investor rick appetite plunged

Note: As of Jan 2019. measure risk appetite based on 45 normalized inputs. Source: Bloomberg, BofA ML, Consensus Economics, Credit Suisse, Federal Reserve Bank of Philadelphia, Haver Analytics, NedDavis, RBC GAM

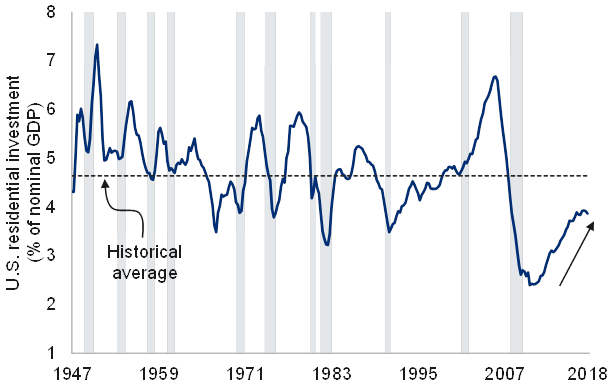

- Similarly, the U.S. housing market is now rolling over, as shown in the next chart.

-

U.S residential investment low but turning down

Note: As of Q3 2018. Shaded area represents recession. Source: BEA, Haver Analytics, RBC GAM

- To be clear, nothing here indicates a recession is imminent or that the cycle is over. But the cycle is nevertheless fairly late, and advancing. This continues to argue against aggressive investment risk-taking. It has been one of the key motivators for our reduction in risk-taking over the past few years, both with regard to the equity-bond mix and also the composition of the bond portfolio.

Upcoming event risks:

- The months ahead bring an unusual number of potentially pivotal macro events (see next chart).

-

Upcoming event risks

Here is a bit of colour on each:

- U.S. shutdown:

- The U.S. government shutdown will recommence on February 15th if the negotiating committee is unable to reach a deal by then.

- A deal is most certainly possible, perhaps involving less funding of border security than the Republicans desire in exchange for a limited extension of Dreamer work permits. But recent news reports have blown alternately hot and cold on the likelihood of a resolution before that date.

- Moreover, even if the committee comes to an agreement on a tentative deal, the White House will have to approve. This is far from certain given President Trump’s stated demand that the wall must be fully funded – and his apparent indifference to a resumption of the shutdown. On the other hand, this is at least in part posturing, as the public has tended to blame Trump and the Republicans disproportionately for the shutdown.

- In the end, it may be slightly more likely that the shutdown resumes than that it is resolved, nicking up to 0.05% off U.S. annual GDP growth for every week that it lasts. The economic damage is fairly slight (and the U.S. Congressional Budget Office believes the economic hit is even smaller than the aforementioned figure). But it does nevertheless add up over time. And let us not forget that the start of the shutdown in mid-December coincided with a sharp decline in the stock market.

- Trump-Kim summit:

- The leaders of the U.S. and North Korea will again meet for a summit on February 27th and 28th.

- The last such meeting was viewed as a success, but little has truly come from it. A similar non-event is likely this time.

- We remain of the opinion that the U.S.-North Korea relationship is unlikely to substantially change, and that it represents only a small risk to global growth or human well-being. The game theory is simply too obvious: North Korea can never initiate a strike against the U.S. lest it be destroyed, and the U.S. is unlikely to initiate a strike against North Korea given the unacceptable casualties it and its allies might suffer.

- The biggest off-consensus risk is that the personalities of Trump and Kim clash in some way, regressing to the launching of barbs against one another, but nothing more.

- U.S.-China trade deadline:

- The U.S. and China have until March 1st to reach a trade deal before U.S. tariffs on a large cross-section of Chinese goods rise from 10% to 25%.

- We suspect a superficial deal will be struck. This will likely involve China committing to buy more U.S. goods like soybeans, a reduction in Chinese auto tariffs and perhaps a change in rules to reduce the forced transfer of technologies from U.S. firms to their Chinese partners.

- This, in turn, should preclude an immediate increase in the tariff rate.

- However, we do not expect existing tariffs to be rescinded. As well, many key American beefs about Chinese trade policy are unlikely to be resolved given the centrality of elements such as state-owned enterprises and capital controls to the Chinese economic model.

- There is still a sizeable risk that U.S. tariffs on China will rise further at a later date.

- Debt ceiling:

- The U.S. debt ceiling will return to effect on March 1st. This will potentially set up for another battle over the summer or early fall after special avoidance measures have been exhausted.

- Given a split Congress and the government shutdown debacle, it seems a pretty good guess that the debt ceiling will also prove a major issue in 2019.

- Whether the debt ceiling proves as problematic as in the summer of 2011 is another question. The battle in 2011 was sufficiently precarious that S&P downgraded the U.S. sovereign debt rating due to the risk of a technical default, and the stock market fell by as much as 10% during the episode.

- Outright disaster remains unlikely, however, as extreme preventative measures remain, if untested (and hopefully not quite to the farcical point of the Mint crafting a trillion dollar coin, as previously proposed). The U.S. economy is still easily capable of financing the public debt if politicians would only get out of the way.

- China National People’s Congress:

- China’s annual National People’s Congress will begin on March 5th, lasting around two weeks.

- The event could be interesting in several ways:

- China could take the opportunity to get another major round of fiscal stimulus rubber-stamped. This would be a market-positive event.

- China is likely to downgrade its growth target for the coming year from 6.5% to the range of 6.0% to 6.5%. This is part of a steady slide lower. For context, 2016 targeted the range of 6.5% to 7.0%, 2015 targeted 7.0% and 2014 aimed for 7.5%.

- The event can surface other significant developments. As an example, last year’s Congress voted (2958 for, versus 2 against) to eliminate the two-term limit for Chinese presidents.

- Given that a downgraded forecast is already widely expected, there is upside risk to the Congress in terms of the magnitude of fiscal stimulus.

- Fed decisions:

- The next few months bring two Fed decisions, on March 20th and May 1st.

- From this vantage point, the Fed is likely to remain on hold unless economic growth and sentiment reaccelerate. We suspect the Fed is already closer to neutral than popularly imagined.

- Brexit:

- Too much ink has already been spilled on these pages about Brexit. Suffice it to say that March 29th is the official deadline for negotiating the exit of the U.K. from the EU.

- As with most negotiations, any solution is likely to be a last minute affair, though the deadline could alternately be extended in a variety of ways. Crashing out seems fairly unlikely still.

- Indian election:

- Among several prominent EM elections in 2019, the next Indian parliamentary election may be the most important. It will be held in April or May.

- Prime Minister Modi and his BJP party – despite some wobbles and ultimately fewer economic reforms than anticipated – have managed to nurture rapid 7% economic growth in India, outpacing China in the process.

- At present, the party looks likely to be weakened by the election without losing control altogether. This would be interpreted by the market in a negative fashion.

- USMCA approval:

- The new NAFTA deal still has to be approved by the legislatures of the U.S., Mexico and Canada. There is no specific timeline, though 2019 seems logical.

- The U.S. is the real question mark. We have always assigned a non-trivial 15% chance that the USMCA is not approved by Congress, reverting back to the pre-existing NAFTA or even (in a less likely, extreme scenario) to World Trade Organization (WTO) rules.

- That risk may now be edging higher given the political dysfunction on display with the government shutdown, plus recent comments in the New York Times that neither Congressional Republicans nor Democrats like the deal. Unlike with most laws, wherein tweaks can be made up until the last moment, it is much harder to modify an international agreement such as this, presenting what could be a problem.

- To be clear, we still think there is a good chance that the USMCA is approved because it is not a bad deal from a U.S. perspective. But political considerations could yet interfere.

U.S. politics:

- Many of the event risks discussed in the prior section are U.S. political events.

- There is one further item of relevance that falls outside of the purview of 2019: the 2020 U.S. presidential election race.

- Normally, an incumbent president has a very good chance of winning a second term. After all, four of the last five presidents have managed the trick, with only George H. W. Bush failing to secure a second tour of duty.

- However, betting markets put just a 37% probability on Republicans winning the 2020 presidential election. Undeniably, President Trump’s popularity remains quite low.

- Fascinatingly, a different betting market assigns a probability of just 27% that Trump himself wins the next election.

- How to resolve the 37% versus 27% disconnect? This means there is a 10% chance that another Republican wins the presidency. That would presumably entail either President Trump not running for a second term (as per Lyndon Johnson in 1968) or someone challenging Trump for the Republican nomination (quite common up until the last few decades) and outdueling him for it (has not happened in the modern era).

- Interestingly, these figures also imply there is more than a 10% chance that Trump is not the candidate, but that the alternative candidate then fails to win the presidential election.

- Technical math aside, the Democratic nomination may also prove quite interesting. Moderates are so far in short supply, with further-to-the-left candidates lining up in droves. They likely recognize that the anti-establishment root of the Trump message remains highly attractive to a sizeable fraction of the U.S. population, if wrapped up in very different policy proposals.

- The election, of course, remains anyone’s guess and could well end up with an unpopular Republican president versus a far-left Democratic nominee. This is arguably the market’s worst political fear as moderates would be in short supply, let alone those with a business-friendly inclination. In fairness, a moderate independent candidate would likely enter the race if this happened.

- Of course, there is still more than a year and a half until the next presidential election, leaving plenty of room for twists, turns, and for that matter, more conventional outcomes.